Sage offers two medical plan options through Cigna and one medical plan option through Kaiser Permanente (Kaiser).

The Cigna HDHP (High Deductible Health Plan) offers in- and out-of-network benefits, providing you the freedom to choose any provider. However, you will pay less out of your pocket when you choose a network provider. Find a network provider at mycigna.com.

- The Cigna 70% plan offers in-network benefits only. All services must be provided by a Cigna network provider (except in

the case of a life- or limb-threatening emergency). No benefits will be paid for services received from an out-of-network provider. - The Kaiser plan offers in-network benefits only. All services must be provided by a Kaiser network provider (except in the case of a life- or limb-threatening emergency). No benefits will be paid for services received from an out-of-network

provider. You can go to kp.org to find a network provider.

Before you enroll in medical coverage, take some time to fully understand how each plan works.

BEFORE YOU CHOOSE A PLAN, CONSIDER THIS:

Are you able to budget for your deductible by setting aside pre-tax dollars from your paycheck in a health savings account (HSA)?

Consider the Cigna HDHP.

What planned medical services do you expect to need in the upcoming year?

MEDICAL COSTS

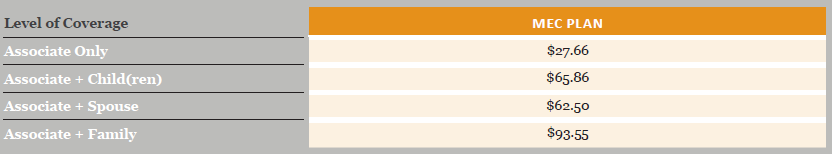

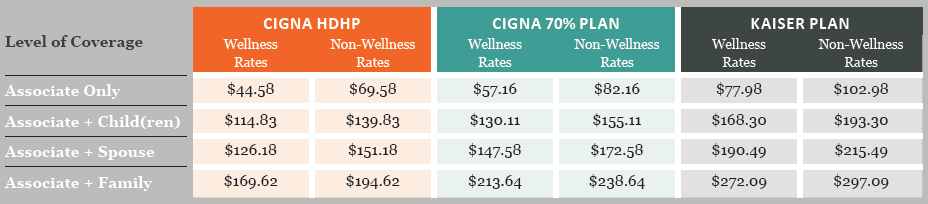

Listed below are the per pay period costs for medical insurance. The amount you pay for coverage is deducted from your paycheck on a pre-tax basis.

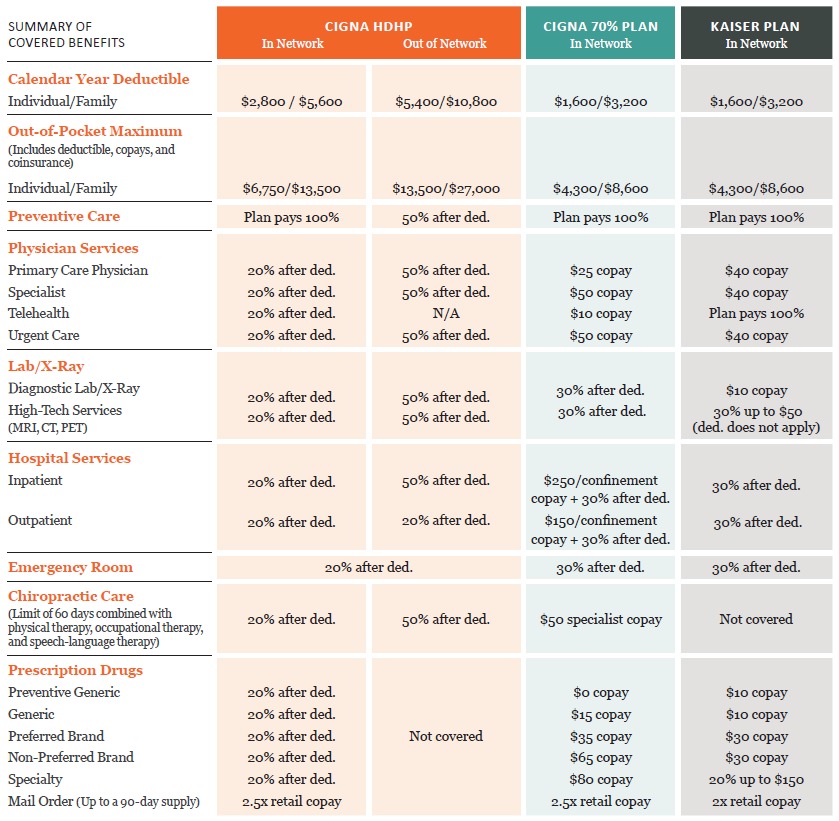

The table below summarizes the benefits of each medical plan.

