Voluntary Benefits

Life and AD&D Benefits

WEST’s comprehensive benefits package includes financial protection for you and your family in the event of an accident or death.

Supplemental Life and AD&D Insurance

WEST provides you the option to purchase supplemental life and AD&D insurance for yourself, your spouse, and your dependent children through The Standard.

You must purchase supplemental coverage for yourself in order to purchase coverage for your spouse and/or dependents. Supplemental life rates are age-banded and based on the employee’s age. Benefits will reduce to 65% at age 65, to 50% at age 70, and to 35% at age 75.

- Employee: $10,000 increments up to $500,000 or 5x annual salary, whichever is less—guarantee issue: $350,000

- Spouse: $5,000 increments up to $250,000 or 50% of the employee’s election, whichever is less—guarantee issue: $30,000

- Dependent children: $10,000—guarantee issue: $10,000

If you elect supplemental coverage when you’re first eligible to enroll, you may purchase up to the guarantee issue amount(s) without completing a statement of health (evidence of insurability). If you do not enroll when first eligible, and choose to enroll during a subsequent annual open enrollment period, you will be required to submit evidence of insurability for any amount of coverage. Coverage will not take effect until approved by The Standard

WEST offers the following voluntary benefits to support your financial wellbeing.

Accident Insurance Benefits

Accident insurance helps protect against the financial burden that accident-related costs can create. This means that you will have added financial resources to help with expenses incurred due to an injury, to help with ongoing living expenses, or to help with any purpose you choose. Claims payments are made in flat amounts based on services incurred during an accident.

You also receive a $50 wellness benefit every year when you complete a health screening.

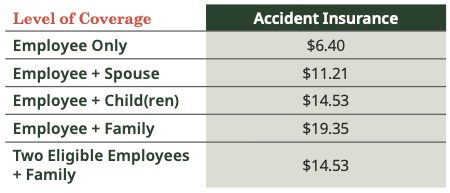

Accident Insurance Costs

Listed below are the monthly costs for accident insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

Critical Illness Benefits

Critical illness insurance provides a financial, lump-sum benefit upon diagnosis of a covered illness. These covered illnesses are typically very severe and likely to render the affected person incapable of working. Because of the financial strain these illnesses can place on individuals and families, critical illness insurance is designed to help you pay your mortgage, seek experimental treatment, or handle unexpected medical expenses. Pre-existing conditions are excluded if you have been diagnosed with the illness six months before gaining coverage and attempt to file a claim during your first six months of coverage.

- Employee: $10,000, $20,000 or $30,000—guarantee issue: $30,000

- Spouse: 50% of employee's election—guarantee issue: $15,000

- Dependent children: Up to age 26: 25% of employee's election—guarantee issue: 25% of employee's election

- Health screening benefit: $50 per insured individual

Hospital Indemnity Benefits

Hospital indemnity insurance will pay benefits that help you with costs associated with a hospital visit such as a covered accident, illness, or childbirth. This benefit pays you a lump-sum upon admittance so that you can choose how best to cover your expenses. You also receive a $50 wellness benefit every year when you complete a health screening.

- Hospital admission: $1,000 per admission

- Daily hospital confinement: $100 per day*

- Hospital intensive care unit confinement: $200 per day*

*Up to 60 days per calendar year

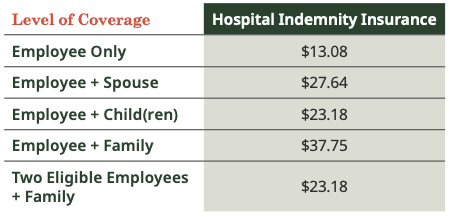

Hospital Indemnity Costs

Listed below are the monthly costs for hospital indemnity insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

Pet Insurance

WEST provides you the option to purchase pet insurance through Nationwide.

Nationwide offers a choice of reimbursement options so you can find coverage that fits your budget. All plans have a $250 annual deductible and $7,500 maximum annual benefit.

