The SAFEbuilt 401(k) retirement plan is designed to help you prepare for retirement and attain your financial goals. The 401(k) retirement plan makes it easy for you to save money on a tax-deferred basis.

When you enroll in the plan, a personal account will be established with Voya in your name, funded by:

- Your contributions (pre-tax and/or Roth).

- Employer matching contributions.

- Investment earnings on both types of contributions.

ELIGIBILITY

SAFEbuilt employees (part-time and full-time) are eligible to enroll in the 401(k) retirement plan. You must meet the following criteria:

- You must attain age 21

- You must complete 1 month of service

Once you have met the eligibility criteria, you may begin participating on the first day of the quarter following your eligibility date.

401(k) PROVIDER INFORMATION

Voya Financial: 800-584-6001

voyaretirementplans.com

BENEFICIARY DESIGNATION

An important aspect of estate planning is making beneficiary designations and keeping them up to date after life changes. It’s generally quick and easy to assign or update your beneficiary designation by visiting voyaretirementplans.com. You will need to provide the name and Social Security number of each beneficiary. If you cannot complete the designation online, you can obtain a paper form.

AUTOMATIC DEFERRALS AND AUTOMATIC INCREASES

As soon as you’re eligible to participate in the 401(k) retirement plan, you will be automatically enrolled at 3% as soon as administratively feasible on or after the first of the quarter following one month of service. If you do not wish to be auto-enrolled, you will need to opt out prior to your automatic enrollment date.

Unless you voluntarily elect to opt out or change your salary deferral percentage, the deferral percentage will begin at 3%.

EMPLOYER MATCHING CONTRIBUTION

SAFEbuilt adds to your savings through its employer match, matching your contributions (pre-tax and/or Roth) dollar for dollar up to 3% each paycheck.

PRE-TAX 401(k) CONTRIBUTIONS

Pretax contributions allow you to reduce your current taxable income.

In addition, any earnings on your contributions are also tax-deferred. Any contributions and earnings are fully taxable as ordinary income when you withdraw them.

ROTH 401(k) CONTRIBUTIONS

You make Roth 401(k) contributions with after-tax money, so you see no immediate tax benefit. Any earnings from those contributions are tax free when you take a qualified distribution.

2023 401(k) PLAN LIMITS

- Your combined elective deferrals—whether to a traditional 401(k), a Roth 401(k) or both—cannot exceed IRS limits. 2023 tax year limits are $22,500 if you are under age 50.

- If you are age 50 or older, you may contribute an additional $7,500 in the form of catch-up contributions.

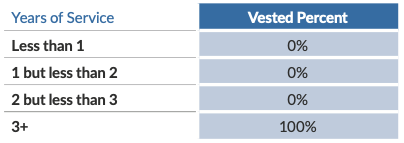

VESTING

The SAFEbuilt matching contributions and their earnings are 100% vested after three years of service.

You are always fully vested in your contributions and earnings.