401(k) RETIREMENT SAVINGS PLAN

Safe Harbor Notice

Viega LLC is required by the IRS to give this notice annually to participants in the Plan. The “Company”

means Viega LLC and each of its predecessors that participate in the Viega LLC 401(k) plan (the “Plan”).

Required Notice to Participant in the Viega LLC 401(k) Plan Distributed to ALL Eligible Employees

Contribution Safe Harbor

By complying with the provisions of the IRS, Viega LLC will be entitled to rely on a contribution safe

harbor provided by the IRS. By making a qualified non-elective contribution (QNEC) in the amount of 3%

of compensation as defined in the plan, Viega LLC will satisfy the nondiscrimination test (referred to as the actual deferral percentage test (ADP Test) required by the Internal Revenue Code. Accordingly, because Viega LLC will be relying on a contribution safe harbor, it will not need to perform the ADP Test.

The safe harbor on which Viega LLC intends to rely is included in sections 401(k)(12)(C) and 401(k)(12)(D) of the Internal Revenue Code.

Minimum Contribution under the Safe Harbor

If you are eligible to participant in the Plan and are an employee of Viega LLC, you will receive a contribution of 3% of your annual base compensation, as defined in the Plan. Under the Plan, base compensation is limited as required by the Internal Revenue Code. The limit may be increased in future years to adjust for the increased cost of living. The safe harbor contribution is immediately 100% vested.

Other Plan Contributions

For the plan year, you may make pretax contributions to the Plan, subject to IRS limits. If you will be age 50 or above this Plan year, you may be eligible to defer an additional pretax amount based on IRS regulations. You may not make after-tax contributions to this Plan.

Additionally, Viega LLC makes matching contributions and can make a discretionary profit-sharing contribution to the Plan that complies with the applicable requirements of the Code.

Effective January 1st, Viega LLC will make matching contributions at the following schedule:

- 100% match on your pretax contribution, up to 2% of your compensation (i.e. dollar-for-dollar match up to 2% of your compensation)

PLUS

50% match on the remaining portion of your pretax contribution, up to an additional 5% of your compensation (i.e. $0.50 match for each dollar you contribute up to 5% of your compensation)

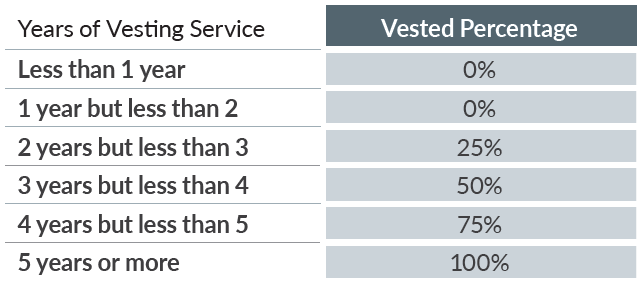

Viega LLC can make a discretionary profit-sharing contribution under the terms of the Plan to each participant who is employed by Viega LLC and eligible to participate in the Plan. There is no requirement that you make pretax deferral to receive a discretionary profit-sharing contribution. This vesting schedule may be different from the current plan, but the new vesting schedule will not be applied to your accrued benefit if it would decrease our accrued benefit or extend the time it takes for you to vest in your accrued benefit.

Procedures for Making Pretax Deferrals

Employees of Viega LLC generally become eligible to participate in the Plan on the first of the month after your hire date and attaining age 21. In order to become a participant in the Plan, you must complete an enrollment form available online at 401k.com.

Distributions and Withdrawals

The distributions and withdrawals provisions of the Plan are discussed in detail in the Summary Plan Description for the Plan available on Viega LLC’s intranet or by calling Human Resources. If you are a participant in the Plan and your employment with Viega LLC is terminated for any reason, you are entitled to receive the vested amount credited to your separate accounts under the Plan, less the balance of any Plan loans outstanding. Questions regarding this notice and the Plan or request for a paper copy of this notice or a Summary Plan Description (free of charge) should be directed to: Plan Owner, Human Resources, 800-774-5237, or Plan Administrator, Fidelity, 800-835-5097.

This notice describes certain terms of the Plan. In the event of any inconsistency between the terms of this notice and the terms of the Plan, the terms of the Plan will prevail.

ROTH 401(k) RETIREMENT SAVINGS PLAN

The Roth 401(k) option offers tax-free retirement income.

