Questions?

Visit wacaresfund.wa.gov and get answers to your questions.

For questions regarding this upcoming benefit program, please email the Washington Cares Fund at wacaresfund@dshs.wa.gov.

You may contact Trident Payroll at payroll@tridentseafoods.com if you have tax questions.

Trident Seafoods does not offer LTC insurance!

WA-Cares LTC Tax Flyer - English

WA-Cares-Fund_Factsheet - Cambodian

WA-Cares-Fund_Factsheet - Chinese

WA-Cares-Fund_Factsheet - Ethiopian

WA-Cares-Fund_Factsheet - Lao

WA Cares Fund (Long Term Care) Tax has arrived!

If you work in Washington state you will be subject to the new Washington Cares Fund payroll tax starting July 1, 2023. The premium has been set by state law at 0.58% of gross wages, or $0.58 per $100. For example, if an employee earns $50,000 annually, the total annual premium is $290 or $12.08 per paycheck. You can estimate your own contribution using a calculator on the WA Cares Fund website.

What is WA Cares Fund? The WA Cares Fund is a mandatory long-term care insurance benefit established by Washington state law in 2019. Starting July 1, 2026, benefits can be used for personal care in your home, an assisted living facility, an adult family home or a nursing home; memory & dementia care, environmental modifications like wheelchair ramps, home delivered meals, and/or compensation for family members who provide care. For further details please visit https://wacaresfund.wa.gov/wa-cares-benefits/.

The WA Cares Long Term Care is not a leave program, but it can be used at the same time as a leave, including Paid Family & Medical Leave (PFML), and insurance, including long-term disability insurance.

Exemptions - All Washington workers will be required to pay taxes WA Cares Fund unless they have been approved for an exemption. Beginning January 1, 2023 you became eligible for exemptions if any of the following apply to you:

Living outside of Washington state

- If you’re a spouse or registered domestic partner of an active-duty service member of the United States armed forces

- If you have a non-immigrant work visa

- If you are a veteran with a 70% service-connected disability rating or higher.

For further exemption details, please visit https://wacaresfund.wa.gov/private-insurance/.

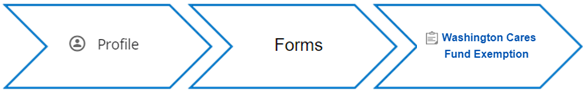

You can submit your exemption form in Dayforce: Log in to Ceridian Dayforce and from the Homepage navigate to the Menu. Select “Profile” from the Menu.

From here you will need to attach your exemption letter from Washington Cares Fund and submit.

Additional Resources - For further details about the Long Term Care, visit https://wacaresfund.wa.gov/about-the-wa-cares-fund/

©2003 - 2024 All rights reserved. Terms & Conditions | Privacy Statement | DMCA