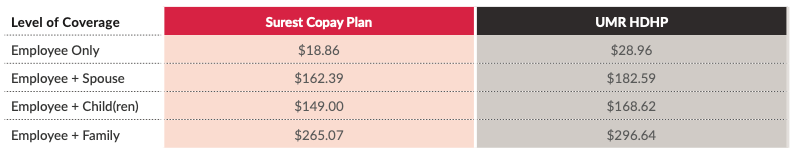

The table below summarizes the benefits of each medical plan.

The copays listed for the Surest Plan reflect the range you'll find when choosing a provider. You decide which providers and cost bet meet your needs.

The coinsurance amounts listed for the UMR HDHP reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

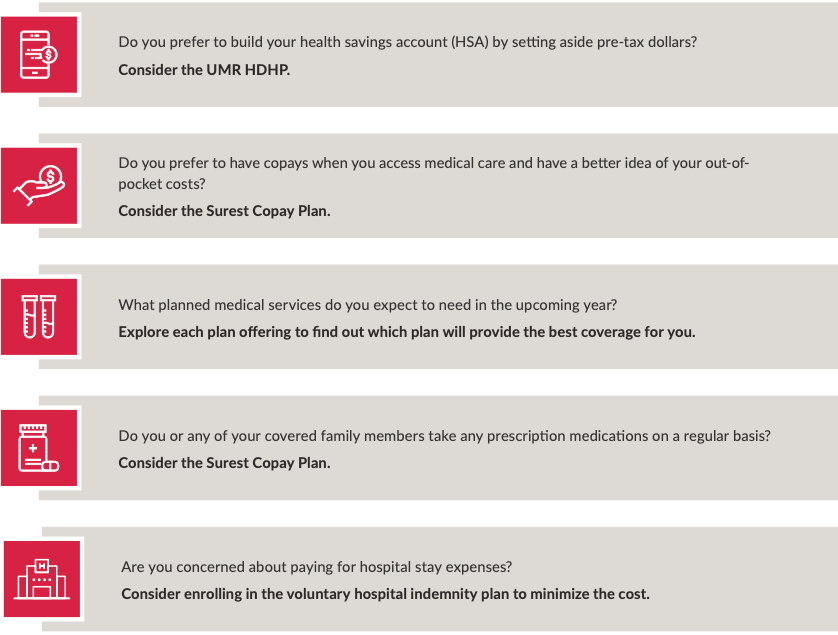

Are you covering your spouse and/or children?

If you elect employee + spouse, employee + child(ren), or family coverage, the individual deductible and out-of-pocket maximum apply to each covered member of the family (capped at family amount).

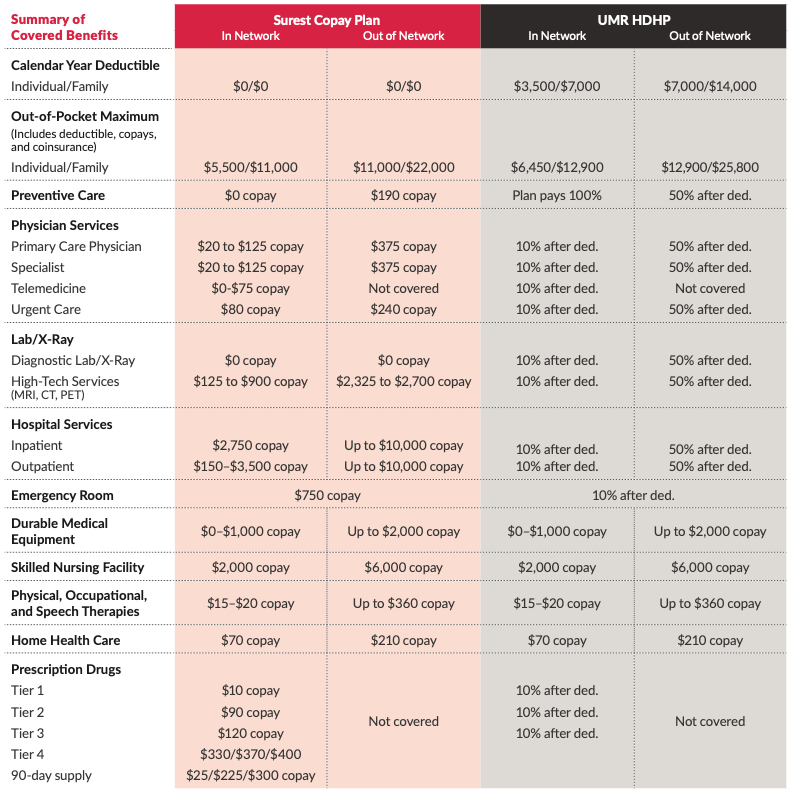

Understanding the Surest Copay Plan

There is no deductible or coinsurance under the Surest Copay Plan. When you need care, other than preventive care, you pay a designated copay for all services. The Surest Copay Plan is easy to use, offers up-front pricing and is designed to help you find opportunities to save money.