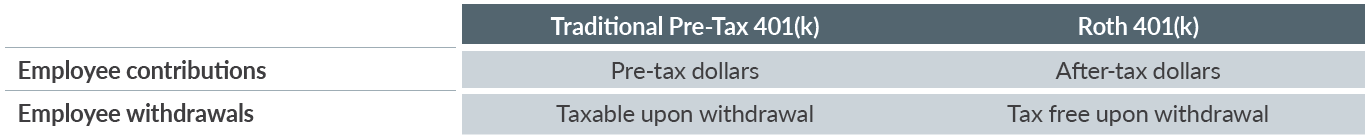

Your plan now gives you the option of contributing to a Roth 401(k) though your retirement savings plan. Unlike a traditional pretax 401(k), the Roth 401(k) allows you to contribute after-tax dollars and then withdraw tax-free dollars from your account when you retire or terminate employment from Viega LLC, if it has been five years since your first Roth 401(k) contribution and you are at least 59 ½ years old.*

How Does the Roth 401(k) Compare With a Traditional Pre-Tax 401(k)? Just as with a traditional pretax 401(k):

- You elect how much of your salary you wish to contribute.

- Your contributions to a Roth 401(k) and traditional pretax

- 401(k) cannot exceed IRS limits. Your contribution is based on your eligible compensation.

- Unlike a traditional pretax 401(k), the Roth 401(k) allows you to withdraw your money tax free when you retire*. But it will also require you to make after tax contributions now.

Taxes: Pay Now or Pay Later

Who Might Benefit from a Roth 401(k)? A Roth 401(k) could be a good option for:

- Younger employees who have a longer retirement horizon and more time to accumulate tax free earnings.

- Highly compensated individuals who aren’t eligible for Roth IRAs, but who want a pool of tax-free money to draw on in retirement.

- Employees who want to leave tax-free money to their heirs.

Here’s Help

- Log into Fidelity NetBenefits and click the Library tab.

- Call 800-835-5097 to speak with a Fidelity representative.

- Contact a tax professional for specific advice on your personal situation.

TUITION REIMBURSEMENT PROGRAM

PROFESSIONAL GROWTH—A CORE VIEGA VALUE

Professional growth has been at the core of who Viega is. The management team at Viega wants to encourage personal development through formal education channels.

You can’t lose with Viega’s tuition reimbursement program. You may receive financial assistance while at the same time improving your job-related skills.

Basic requirements are:

- Full-time status

- First of the month following hire date

- Masters or Bachelor’s degree

- Courses taken at an accredited educational establishment

- Employee not in a disciplinary status

- Courses pre-approved by your immediate manager and Human Resources

- Classes taken during non-work hours

You must get approval for the class(es) from both your manager and Human Resources prior to taking the class. Then you pay for the class up front. Upon completion of the class, you submit your grades and receipts for reimbursement to Human Resources.

For undergraduate classes, we reimburse:

- 100% for a grade of A

- 80% for a grade of B

- 50% for a grade of C

For graduate programs, we reimburse:

- 100% for B or better

Yearly maximums are $3,600 for undergraduate degrees and $5,000 for graduate degrees. There are repayment rules that apply if you leave the company less than four years from the last day of the course.

Contact Human Resources for more information.

SICK TIME

Sick allowance is separated into two categories: sick time and sick bank.

Sick time is the amount of time an employee is allotted to take off during a given year, whereas a sick bank is an accumulation of any unused sick time. Each of the aforementioned is non-cashable upon termination, unless the employee is retiring.

SICK TIME:

- All eligible employees may receive up to five (5) sick days per year. The number of sick days allowed for new employees is dependent on when they are hired:

- If hired January 1 through March 31, the new employee with receive five (5) sick days.

- If hired April 1 though June 30, the new employee will receive three (3) sick days.

- If hired July 1 though September 30, the new employee will receive two (2) sick days.

- If hired October 1 through December 31, the new employee will receive one (1) sick day.

- Employees may carry-over sick time from year to year via their sick bank.

- Sick time balances are transferred into the employees sick bank after December 31 of every year.

SICK BANKS

- There is no cap on the amount of hours an employee may accumulate in their sick bank.

- Sick time hours can only be transferred into a sick bank.

- Sick bank time in excess of eighty (80) hours can be cashed out on the first paycheck following the end of the calendar year. Employees must submit a written request to Human Resources prior to December 1.

- When an employee terminates employment with Viega, voluntarily or involuntarily, with the exception of employees rehired one year from being laid off, any remaining time in the sick bank will be forfeited. If an employee is rehired within one year after being laid off, their sick bank balance will be restored to what it was as of their last day of employment prior to being laid off.