The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

ARE YOU COVERING YOUR SPOUSE AND/OR CHILDREN?

Cigna HDHP members: If you elect associate + spouse, associate + child(ren), or family coverage, the individual deductible and out-of-pocket max DO NOT apply. The family deductible must be met, either by one individual, or by a combination of family members, before the plan begins to pay. The same rule applies to the out-of-pocket max.

Cigna 70% Plan and Kaiser Plan members: If you elect associate + spouse, associate + child(ren), or family coverage, the individual deductible and out-of-pocket max apply to each covered member of the family (capped at family amount).

COMPARING YOUR MEDICAL PLAN OPTIONS

Choosing the right medical plan is an important decision. Take the time to learn about your options to ensure you select the right plan for you and your family.

Cigna HDHP

- Lower cost per paycheck

- Higher deductible

- You can fund a health savings account

Cigna 70% Plan

- Mid-range cost per paycheck

- Lower deductible

- You can fund a health care flexible spending account

Kaiser Plan

- Higher cost per paycheck

- Lower deductible

- You can fund a health care flexible spending account

FIVE THINGS TO CONSIDER

- Do you prefer to pay MORE for medical insurance out of your paycheck, but less when you need care?

- Or, do you prefer to pay LESS out of your paycheck, but more when you need care?

- What PLANNED medical services do you expect to need in the upcoming year?

- Are you able to BUDGET for your deductible with pre-tax dollars from your paycheck in an HSA or FSA?

- Do you or any of your covered family members take any prescription MEDICATIONS on a regular basis?

NUMBERS TO KNOW

DEDUCTIBLE

The amount you must pay for medical services before the insurance plan will begin to pay. However, your preventive care is covered 100% by the plan.

HDHP In-Network Deductible:

- Individual: $2,800

- Family: $5,600*

70% Plan In-Network Deductible:

- Individual: $1,600

- Family: $3,200

Kaiser Plan In-Network Deductible:

- Individual: $1,600

- Family: $3,200

OUT-OF-POCKET (OOP) MAXIMUM

The maximum amount of money you will pay for medical services during the plan year. The OOP maximum is the sum of your deductible and coinsurance payments.

HDHP In-Network OOP Maximum:

- Individual: $6,750

- Family: $13,500*

70% Plan In-Network OOP Maximum:

- Individual: $4,300

- Family: $8,600

Kaiser Plan In-Network OOP Max:

- Individual: $4,300

- Family: $8,600

COINSURANCE

A form of cost-sharing where you and the insurance plan share expenses in a specified ratio after you meet the deductible (until you reach the OOP maximum).

HDHP In-Network Coinsurance:

- 20%

70% Plan In-Network Coinsurance:

- 30%

Kaiser Plan In-Network Coinsurance:

- 30%

*For the Cigna HDHP: If you elect family coverage, the individual deductible and out-of-pocket maximum do not apply. You must satisfy the full family deductible before the plan begins to pay toward services. Additionally, you must satisfy the full family out-of-pocket maximum before the plan will cover all expenses for the remainder of the plan year.

In-network preventive care is free for medical plan members.

The Sage medical plans pay 100% of the cost of preventive care when received from a network provider. This means you won’t have to pay anything out of your pocket.

WHAT IS PREVENTIVE CARE?

The focus of preventive health care is to PREVENT illnesses, disease, and other health problems, and to DETECT issues at an early stage when treatment is likely to work best.

WHY IS PREVENTIVE CARE IMPORTANT?

It is important that you have a preventive exam each year—even if you feel healthy and are symptom free—in order to IDENTIFY FUTURE HEALTH RISKS.

WHAT'S COVERED?

Covered preventive services VARY BY AGE AND GENDER. Talk with your provider to determine which screenings, tests, and vaccines will be covered, when you should get them, and how often.