Health services are assigned a price tag (copay). For preventive care, the copay is $0 if you visit an in-network provider. For office visits and other procedures—from having an MRI to having a baby—you see one price. By combining the labs and x-rays that go along with a medical procedure or test into one price, it’s easier to know what you’ll pay in advance.

Just like the other medical plans available to you, the out-of-pocket maximum is the most you’ll pay in a calendar year for services covered by the plan. Once this limit is reached, the plan pays 100% for covered services for the rest of the calendar year.

Before making an appointment, check and compare costs—then choose the option that works best for your budget and lifestyle. Receive one bill for a single trip to the doctor or hospital.

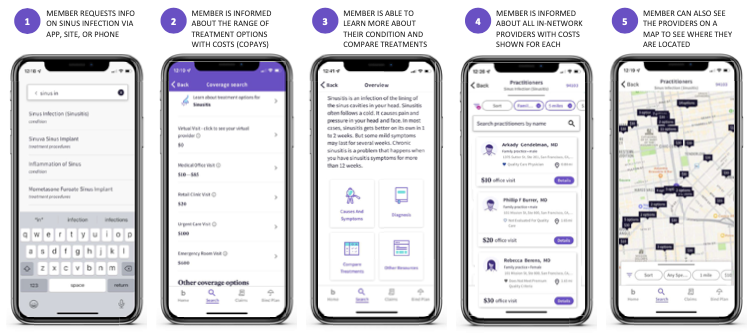

To view prices or check if your doctor is in the network, visit surest.com or download the app. Example: Sinus Infection

Strategies for saving money on your health insurance

- Contribute on a pre-tax basis to an FSA or HSA.

- Consider purchasing accident insurance to minimize health care costs associated with an accident.

- Consider purchasing critical illness insurance to receive a lump-sum benefit in the event of the diagnosis of a critical illness.

- Consider purchasing hospital indemnity insurance if you anticipate a hospital stay.

- Use in-network providers.

- Take advantage of telehealth! UMR HDHP members have 24/7 access to doctors through Teladoc and Surest Copay Plan members can access telehealth through Doctors on Demand.

- Ask your doctor to suggest generic prescriptions when possible.

- Commit to living a healthy lifestyle to improve your overall health and reduce your health care expenses.

Save money on your health care!

Note: Some services are generally not considered preventive if you get them as part of a visit to diagnose, monitor, or treat an illness or injury. Please be aware that you will be responsible for the cost of any non-preventive care services you receive at your preventive care exam based on your plan design. Learn more about preventive care at umr.com or surest.com.

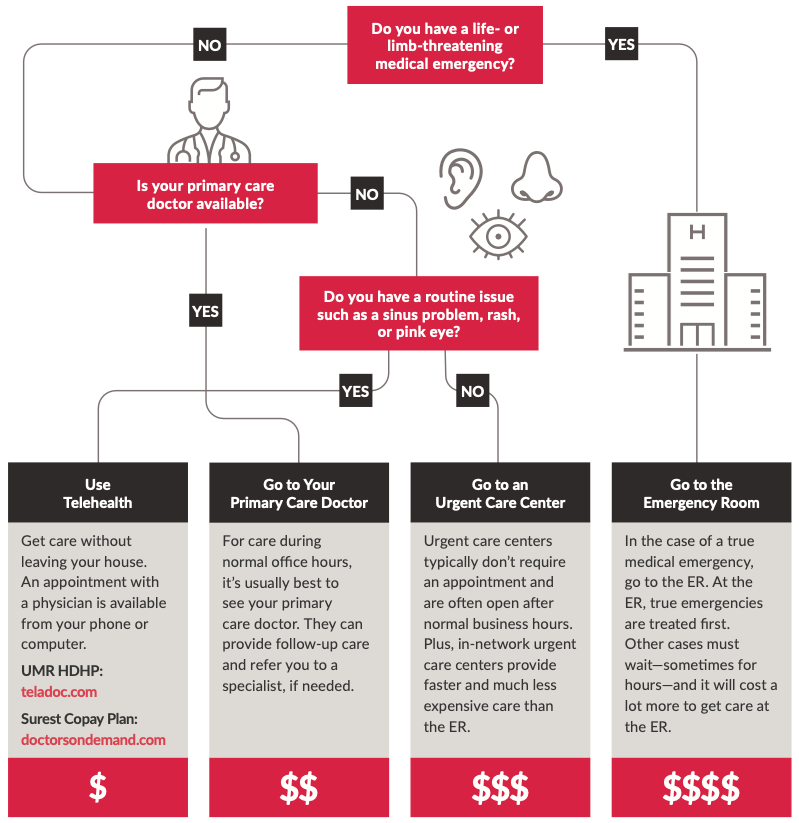

Know where to go for your health care.

Where you go for medical services can make a big difference in how much you pay and how long you wait to see a health care provider. Use the chart below to help you choose where to go for care.

UMR HDHP: teladoc.com

Surest Copay Plan: doctorsondemand.com