Voluntary Benfits Overview

SUPPLEMENTAL LIFE AND AD&D INSURANCE

Southwest Human Development provides you the option to purchase supplemental life and AD&D insurance for yourself, your spouse, and your dependent children through Unum. You must purchase supplemental coverage for yourself in order to purchase coverage for your spouse and/or dependents. Supplemental life rates are age-banded. Benefits will reduce to

65% at age 70 and to 45% at age 75.

- Employee: $10,000 increments up to $500,000 or 5x employee's base annual earnings, whichever is less—guarantee

issue: $150,000 - Spouse: $5,000 increments up to $500,000 not to exceed 100% of employee's election—guarantee issue: $25,000

- Dependent children: $2,000 increments up to $10,000—guarantee issue: $10,000

During this open enrollment period, we will be moving our life insurance benefits from Equitable to Unum. If you are currently enrolled in supplemental life and AD&D insurance through Equitable, your current benefit elections will automatically be carried over to Unum with no coverage interruption and no statement of health required. If this is your first time enrolling in supplemental life and AD&D insurance, you may purchase up to the guarantee issue amount(s) without completing a statement of health (evidence of insurability). If you do not enroll during this enrollment period, and choose to enroll during a subsequent annual open enrollment period, you will be required to submit evidence of insurability for any amount of coverage. Coverage will not take effect until approved by Unum.

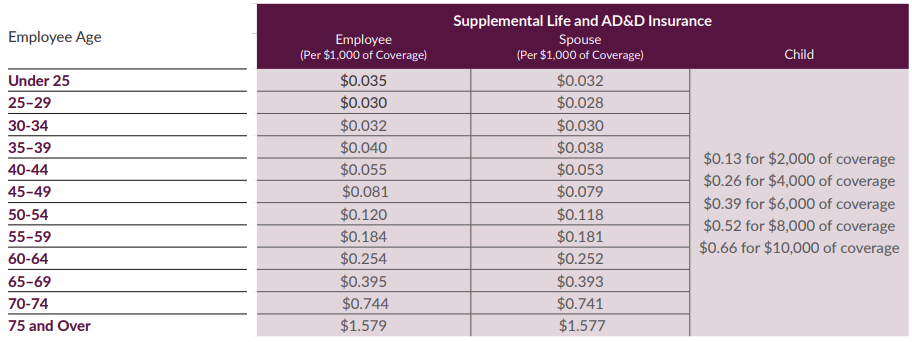

SUPPLEMENTAL LIFE AND AD&D COSTS

Listed below are the per pay period costs for supplemental life and AD&D insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis. Spouse rates are based on the employee's age.

VOLUNTARY LONG-TERM DISABILITY INSURANCE

Southwest Human Development provides you the option to purchase voluntary long-term disability (LTD) insurance through Unum. LTD insurance is designed to help you meet your financial needs if your disability extends beyond the STD period.

- Benefit: 60% of base monthly pay up to $8,000 per month

- Elimination period: 180 days

- Benefit duration: Social Security normal retirement age

- Pre-existing condition exclusion: 3/12; benefits will not be paid for any disability for which you received medical treatment, care, or consultation for during the 3 months preceding your effective date until you have been covered under the policy for 12 months

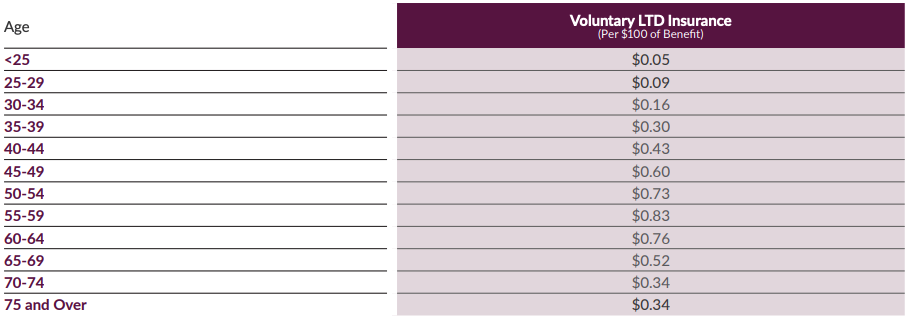

VOLUNTARY LONG-TERM DISABILITY COSTS

VOLUNTARY LONG-TERM DISABILITY COSTS Listed below are the per pay period costs for voluntary LTD insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

ACCIDENT INSURANCE

Southwest Human Development provides you the option to purchase accident insurance through Unum.

Accident insurance helps protect against the financial burden that accident-related costs can create. This means that you will have added financial resources to help with expenses incurred due to an injury, to help with ongoing living expenses, or to help with any purpose you choose. Claims payments are made in flat amounts based on services incurred during an accident.

