Dental / Vision

Dental Benefits

WEST offers a dental insurance plan through Delta Dental of Wyoming.

The Delta Dental plan offers in- and out-of-network benefits, providing you the freedom to choose any provider. The amount you pay varies based on whether you see a Premier dentist, PPO + Premier dentist, or out-of-network (non-participating) dentist.

- You will pay less out of your pocket when you see a Premier or PPO + Premier dentist.

- Premier and PPO + Premier dentists file claims directly with Delta Dental of Wyoming and accept Delta Dental of Wyoming’s reimbursement in full. When you see a Premier or PPO + Premier dentist, you will only be responsible for your deductible and coinsurance, as well as any charges for non-covered services up to Delta Dental of Wyoming’s approved amount.

- If you choose to see an out-of-network dentist, you will incur additional out-of-pocket expenses, and you will be billed the total amount the dentist charges (called balance-billing).

- When you see a Premier or PPO + Premier dentist, you are protected from balance-billing.

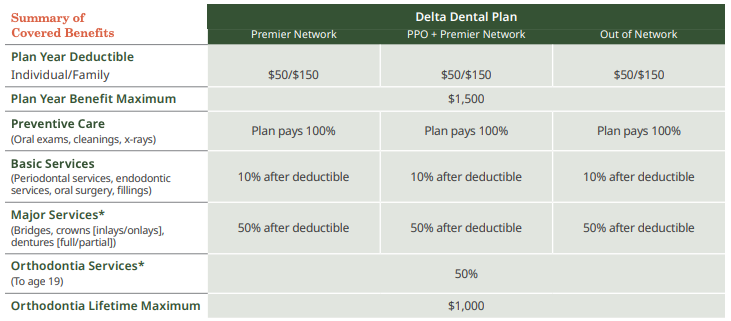

The table below summarizes key features of the dental plan. The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

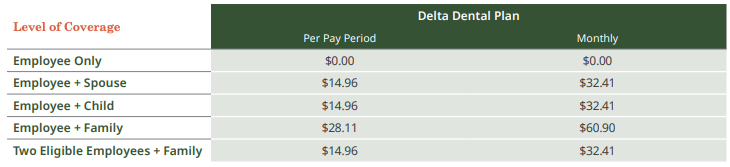

Dental Costs

Listed below are the monthly costs for dental insurance. The amount you pay for coverage is deducted from your paycheck on a pre-tax basis, which means you don’t pay taxes on the amount you pay for coverage.

Vision Benefits

WEST offers a vision insurance plan through VSP.

You have the freedom to choose any vision provider. However, you will maximize the plan benefits when you choose a VSP Choice Network provider.

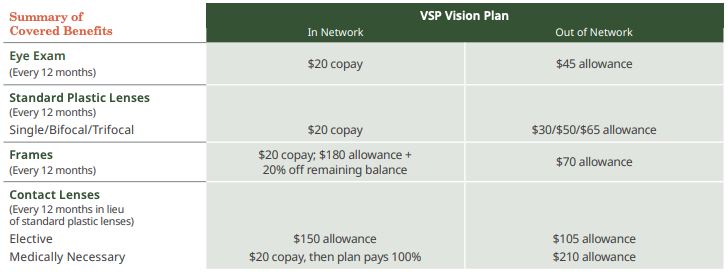

The table below summarizes key features of the vision plan. Please refer to the official plan documents for additional information on coverage and exclusions.

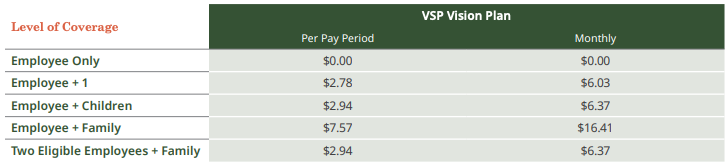

Vision Costs

Listed below are the monthly costs for vision insurance. The amount you pay for coverage is deducted from your paycheck on a pre-tax basis, which means you don’t pay taxes on the amount you pay for coverage.

Resources

Essential Medical Eye Care (Member)

Exclusive Member Extras (Client & Member)

Delta Dental Mobile App

Dental Summary of Benefits

Oral health flyer

Western Eco Systems ASC PPO + Premier Summary of Benefits

VSP Member Benefit Summary

Western Eco Systems ASC PPO + Premier Summary of Benefits

Western Eco Systems ASC Policy Handbook

A Look at your VSP Vision Coverage

A Look at your VSP Vision Coverage - Spanish