SAVE MONEY ON YOUR HEALTH CARE

Choose an in-network provider.

Choose an in-network provider and you’ll pay less out of your pocket. Why? Because in-network doctors and facilities contract with the insurance company and agree to charge a lower price for services.

Request an in-network lab.

When your doctor orders a test, confirm that an in-network lab will be used. If your tests are sent to an out-of-network lab, you may incur additional out-of-pocket expenses.

Check your explanation of benefits.

After your appointment, review your explanation of benefits (EOB) and provider bill to confirm you were billed correctly.

Note: Some services are generally not considered preventive if you get them as part of a visit to diagnose, monitor, or treat an illness or injury. Please be aware that you will be responsible for the cost of any non-preventive care services you receive at your preventive care exam based on your plan design. Learn more about preventive care at mycigna.com.

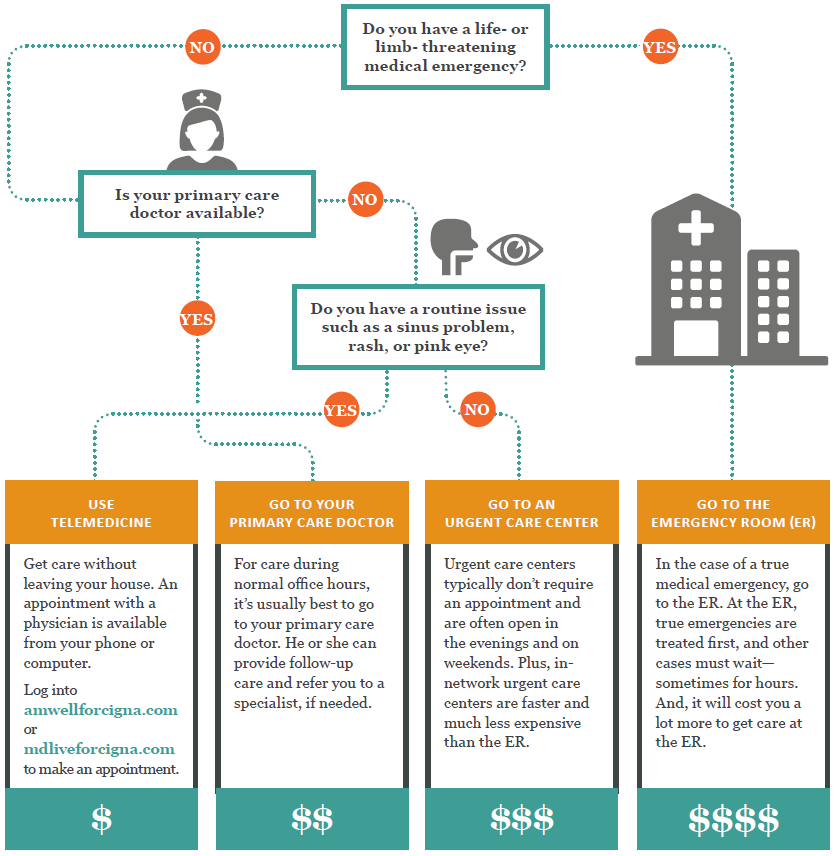

Know where to go for your health care.

Where you go for medical services can make a big difference in how much you pay and how long you wait to see a health care provider. Use the chart below to help you choose where to go for care.

CIGNA PHARMACY PROGRAMS

Prescription coverage is provided through the Cigna medical plans.

CIGNA COACHRX

Cigna CoachRx is a free program that helps you manage your medications. The program provides personalized support to help you take your medications safely and regularly and help you find ways to lower your medication costs.

Visit cigna.com/coachrx or call 800-835-8981 to learn more.

CIGNA 90 NOW

Maintenance medications are taken regularly, over time, to treat an ongoing health condition. With Cigna 90 Now, maintenance medications have to be filled in a 90-day supply at one of the 90-day retail pharmacies in your plan’s network, or through Cigna Home Delivery Pharmacy. For more information about your pharmacy network, visit

cigna.com/rx90network.

PREVENTIVE GENERICS COVERED 100%

Preventive medications are used for the prevention of conditions such as high blood pressure, high cholesterol, diabetes, asthma, osteoporosis, heart attack, stroke, and prenatal nutrient deficiency. The cost of certain generic preventive medications will be covered 100% by the Cigna medical plans. You will not have to pay anything out of your pocket for certain preventive generic medications.

