SAFEbuilt provides basic life and accidental death and dismemberment (AD&D) insurance to all benefits-eligible employees AT NO COST*, and you have the option to purchase voluntary life and AD&D insurance.

BASIC LIFE AND AD&D INSURANCE

SAFEbuilt automatically provides basic life and AD&D insurance through Anthem to all benefits-eligible employees AT NO COST*. If you die as a result of an accident, your beneficiary would receive both the life benefit and the AD&D benefit. Please be sure to keep your beneficiary designations up to date.

- Employee life benefit: $100,000 (maximum 3x annual salary)

- Employee AD&D benefit: $100,000 (maximum 3x annual salary)

Benefits reduce to 65% at age 65 and to 50% at age 70.

*IRS regulations require companies to tax the value of the basic life insurance benefit that is over $50,000 by using the IRS Group Term Life Imputed Income Tax Table. The value is what the IRS deems the premium to be on that benefit over $50,000. That value is what is taxed. Refer to IRS Publication 15-B for more details.

VOLUNTARY LIFE AND AD&D INSURANCE

SAFEbuilt provides you the option to purchase voluntary life and AD&D insurance for yourself, your spouse, and your dependent children through Anthem. You must purchase voluntary coverage for yourself in order to purchase coverage for your spouse and/or dependents. Benefits reduce to 65% at age 65 and to 50% at age 70.

- Employee: $10,000 increments up to $1,000,000 or 5x annual earnings, whichever is less. Guarantee issue is $250,000*

- Spouse: $10,000 increments up to $250,000 or 100% of the employee’s election, whichever is less. Guarantee issue is $50,000*

- Dependent children: $1,000 increments up to $10,000. Guarantee issue is $10,000*

*If you elect voluntary coverage when you are first eligible to enroll, you may purchase up to the guarantee issue amount without completing a statement of health (evidence of insurability). If you do not enroll when first eligible and choose to enroll at a later date (not limited to open enrollment), or choose to increase the amount of coverage, you will be required to submit evidence of insurability (EOI), regardless of coverage amount. Coverage will not take effect until approved by Anthem.

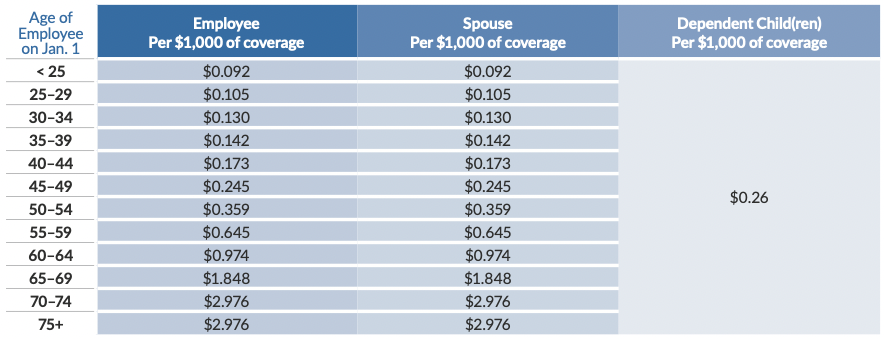

VOLUNTARY LIFE AND AD&D INSURANCE COSTS

Listed below are the monthly costs for voluntary life and AD&D combined. The amount you pay for coverage is deducted from your paycheck on a post-tax, bimonthly basis.