You also receive a $50 wellness benefit every year when you complete a health screening.

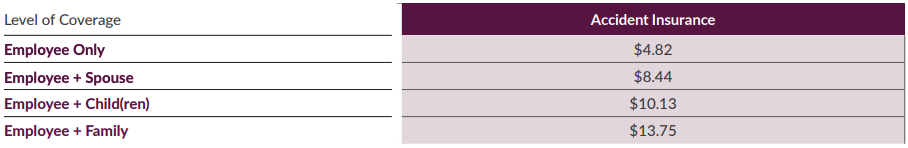

ACCIDENT COSTS

Listed below are the per pay period costs for accident insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

HOSPITAL INDEMNITY INSURANCE

Southwest Human Development provides you the option to purchase hospital indemnity insurance through Unum.

This plan provides a lump-sum benefit due to a hospitalization. If you elect coverage for yourself, you can elect coverage for your spouse and child(ren).

The hospital indemnity plan includes:

- Hospital confinement benefit

- Critical care unit benefit

- Hospital admission benefit

You also receive a $50 wellness benefit every year when you complete a health screening. Please refer to the official plan documents for a full list of covered injuries and expenses.

HOSPITAL INDEMNITY INSURANCE COSTS

Listed below are the per pay period costs for hospital indemnity insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

CRITICAL ILLNESS INSURANCE

Southwest Human Development provides you the option to purchase critical illness insurance through Unum.

Critical illness insurance provides a financial, lump-sum benefit upon diagnosis of a covered illness. These covered illnesses are typically very severe and likely to render the affected person incapable of working. Because of the financial strain these illnesses can place on individuals and families, critical illness insurance is designed to help you pay your mortgage, seek experimental treatment, or handle unexpected medical expenses.

This plan includes coverage for invasive and non-invasive cancers as well as skin cancer.

- Employee: Increments of $10,000 up to $30,000—guarantee issue: $30,000

- Spouse: Increments of $10,000 up to $30,000 not to exceed 100% of employee's election—guarantee issue: $30,000

- Dependent children: Automatically covered at 100% of employee's election

- Wellness benefit: $50 for $10,000 of coverage; $75 for $20,000 of coverage; $100 for $30,000 of coverage

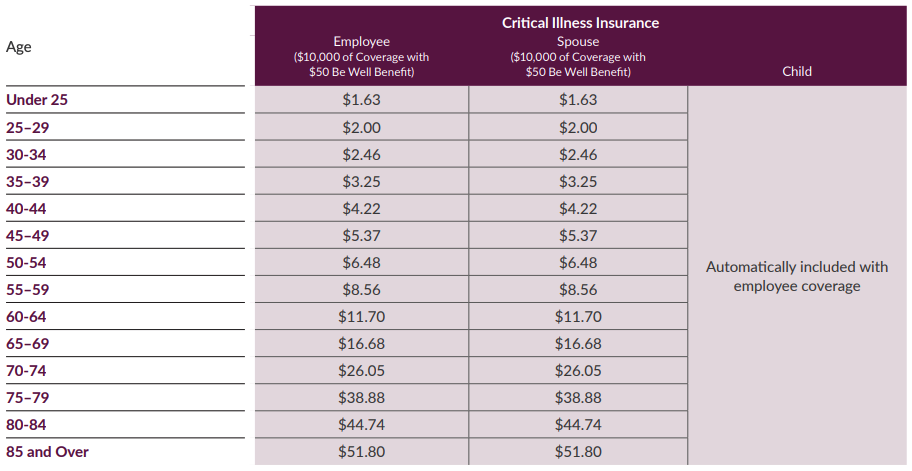

CRITICAL ILLNESS COSTS

Listed below are the per pay period costs for critical illness insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

LIFELOCK WITH NORTON

Southwest Human Development offers you the option to purchase identity and device protection through LifeLock with Norton. Choose between two membership levels—Essential or Premier—based on your needs.

Your membership provides you with access to a suite of credit, device, and identity monitoring services, including webcam protection, online privacy protection, data breach and account activity alerts, multi-layer security for your cloud storage and devices, as well as a parent portal where you can monitor your child’s online activity and block harmful sites.

The cost for each membership option is listed below:

- Essential membership: Employee-only coverage is available AT NO COST. You can enroll in family coverage for $3.00 per pay period.

- Premier membership: The cost for coverage is $3.00 per pay period for employee-only coverage or $7.15 per pay period for family coverage.

If you are already enrolled in a LifeLock membership and would like to take advantage of the LifeLock with Norton benefit through Southwest Human Development, please call 800-607-9174 between 9 a.m.–7 p.m. EST, Monday–Friday to cancel your existing membership. You will receive a refund for any unused premium.