Medical

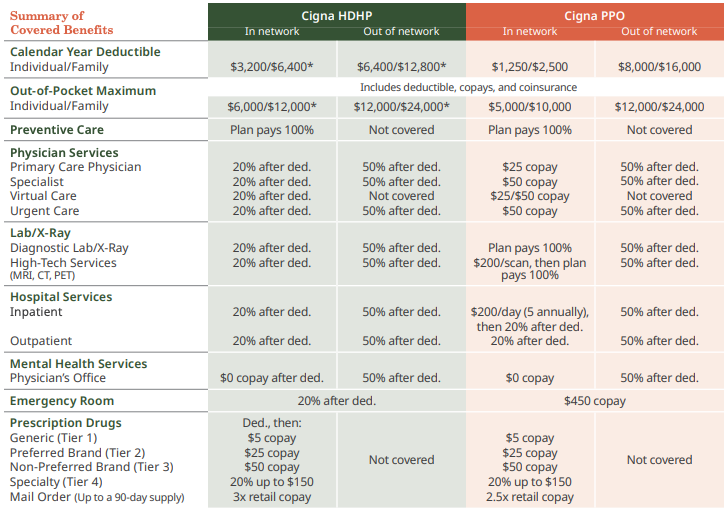

WEST offers two medical insurance plan options—the Cigna high-deductible health plan (HDHP) and the Cigna PPO plan.

Numbers to Know

Deductible

The amount you must pay for medical services before the insurance plan will begin to pay. However, your preventive care is covered 100% by the plan.

- HDHP In-Network Deductible: $3,200/$6,400

- PPO In-Network Deductible: $1,250/$2,500

Out-of-Pocket (OOP) Max

The maximum amount of money you will pay for medical services during the plan year. The OOP max is the sum of your deductible and coinsurance payments.

- HDHP In-Network OOP Max: $6,000/$12,000

- PPO In-Network OOP Max: $5,000/$10,000

Coinsurance

A form of cost-sharing where you and the insurance plan share expenses in a specified ratio after you meet the deductible (until you reach the OOP maximum).

- HDHP In-Network Coinsurance: 20%

- PPO In-Network Coinsurance: 20%

The medical plans offer in- and out-of-network benefits, providing you the freedom to choose any provider. However, you will pay less out of your pocket when you choose a Cigna Open Access Plus provider.

The table below summarizes the benefits of the medical plans. The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

*The Cigna HDHP has an embedded deductible. This means an individual enrolled in employee + spouse, employee + child(ren), or an employee + family coverage will not have to pay a deductible higher than the individual deductible amount before the plan begins to pay.

Medical ID Cards

Effective January 1, 2024, Cigna will be transitioning ID cards to digital only. Access your ID card by visiting mycigna.com or by downloading the myCigna app.

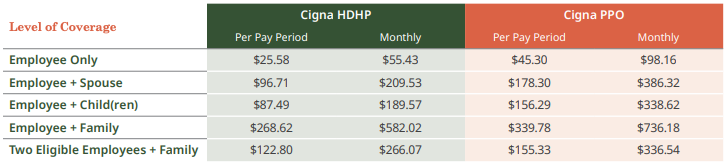

Medical Costs

Listed below are the monthly costs for medical insurance. The amount you pay for coverage is deducted from your paycheck on a pre-tax basis, which means you don’t pay taxes on the amount you pay for coverage.

Preventive Care

In-network preventive care is 100% free for medical plan members. You won’t have to pay anything out of your pocket when you receive in-network preventive care. Practice preventive care and reap the rewards of a healthier future.

Preventive care helps keep you healthier long-term.

An annual preventive exam can help IDENTIFY FUTURE HEALTH RISKS and treat issues early when care is more manageable and potentially more effective.

Preventive care helps keep your costs low.

With a preventive care exam each year, you can TARGET HEALTH ISSUES EARLY when they are less expensive to treat. You can also effectively manage chronic conditions for better long-term health.

Preventive care keeps your health up to date.

Yearly check-ins with your doctor keeps your health on track with AGE- AND GENDER-SPECIFIC EXAMS, VACCINATIONS, AND SCREENINGS that could save your life.