VACATION TIME

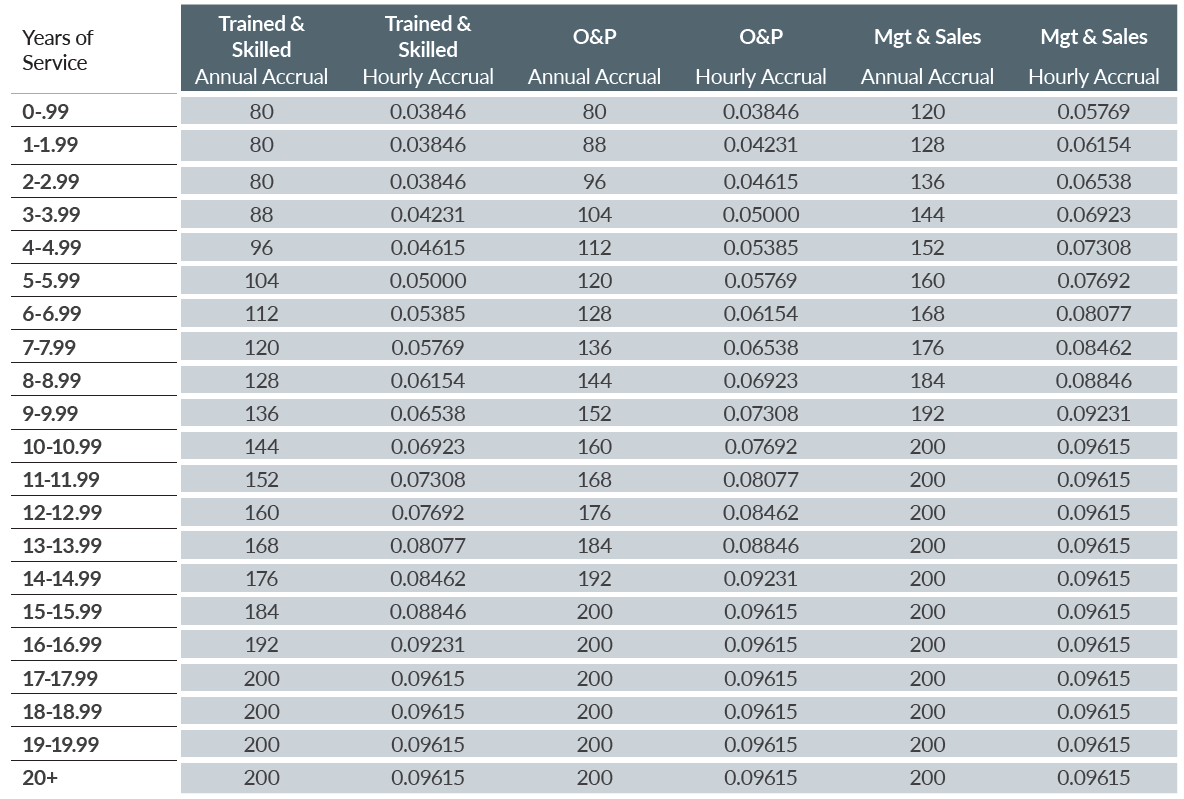

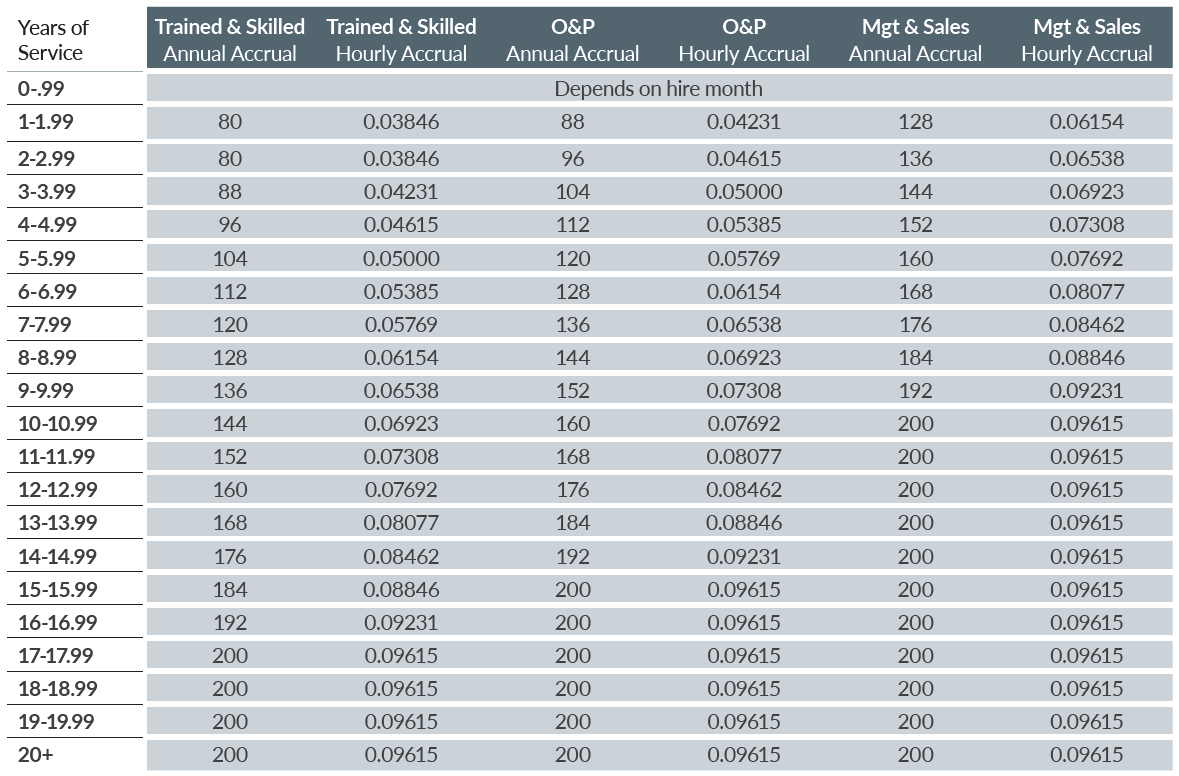

An employee’s vacation time allowance is based on tenure plus the Competency Development Category their position falls into: Trained, Skilled, Office Administration & Professional & Sales & Management plus exemption status.

NON-EXEMPT

Vacation time offered (for the purpose of this policy the hourly accrual rate applies): Vacation time is available immediately for use.

EXEMPT

