BUDGETING FOR YOUR HEALTH CARE

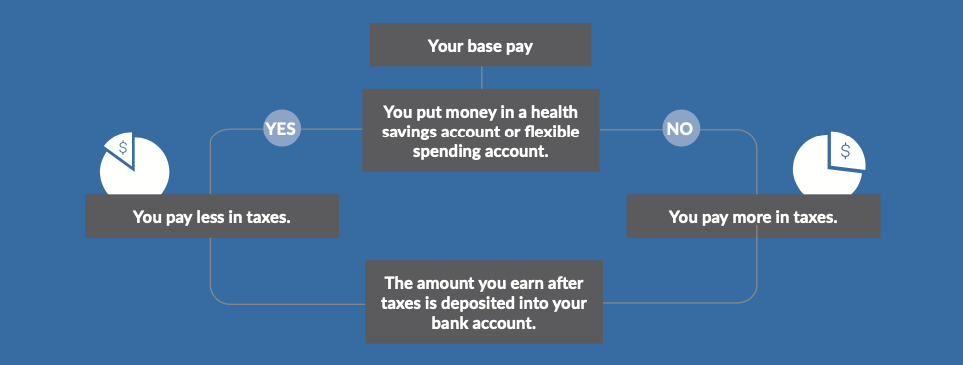

You can save about 20%* on your care by putting money in a health savings account or flexible spending account. This is because you don’t pay taxes on your contributions.

COMPARE YOUR OPTIONS

*Percentage varies based on your tax bracket.

(1) SAFEbuilt contributes up to $750 annually for employee only coverage and up to $1,500 annually for employee plus dependent(s) coverage. Contributions are made on a per paycheck basis (two per month).

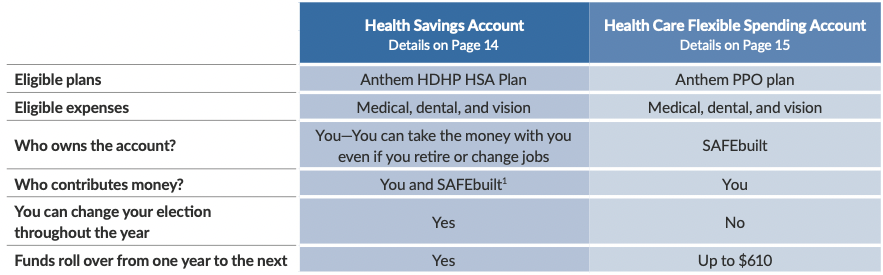

HEALTH SAVINGS ACCOUNT

If you enroll in the Anthem HDHP HSA Plan, you may be eligible to open and fund a health savings account (HSA) through PlanSource.

An HSA is a savings account that you can use to pay out-of-pocket health care expenses with pre-tax dollars.

EMPLOYER CONTRIBUTION

SAFEbuilt will help you save by contributing annually to your account.

- Employee-only: $750 ($31.25 bimonthly)

- Employee + dependent(s): $1,500 ($62.50 bimonthly)

2023 IRS HSA CONTRIBUTION MAXIMUMS

Contributions to an HSA cannot exceed the IRS allowed annual maximums.

- Individuals: $3,850

- All other coverage levels: $7,750

If you are age 55+ by December 31, 2023, you may contribute an additional $1,000.

HSA ELIGIBILITY

You are eligible to fund an HSA if you are enrolled in the Anthem HDHP HSA Plan and meet the following eligibility requirements:

- You are not covered by any other medical plan, such as that of your spouse

- You are not enrolled in Medicare

- You are not enrolled in TRICARE or TRICARE for Life

- You are not claimed as a dependent on someone else’s tax return

- You are not covered by medical benefits from the Veterans Administration

- You do not have any disqualifying alternative medical savings accounts, like a flexible spending account* or Health Reimbursement Account

*If you currently have a regular health care FSA and will have a carryover balance into 2023, you may move your funds to a limited purpose FSA to be used for dental and vision expenses only in 2023. Contact the Benefits Team for information and assistance.

FLEXIBLE SPENDING ACCOUNTS

SAFEbuilt offers three flexible spending account (FSA) options, which are administered by PlanSource.

Log into your account at plansource.wealthcareportal.com to: view your account balance(s), calculate tax savings, view eligible expenses, download forms, view transaction history, and more.