Virtual Care

You have access to virtual care through MDLIVE. Get the care you need when and wherever you need it. Whether you’re on the go, at home, or at the office, care comes to you in the form of virtual care.

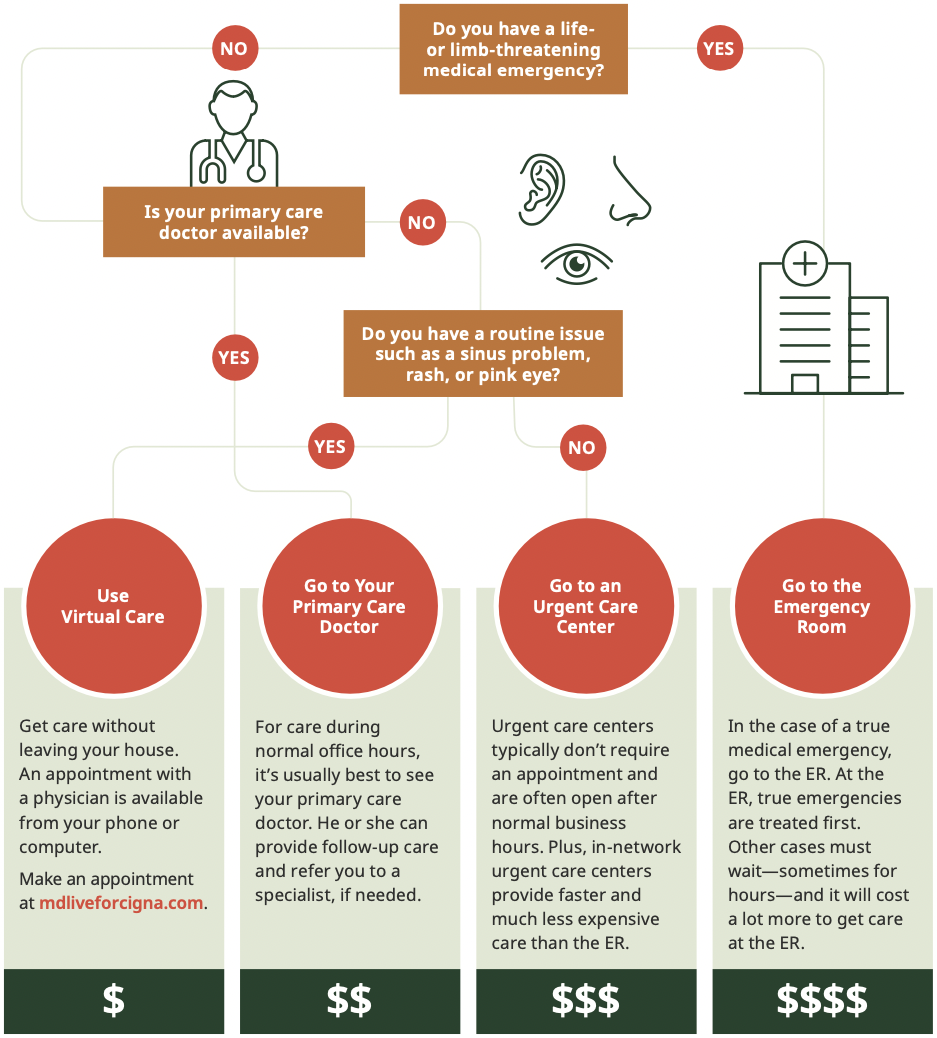

Know Where to Go for Care

Where you go for medical services can make a big difference in how much you pay and how long you wait to see a health care provider. Use the chart below to help you choose where to go for care.

Resources

CIGNA PPO - Summary of Benefits and Coverage

CIGNA PPO - Benefit Summary

CIGNA HDHP - Summary of Benefits and Coverage

CIGNA HDHP - Benefit Summary

Your health has met its app

Words to know - health plan basics

Transition to digital ID cards FAQ

Pick the health plan that fits

myCigna customer flyer

Have your ID card handy

Enrollment Hotline 1.800.564.7642 Flyer

Enrollment Event Resources Know Before You Go Three Steps

Cigna.com Business to Customer Directory Find a Doctor

Cigna Virtual Care All Services Customer Flyer

Behavioral Network Customer Flyer