Vacation time offered (for the purpose of this policy the annual accrual rate applies):

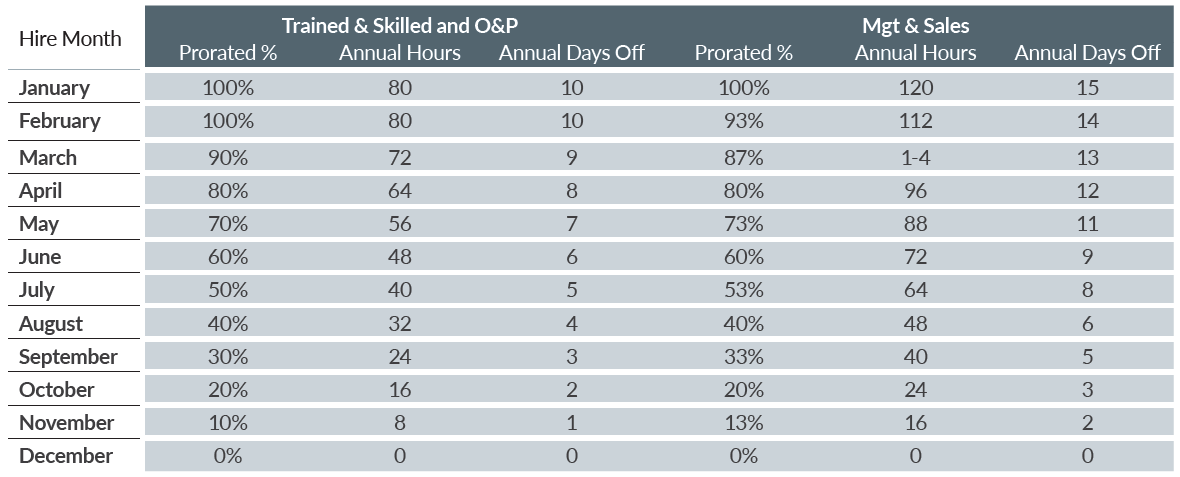

Vacation time for new hires and employees changing positions is prorated based on the following percentage scale:

Vacation time is awarded for use immediately. Notwithstanding the immediate availability to use vacation time, the actual accrual of vacation time occurs incrementally throughout the year in which it is provided, in applicable states.