SAFEbuilt provides you the option to purchase voluntary benefits that provide financial security for you and your family.

ACCIDENT INSURANCE

Accident insurance offered through The Standard can pay a set benefit amount based on the type of injury you have and the type of treatment you need. It includes a range of incidents, from common injuries to more serious events.

Why is this coverage so valuable?

- It can help you with out-of-pocket costs that your medical plan doesn’t cover, like copays and deductibles.

- You are guaranteed base coverage, without answering health questions.

- This benefit pays a cash sum directly to you so you can decide what expenses to pay.

- You can keep your coverage even if you change jobs or retire.

- This plan includes a wellness benefit that pays $100 per calendar year per insured individual if a covered health screening test is performed, including: blood tests, chest X-rays, stress tests, mammograms, and colonoscopies.

Click here to learn more about this benefit.

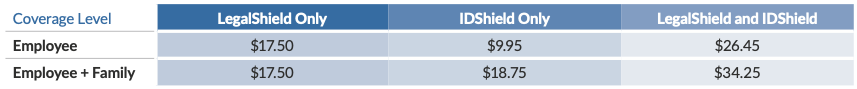

ACCIDENT INSURANCE COSTS

Listed below are the monthly costs for accident insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax, bimonthly basis.

CRITICAL ILLNESS INSURANCE

Critical Illness insurance is offered through The Standard. If you are diagnosed with an illness that is covered by critical illness insurance, you can receive a lump-sum benefit payment. You can use the money however you want to assist you in offsetting unexpected expenses due to a critical illness diagnosis.

Why is this coverage so valuable?

- The money can help you pay out-of-pocket expenses like copays, deductibles, and other living expenses that may be impacted.

- You can use this coverage more than once. Even after you receive a payout for one illness, you’re still covered for any remaining conditions. Benefits will pay once per diagnosis.

- You can keep your coverage even if you change jobs or retire.

Who can get coverage?

- Employee: $10,000, $20,000, or $30,000

- Spouse: $5,000, $10,000 or $15,000, not to exceed 50% of employee’s coverage

- Dependent children: 25% of employee’s election

Click here to learn more about this benefit.

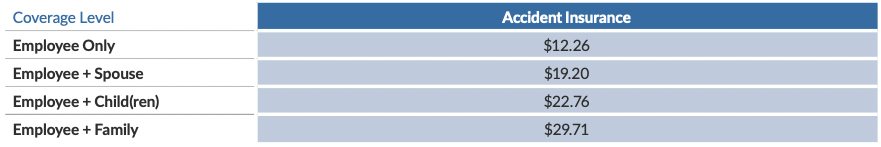

CRITICAL ILLNESS INSURANCE COSTS

Listed below are the monthly costs for critical illness insurance The amount you pay is deducted from your paycheck on a post-tax, bimonthly basis.

*Covered individual’s age upon initial attainment of coverage and each January 1 thereafter.

HOSPITAL INDEMNITY INSURANCE

Hospital indemnity insurance offered through The Standard can complement your medical coverage by helping to ease the financial impact of a hospitalization. It provides a lump-sum payment that can be used for hospital admission, accident-related inpatient rehabilitation, hospital stays, or any other expenses that you incur.

What’s included?

- $1,500 for each covered hospital admission (once per year).

- $100 for each day of your covered hospital stay, up to 15 days (once per year).

- $200 for each day you spend in intensive care, up to 15 days (once per year). This is in addition to the covered hospital stay benefit.

- A wellness benefit that pays $50 per calendar year per insured individual if a covered health screening test is performed, including: blood tests, chest X-rays, stress tests, mammograms, and colonoscopies.

- You can keep your coverage even if you change jobs or retire.

Click here to learn more about this benefit.

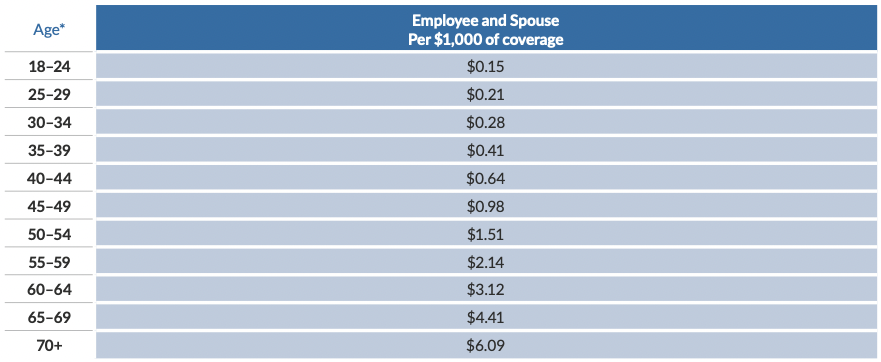

HOSPITAL INDEMNITY INSURANCE COSTS

Listed below are the monthly costs for hospital indemnity insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax, bimonthly basis.

*Covered individual’s age on December 31 of the year the policy is originated.

LEGALSHIELD: LEGAL PROTECTION

Unexpected legal questions arise every day, and with LegalShield on your side, you’ll have access to a quality law firm for covered personal situations, even 24/7 for emergency situations, no matter how traumatic or how trivial they may seem. Because their dedicated law firms are prepaid, their sole focus is to serve you, rather than bill you.

Coverage includes:

- Legal consultation and advice

- Court representation

- Dedicated provider law firms

- Legal document preparation and review

- Will preparation

- Letters and phone calls made on your behalf

- Speeding ticket assistance

- 24/7 emergency legal access

For more information about this benefit, visit benefits.legalshield.com/safebuilt.

IDSHIELD: IDENTITY THEFT PROTECTION

During these unprecedented times, it is more important than ever to safeguard not only our physical health, but our digital and financial health as well. With an identity theft protection plan from IDShield, you can have peace of mind knowing your identity is secure.

Benefits include:

- Identity consultation and advice

- Dedicated licensed private investigators

- Identity, credit, and financial account monitoring (TransUnion, Equifax, and Experian)

- Child monitoring (family plan only)

- Full-service identity restoration

- Real-time alerts

- 24/7 emergency access

- Social media monitoring and online privacy reputation management

For more information about this benefit, visit benefits.legalshield.com/SAFEbuiltids.

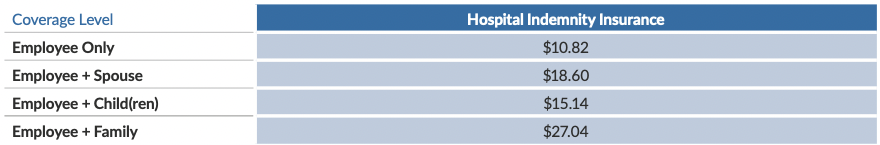

LEGAL AND IDENTITY THEFT PROTECTION COSTS

Listed below are the monthly costs for legal and identity theft protection services. The amount you pay for coverage is deducted from your paycheck on a post-tax, bimonthly basis.