Medical insurance

Rise Broadband offers three medical plan options through Cigna.

Before you enroll in medical coverage, take some time to fully understand how each plan works. Refer to page 6 for an overview of the plan benefits.

If you still need help deciding, use the calculators in Bswift or contact one of the benefit counselors.

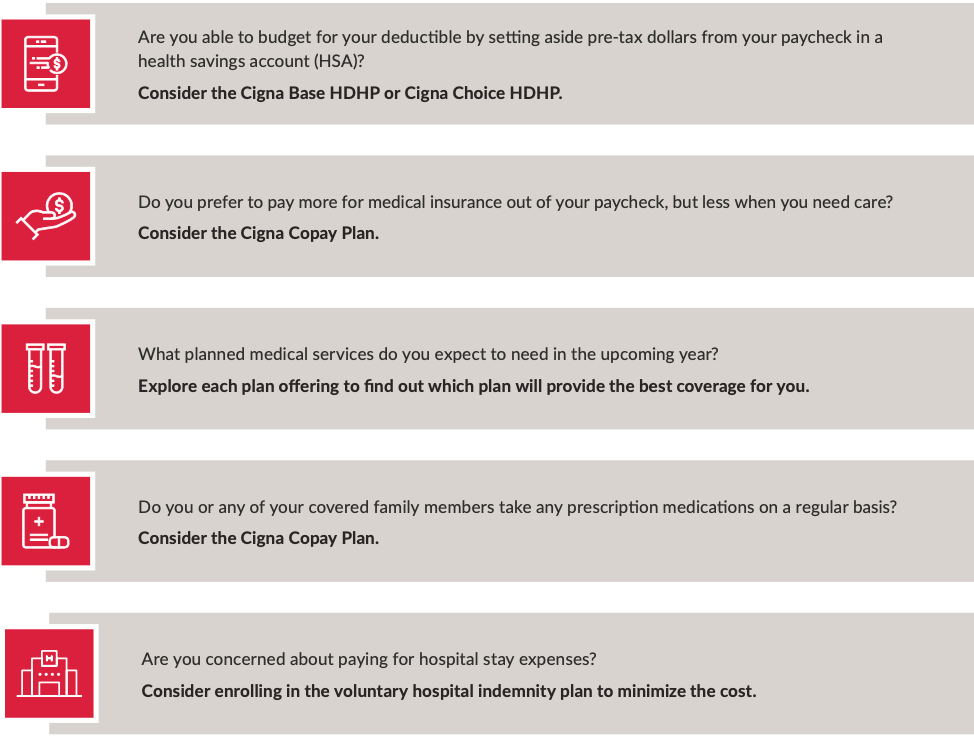

Before you choose a plan, consider this:

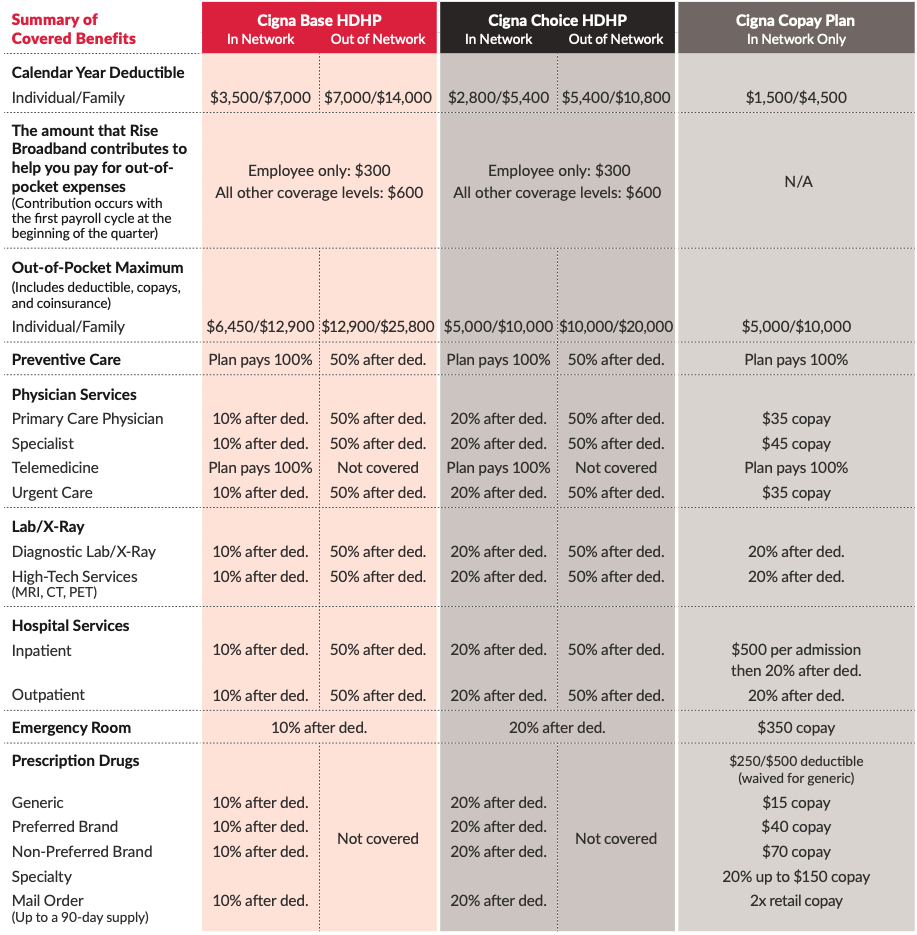

The table below summarizes the benefits of each medical plan.

The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

Are you covering your spouse and/or children?

If you elect employee + spouse, employee + child(ren), or family coverage, the individual deductible and out-of-pocket maximum apply to each covered member of the family (capped at family amount).

Telehealth

Rise Broadband provides you with 24/7 access to HealthiestYou AT NO COST to you. HealthiestYou is a telehealth service that connects you to board certified, licensed physicians via phone, video, or email.

Physicians are able to diagnose, treat, and prescribe medications for:

- Allergies

- Pink Eye

- Bronchitis

- Sinusitis

- Earache

- Strep or sore throat

HealthiestYou gives you access to mental health providers, dermatologists, and nutritionists.

For these services, you will pay a copay:

- Therapist: $5 copay

- Psychologist: $25 copay

- Psychiatrist: $50 copay

- Dermatologist: $85 copay

- Nutritionist: $59 copay

For more information, visit member.healthiestyou.com or download the HealthiestYou mobile app.

Cigna member service

For help understanding your plan, finding providers, estimating out-of-pocket costs, navigating claims and explanations of benefits, searching for medication, and more. For more information, call 866-494-2111, visit mycigna.com, or download the myCigna mobile app.

SaveOnSP Program

If you are enrolled in the Cigna Copay Plan, you have the option to pay $0 for certain specialty prescriptions through the SaveOnSP program at no additional cost.

If your specialty prescription is eligible for the SaveOnSP program, a representative from SaveOnSP will call you. Once enrolled, you will pay $0 for your specialty medication.

Some of the eligible conditions for the SaveOnSP program include:

- Multiple Sclerosis

- Rheumatoid Arthritis

- Psoriasis

- Oncology

Note: If you enroll in the SaveOnSP program, the cost of your medication is paid for through a manufacturer copay assistance program and the cost share will not count toward your deductible or out-of-pocket maximum.

Preventive medications

The Cigna medical plans cover generic and preferred brand drugs at 100% (no deductible, coinsurance, or copay) to help keep you healthy, prevent illness, and manage ongoing health conditions. Preventive medications are used for the prevention of conditions such as high blood pressure, high cholesterol, diabetes, asthma, osteoporosis, heart attack, stroke, and prenatal nutrient deficiency.

Log into mycigna.com for a complete and up-to-date drug list. Preventive medications are indicated with a “PM” symbol after the drug name.

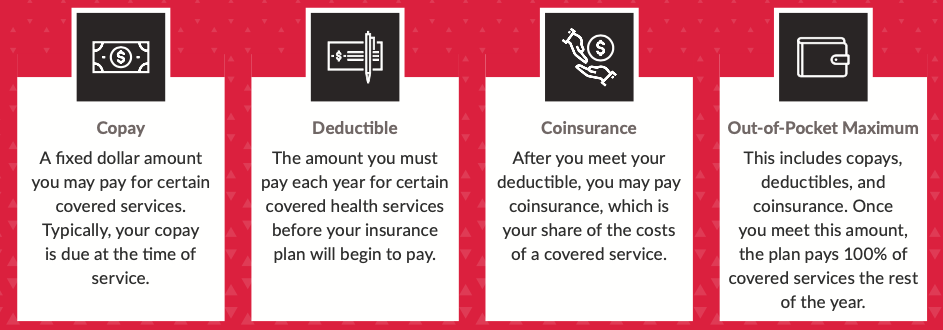

Key terms to know

Strategies for saving money on your health insurance

- Complete the requirements to receive the Wellness Credit, please see below for more information.

- Contribute on a pre-tax basis to an FSA or HSA. Remember, the HSA account also comes with an employer contribution.

- Consider purchasing accident insurance to minimize health care costs associated with an accident.