Coverage includes:

- Accidents

- Illnesses

- Hereditary and congenital conditions

- Cancer

There are three simple ways for employees to sign up for their new pet insurance voluntary benefit:

- Go directly to the dedicated URL: benefits.petinsurance.com/westernecosystems.

- Call 877-738-7874 and mention that you are an employee of Western EcoSystems Technology, Inc. to receive preferred pricing.

- Visit petsnationwide.com.

Identity Theft Protection

WEST provides you the option to purchase identity theft protection through IDShield.

This includes monitoring your identity, credit, financial accounts, and social media accounts with safety alerts, and identity consultation and restoration services should your identity be compromised. In the event of an emergency, IDShield provides 24/7 emergency assistance.

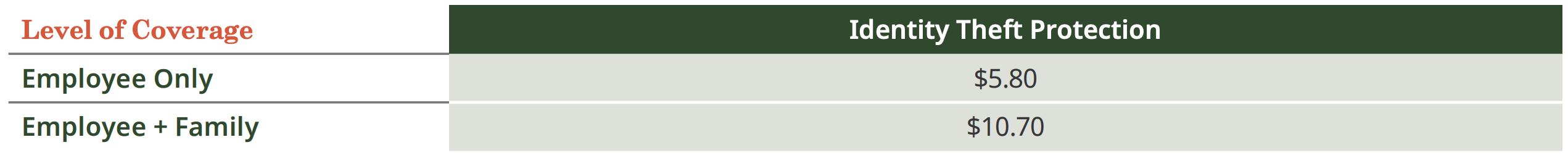

Identity Theft Protection Costs

Listed below are the monthly costs for identity theft protection. The amount you pay for coverage is deducted from your paycheck on a post-tax basis, which means you don’t pay taxes on the amount you pay for coverage.

Medical Transport Solutions

WEST provides you the option to purchase medical transport solutions through MASA.

No matter how comprehensive your local in-network coverage may be, you still have significant exposure to out-of-network emergency transportation. Moreover, when you and your family travel outside your area, there is an 80% chance of being picked up by an out-of-network provider. A MASA membership prepares you for the unexpected.

The cost for medical transport solutions is $19 per month per employee regardless of the number of family members that you cover.

Resources

Nationwide Pet Insurance - 2022 Employee 5070 Resource Kit

West Inc - IDShield Breakroom Poster

West Inc - IDShield Mobile App Flier

West Inc - IDShield Enrollment Flier

West Inc - IDShield Account Creation Flier

Cigna Supplemental Health - Benefit_Guide

Cigna Supplemental Health - English Customer Video Links

Cigna Supplemental Health - Value Add flyer

CIGNA SUPPLEMENTAL HEALTH RESOURCES

Cigna Supplemental Health – CI – Health Screen & Wellnes Benefit flyer

Cigna Supplemental Health – How to File a Health Screen & Wellnes Claim

Cigna Supplemental Health – AI – Health Screen & Wellnes Benefit flyer

Cigna Supplemental Health – How to File a Claim flyer – Western EcoSyste

Cigna Supplemental Health – Customer flyer AI Plan 1 – Western EcoSystem

Benefit Summary_Western EcoSystems Technology, Inc._VHC_c1_Monthly_10.07.2022

Cigna Supplemental Health – HC – Health Screen & Wellnes Benefit flyer

Benefit Summary_Western EcoSystems Technology, Inc._VCI_c1_Monthly_10.07.2022

Cigna Enrollment Platform Content.AI plain text

Cigna Supplemental Health – English Customer Video Links – Western EcoSy

Cigna Supplemental Health – Benefit Guide – Western EcoSystems Technolog

Cigna Enrollment Platform Content.CI_Dep plain text

Benefit Summary_Western EcoSystems Technology, Inc._VAI_c1_Monthly_10.07.2022

Cigna Enrollment Platform Content.HC plain text

Cigna Enrollment Platform Content.CI plain text

Cigna Supplemental Health – Simple File flyer – Western EcoSystems Techn

Cigna Supplemental Health – Value Add flyer – Western EcoSystems Technol