Log into mycigna.com for a complete and up-to-date drug; list preventive medications are indicated with a “PM” symbol after the drug name.

MANDATORY GENERIC PHARMACY PROGRAM

The mandatory generic pharmacy program substitutes generic drugs for all brand-name prescription drugs with a direct generic equivalent. If you choose to fill your prescription with a brand-name drug when a generic alternative is available, you will pay the brand-name copay plus the difference in the cost between the brand and generic, up to the full cost of the brand-name drug.

Note: These cost differences will not be limited by per-prescription maximums or annual out-of-pocket maximum limits.

STEP THERAPY

Step therapy is a prior authorization program. Certain medications in the step therapy program need approval before they’re covered.

When you fill a prescription for a step therapy medication, Cigna will send you and your doctor a letter explaining what steps you need to take before you refill your medication. This may include trying a generic or lower cost alternative, or asking Cigna for authorization for coverage of your medication. At any time, if your doctor feels a different medication isn’t right for you due to medical reasons, he/she can request authorization for continued coverage of a step therapy medication.

You can find step therapy medications on your prescription drug list. If “ST” is listed next to your medication name, then it’s part of the step therapy program.

The information on this page does not apply to the MEC plan.

CIGNA TELEHEALTH CONNECTION

Cigna provides access to two telehealth services as part of your medical plan—AmWell and MDLIVE.

Cigna Telehealth Connection lets you get the care you need—including most prescriptions—for a wide range of minor conditions. Now you can connect with a board-certified doctor via secure video chat or phone, without leaving your home or office.

WHAT CAN BE TREATED?

- Acne

- Allergies

- Asthma

- Bronchitis

- Cold and flu

- Constipation

- Diarrhea

- Ear infection

- Fever

- Headache

- Insect bite

- Joint aches

- Nausea

- Rashes

- Sinus infection

- Sore throat

- UTI

Register for one or both* so you’ll be ready to use a telehealth service when and where you need it.

To register for AmWell visit amwellforcigna.com or call 855-667-9722.

To register for MDLIVE visit mdliveforcigna.com or call 888-726-3171.

*Availability may vary by location and plan type and is subject to change. See vendor sites for details.

CIGNA CARE MANAGEMENT

Cigna care management helps you access the right care, at the right time, in the right place.

With precertification, you find out in advance if a service is covered, which can help you lower costs and avoid unnecessary procedures. The Cigna nurse case managers support you as you recover after a hospital stay or outpatient procedure to help you get back to better health.

WHAT DOES CARE MANAGEMENT MEAN FOR YOU?

- Ease. When you or a covered family member visit a participating Cigna doctor or facility:

- Your doctor arranges all the care.

- Your doctor gets precertification when it’s needed. If you visit an out-of-network doctor or facility, you’re responsible for getting precertification.

- Savings. Cigna reviews inpatient and outpatient services and looks for ways to save you money. Cigna may:

- Provide a list of preferred facilities in your plan’s network.

- Transition inpatient care to outpatient treatment.

- Help identify avoidable treatments or procedures.

- Quality of care. You’ll have access to nurse case managers who can help you find the support you need to get

better. This includes:- Home health care.

- Therapies.

- Special medical needs to help you avoid complications after a hospital stay or outpatient procedure.

CIGNA TOOLS AND RESOURCES

mycigna.com is completely personalized, so it’s easy to quickly find exactly what you’re looking for.

- Find doctors and medical services.

- Manage and track claims.

- See cost estimates for medical procedures.

- Compare quality of care ratings for doctors and hospitals.

- Access a variety of health and wellness tools and resources.

Manage your health and health care expenses with ease. It’s all waiting for you on mycigna.com.

CONNECT WITH BETTER HEALTH. HERE’S HOW:

Health and wellness

- Condition and wellness resources. Using the interactive medical library, find information on health conditions, first aid, medical exams, wellness, and more.

Cost estimates and quality of care ratings

- Find a doctor. Personalized search results make it easy to find the right doctor for you. Search by name, specialty, procedure, location, and other criteria.

- Estimate medical costs. Review estimated costs for specific, in-network procedures, treatments, and facilities so there aren’t any surprises.