- Consider purchasing critical illness insurance to receive a lump sum benefit in the event of the diagnosis of a critical illness.

- Consider purchasing hospital indemnity insurance if you anticipate a hospital stay.

- Use in-network providers.

- Take advantage of telehealth.

- Take advantage of the SaveOnSP Program.

- Take advantage of FREE preventive medications.

- Commit to living a healthy lifestyle to improve your overall health and reduce your healthcare expenses.

- Ask your doctor to suggest generic prescriptions when possible.

Wellness requirements through MotivateMe

Rise Broadband has partnered with Cigna to offer the MotivateMe program to all employees enrolled in the medical insurance plan. This program helps you earn rewards for improving your overall health.

By visiting your doctor for an annual preventive care exam and completing the online health assessment through mycigna.com, your monthly deduction for medical insurance will be reduced by $50 per month. If you cover your spouse/domestic partner on your medical insurance, he or she will also need to participate.

Remember, preventive exams and most preventive prescriptions to treat asthma, blood pressure/blood thinner, cholesterol, diabetes, and osteoporosis are FREE! And you can receive your preventive exam at any time during a calendar year. There’s no need to wait for a whole year after your last exam.

Important dates and deadlines:

- For open enrollment this year, employees hired before March 1 must complete the Motivate Me requirements by November 30, 2021. Subsequent years will follow the schedule outlined below.

- Employees and their eligible spouse/domestic partner must complete their preventive exam and risk assessment before August 31 to receive the wellness incentive for the following year.

- Employees hired before March 1 will receive the incentive during the year they’re hired. The employee and their eligible spouse/domestic partner must complete their preventive exam and risk assessment before August 31 to receive the wellness incentive for the following year.

- Employees hired on or after March 1 will receive the incentive during the year they’re hired as well as the following calendar year. During their second calendar year, the employee and their eligible spouse/domestic partner must complete their preventive exam and risk assessment prior to August 31 to receive the wellness incentive for their third calendar year.

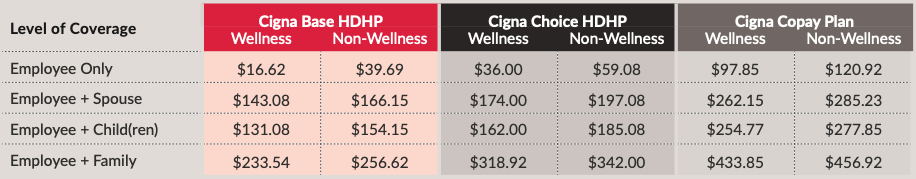

Medical costs

Listed below are the biweekly costs for medical insurance. The amount you pay for coverage is deducted from your paycheck on a pre-tax basis.

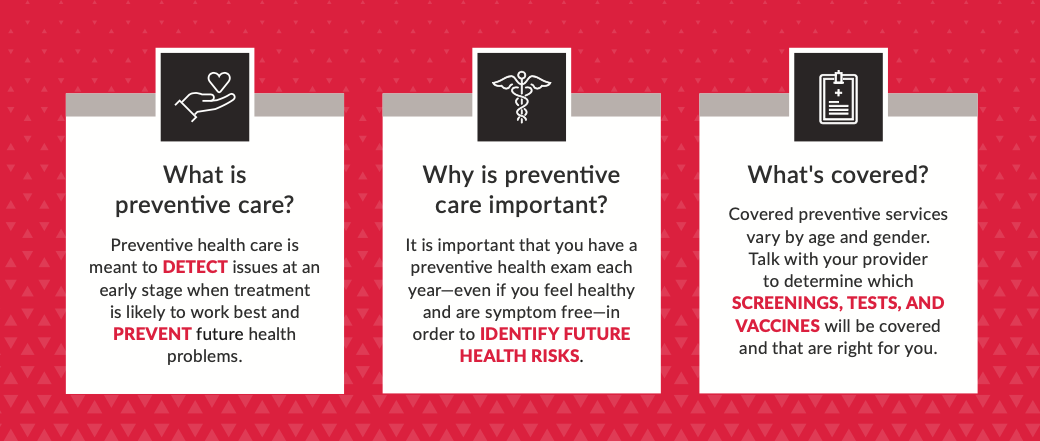

In-network preventive care is free for medical plan members.

The cost of your preventive care is covered 100% by the Rise Broadband medical plans. This means you won’t have to pay anything out of your pocket.

Save money on your health care!

Note: Some services are generally not considered preventive if you get them as part of a visit to diagnose, monitor, or treat an illness or injury. Please be aware that you will be responsible for the cost of any non-preventive care services you receive at your preventive care exam based on your plan design. Learn more about preventive care at mycigna.com.