Voluntary Benefits

Schwazze offers the following voluntary benefits to support your financial wellbeing.

Depending on your personal situation, basic life and AD&D insurance might not be enough coverage for your needs. To protect those who depend on you for financial security, you may want to purchase supplemental coverage.

SUPPLEMENTAL LIFE AND AD&D INSURANCE

Schwazze provides you the option to purchase supplemental life and AD&D insurance for yourself, your spouse, and your dependent children through Sun Life Financial.

You must purchase supplemental coverage for yourself in order to purchase coverage for your spouse and/or dependents. Supplemental life rates are age-banded. Benefits will reduce to 65% at age 65 and to 50% at age 70.

- Employee: $10,000 increments up to $500,000 or 5x annual salary, whichever is less—guarantee issue: $100,000

- Spouse: $5,000 increments up to $250,000 or 50% of the employee’s election, whichever is less—guarantee issue:

$30,000 - Dependent children: 14 days to 6 months: $500; 6 months to age 19 (or 26 if full-time student): $10,000— guarantee issue: $10,000

If you elect supplemental coverage when you’re first eligible to enroll, you may purchase up to the guarantee issue amount(s) without completing a statement of health (evidence of insurability). If you do not enroll when first eligible, and choose to enroll during a subsequent annual open enrollment period, you will be required to submit evidence of insurability for any amount of coverage. Coverage will not take effect until approved by Sun Life Financial.

SHORT-TERM DISABILITY INSURANCE

Schwazze provides you the option to purchase short-term disability (STD) insurance through Sun Life Financial. STD insurance is designed to help you meet your financial needs if you become unable to work due to an illness or injury. Benefits will be reduced by other income, including state-mandated STD plans.

- Benefit: 60% of weekly earnings up to $1,000

- Elimination period: 8 days

- Benefit duration: Up to 25 weeks

STD MATERNITY BENEFITS

STD insurance can cover a portion of your income while on paid or unpaid maternity leave. You must apply for STD benefits prior to giving birth to qualify. Please view the official plan documents for varying coverage based on birth circumstances. Benefits will be reduced by other income, including state-mandated STD plans.

Disability insurance is an important part of your benefits coverage. You may use disability benefits to pay for your necessary expenses while you are unable to work, such as mortgage payments, medical expenses, childcare, and more. If you are enrolled and become unable to work due to an accident, illness, injury, or pregnancy, you must apply for benefits as soon as you are able after your event. Please notify Sun Life Financial as soon as possible to ensure you qualify for coverage and receive timely payouts.

ACCIDENT INSURANCE BENEFITS

Accident insurance provides cash benefits if you or a covered family member is accidentally injured while off the job. Claims payments are made in flat amounts based on services incurred during an accident.

You receive a $50 wellness benefit every year you and any of your covered family members complete a single covered health assessment.

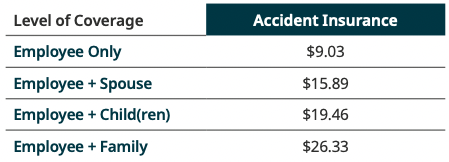

ACCIDENT INSURANCE COSTS

Listed to the right are the monthly costs for accident insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

CRITICAL ILLNESS BENEFITS

Critical illness insurance provides cash benefits if you or a covered family member is diagnosed with a critical illness or event. Benefits are paid in addition to what is covered under your health insurance. This plan includes access to a personal health advocate who can assist you in managing health care services for you and your entire family.

- Employee: $10,000, $20,000, or $30,000—guarantee issue: $30,000

- Spouse: $5,000, $10,000, or $15,000 (up to 50% of the employee coverage amount)—guarantee issue: $15,000

- Dependent children: Up to 25% of employee election—guarantee issue: all amounts

You receive a $50 wellness benefit every year you and any of your covered family members complete a single covered health assessment.

HOSPITAL INDEMNITY BENEFITS

If you or a covered family member have to go to the hospital for an accident or injury, hospital indemnity insurance provides a lump-sum cash benefit to help you take care of unexpected expenses—anything from deductibles to child care to everyday bills.

- Hospital admission: $1,000

- Hospital confinement: $100 per day up to 60 days

- Intensive care unit admission: $1,000 per admission

- Intensive care unit confinement: $200 per day up to 60 days

You receive a $50 wellness benefit every year you and any of your covered family members complete a single covered health assessment.

HOSPITAL INDEMNITY COSTS

Listed to the right are the monthly costs for hospital indemnity insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

PET INSURANCE

Schwazze offers a voluntary pet insurance through Nationwide. The plan is designed to provide pet parents 90% cash back on eligible vet bills at the vet of their choice.

There are two levels of coverage to choose from, My Pet Protection and My Pet Protection Plus with Wellness. Both plans have a $250 annual deductible and a $7,500 annual maximum per pet.

My Pet Protection covers:

- Accidents and injuries

- Cancer

- Dental disease

My Pet Protection with Wellness includes everything in the My Pet Protection Plan plus:

- Wellness exams

- Flea and tick

- Spay or neuter

- Heartworm prevention Pre-existing conditions are not covered in either plan.

Visit petinsurance.com for more information and a quote.