- Compare hospitals and doctors. See how they compare by cost, patient outcomes, and more.

- Quality of care. Quality distinctions and cost-efficiency ratings for doctors appear with every search result, with quality-designated doctors appearing at the top of your list.

- Prescription drug price quote tool. Compare prices between Cigna Home Delivery Pharmacy and our network of retail pharmacies to help ensure you’re getting the best price possible.

- Manage and track claims. Quickly search and sort claims, as well as track account balances, like deductibles and out-of-pocket maximums.

GET THE MOST OUT OF CIGNA

For a quick tour on how to get the most out of Cigna, visit mycigna.com and click the “Site Benefits” tab.

New Cigna members, after January 1 or your benefits effective date, register at mycigna.com.

PREVENTIVE HEALTH NOW INCENTIVE PROGRAM

HEALTHY YOU, HAPPY WALLET

Our mission is to create a culture that inspires, supports, and engages our associates in making healthy, everyday lifestyle choices in their professional and personal lives. Knowing your health status is an important step in living a healthy life.

Associates may be eligible to participate in the wellness discount program. Current associates going through open enrollment have until December 31, 2019 to complete the HRA as outlined below. New hires must complete an HRA within 60 days of the effective date of coverage. Once completed by the appropriate deadline, associates will be awarded a premium credit for the 2020 plan year.

COMPLETE A HEALTH RISK ASSESSMENT

Log into preventivehealthnow.com to complete your health risk assessment (HRA).

If you complete an HRA within 60 days of your effective date of coverage, you will be awarded a premium credit for the 2020 plan year.

REGISTER FOR THE WELLNESS PORTAL

Visit preventivehealthnow.com and click “Log-In” in the top right.

- Your username is your lastnamelast4SSN (for example: Smith1234).

- Your initial password is PHN1234.

- It will have you create a new password. The password MUST be 8 characters long with an uppercase, lowercase, number, AND symbol. For example: Benefit1$. You cannot use , . ? - = + as a symbol.

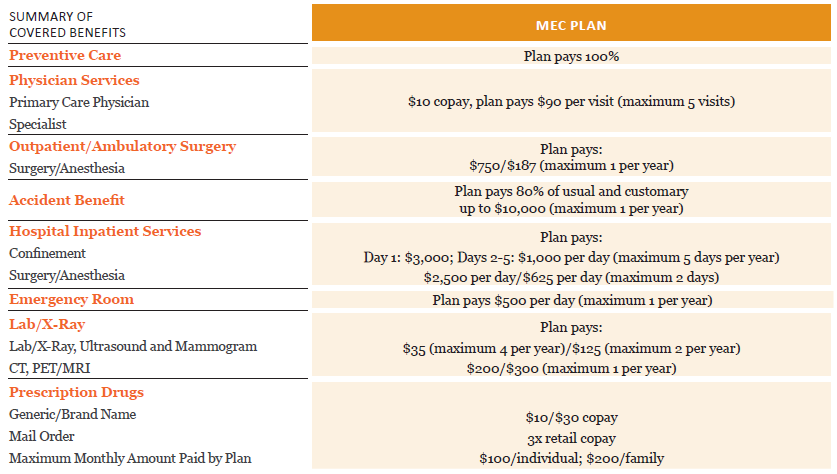

MINIMUM ESSENTIAL COVERAGE

Sage offers a lower-cost minimum essential coverage (MEC) health plan option for non-union associates. The MEC plan is not an insurance plan.

This is not a traditional health insurance plan—it is a limited benefit medical plan that reimburses members for covered expenses up to specified limits. You will be responsible for paying all costs above the reimbursement limits.

As the name implies, this plan provides significantly less coverage than the Cigna plans, but the amount you pay for this plan is much less than what you would pay for either of the Cigna plans.

You can minimize the amount you will have to pay out of your pocket by utilizing in-network providers through the First Health Network. Providers in the First Health Network have agreed to discount their fees for MEC plan members. Locate a First Health Network provider at myternian.com or by calling 800-214-7224.

The table below summarizes the benefits of the MEC plan. Please refer to the official plan documents for additional information on coverage and exclusions.

MEDICAL COSTS

Listed below are the per pay period costs for medical insurance. The amount you pay for coverage is deducted from your paycheck on a pre-tax basis.