HSA / FSA

Budgeting For Your Care

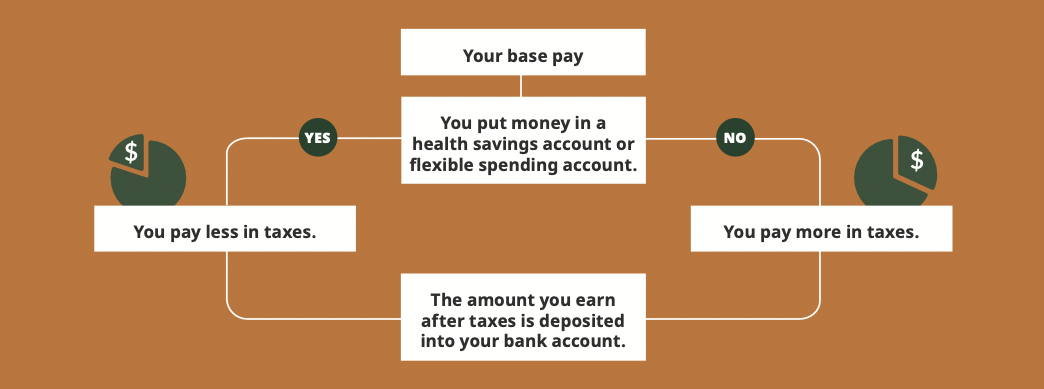

When you put money into a health savings account or flexible spending account, you can save about 20%* on your care. This is because you don’t pay taxes on your contributions.

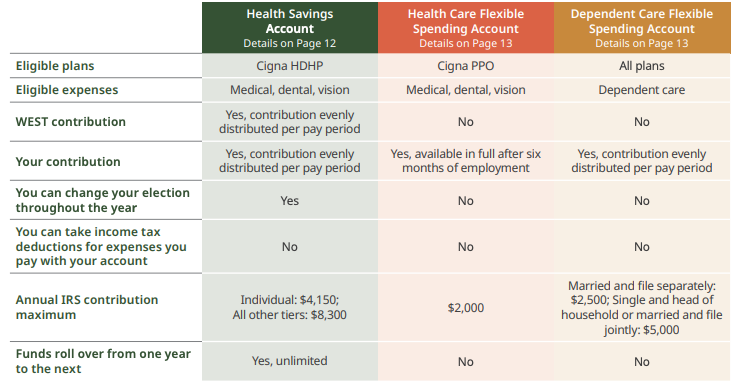

Compare Your Options

*Percentage varies based on your tax bracket.

Health Savings Account

If you enroll in the Cigna HDHP, you may be eligible to open and fund a health savings account (HSA) through Rocky Mountain Reserve.

An HSA is a savings account that you can use to pay out-of-pocket health care expenses with pre-tax dollars.

WEST Contribution

If you enroll in the Cigna HDHP, WEST will help you save by contributing to your account.

- Employee-only: $500 per year

- All other coverage levels: $750 per year

These amounts will be equally distributed per pay period.

2024 IRS HSA Contribution Maximums

Contributions to an HSA (including the WEST contribution) cannot exceed the IRS allowed annual maximums.

- Individuals: $4,150

- All other coverage levels: $8,300

If you are age 55+ by December 31, 2024, you may contribute an additional $1,000.

HSA Eligibility

You are eligible to fund an HSA if:

- You are enrolled in the Cigna HDHP.

You are NOT eligible to fund an HSA if:

- You are covered by a non-HSA eligible medical plan, health care FSA, or health reimbursement arrangement.

- You are eligible to be claimed as a dependent on someone else’s tax return.

- You are enrolled in Medicare, TRICARE, or TRICARE for Life.

Refer to IRS Publication 969 for additional eligibility details. If you are over age 65, please contact Human Resources.

Maximize Your Tax Savings with an HSA

Spend

Pay for eligible expenses such as deductibles, dental and vision exams, menstrual care products, and prescriptions.

Save

Roll over funds every year to boost your long-term savings. Even if you switch health plans or jobs, the money is yours to keep.

Invest

Invest and grow HSA funds tax free—including interest and investment earnings. After age 65, spend HSA dollars on any expense penalty free.

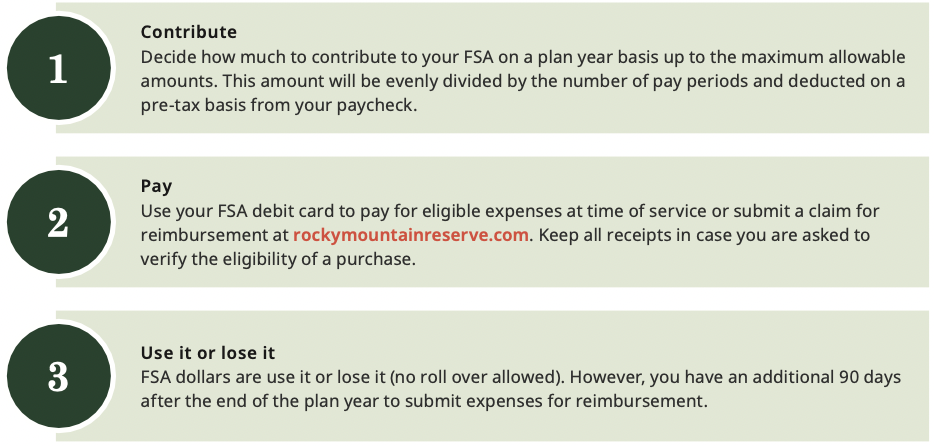

Flexible Spending Accounts

WEST offers two flexible spending account (FSA) options through

Rocky Mountain Reserve.

Log into your account at rockymountainreserve.com to: view your account balance(s), calculate tax savings, view eligible expenses, download forms, view transaction history, and more.

Health Care FSA (not allowed if you fund an HSA)

Pay for eligible out-of-pocket medical, dental, and vision expenses with pre-tax dollars. You are eligible the first of the month following completion of six months of employment. Please note, if you are enrolled in the Cigna HDHP and you contribute to an HSA, you are not eligible to fund a health care FSA.

- Health care FSA dollars are use it or lose it (no roll over allowed). However, you have an additional 90 days after the end of the plan year to submit expenses for reimbursement.

The health care FSA maximum contribution is $2,000 for the 2024 calendar year.

Dependent Care FSA

The dependent care FSA allows you to pay for eligible dependent day care expenses with pre-tax dollars. Eligible dependents are children under 13 years of age, or spouse, a child over 13, or elderly parent residing in your home who is physically or mentally unable to care for him or herself.

- Dependent care FSA dollars are use it or lose it (no roll over allowed). However, you have an additional 90 days after the end of the plan year to submit expenses for reimbursement.

You may contribute up to $5,000 to the dependent care FSA for the 2024 calendar year if you are married and file a joint return or if you file a single or head of household return. If you are married and file separate returns, you can each elect $2,500 for the 2024 calendar year.