Voluntary Benefits

Grifols provides you the option to purchase voluntary protection benefits through Lincoln Financial.

These supplemental benefit options pay cash benefits directly to you if you are faced with an accidental injury, hospitalization, or serious illness. These plans can help offset deductibles and other out-of-pocket expenses associated with unexpected illnesses or accidents. The amount you pay for coverage is based on your age. Your exact cost for these voluntary benefit plans will be provided to you during the completion of the enrollment process.

Supplemental Life and AD&D Insurance

Grifols provides you the option to purchase supplemental life and AD&D insurance for yourself, your spouse, and your dependent children through Lincoln Financial Group.

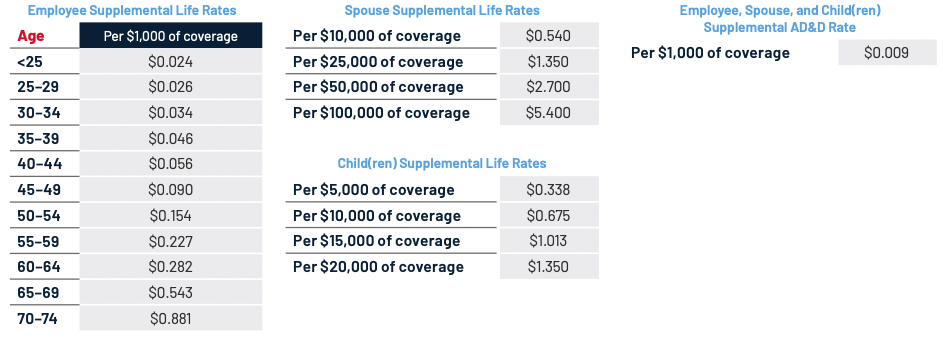

You must purchase supplemental coverage for yourself in order to purchase coverage for your spouse and/or dependents. Supplemental life rates are age-banded. Benefits will reduce to 65% at age 65 and to 50% at age 70.

- Employee: 1x, 2x, 3x, or 4x annual earnings rounded

to the highest multiple of $1,000. This amount may not exceed $1,000,000 when combined with your basic life insurance benefit — guarantee issue: $300,000. - Spouse: $10,000, $25,000, $50,000, or $100,000 up to 100% of the employee’s election.

- Dependent children: $5,000, $10,000, $15,000, or $20,000.

Note: To complete evidence of insurability, log into mylincolnportal.com (company code: LMBENEFITS) and click on “Complete a Statement of Health.” For additional instructions or to obtain a statement of health (evidence of insurability) form, visit the CTS Share Point site. All EOI forms must be returned directly to Lincoln Financial Group.

Supplemental Life and AD&D Insurance Costs

Listed below are the biweekly (24 pay periods) rates for supplemental life and AD&D insurance. The amount you pay for supplemental life and AD&D insurance is deducted from your paycheck on a post-tax basis.

Accident Insurance

Accident insurance can pay a set benefit amount based on the type of injury you have and the type of treatment you need. It includes a range of incidents, from common injuries to more serious events.

Why is this coverage so valuable?

- It can help you with out-of-pocket costs that your health plan doesn’t cover, like copays and deductibles.

- You’re guaranteed base coverage, without answering health questions.

- It includes a wellness benefit that pays $50 per calendar year per insured individual if a covered health screening test is performed, including: blood tests, chest X-rays, stress tests, mammograms, and colonoscopies.

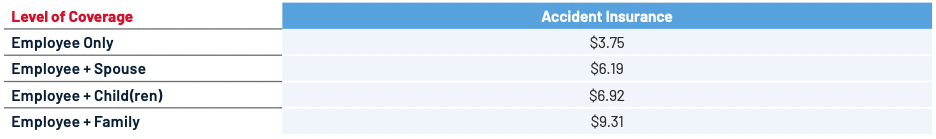

Accident Insurance Costs

Listed below are the biweekly (24 pay periods) costs for accident insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

Critical Illness Insurance

If you’re diagnosed with an illness that is covered by critical illness insurance, you can receive a lump-sum benefit payment. You can use the money however you want to assist you in offsetting unexpected expenses due to a critical illness diagnosis.

Please be sure to keep your beneficiary designations up to date.

Why is this coverage so valuable?

- The money can help you pay out-of-pocket expenses like copays, deductibles, and other living expenses that may be impacted.

- You can use this coverage more than once. Even after you receive a payout for one illness, you’re still covered for the remaining conditions and for the reoccurrence of any critical illness with the exception of skin cancer. The reoccurrence benefit pays 100% of your coverage amount. Diagnoses must be at least 180 days apart or the conditions can’t be related to each other.

- It includes a wellness benefit that pays $50 per calendar year per insured individual if a covered health screening test is performed, including: blood tests, chest X-rays, stress tests, mammograms, and colonoscopies.

Who can get coverage?

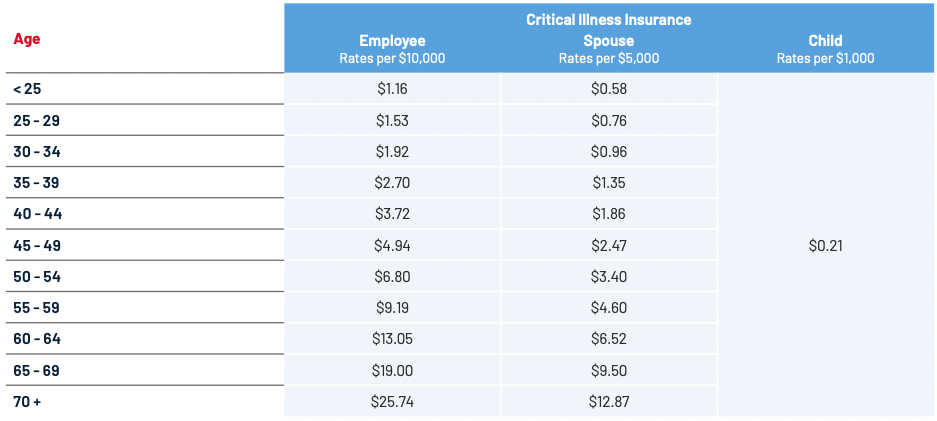

- Employee: $10,000 increments up to $30,000; guarantee issue: $30,000.

- Spouse: Up to 50% of employee election; guarantee issue: $15,000.

- Dependent children: Up to 50% of employee election.

Critical Illness Insurance Costs

Listed below are the biweekly (24 pay periods) costs for critical illness insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

Hospital Indemnity Insurance

Hospital indemnity insurance can complement your medical coverage by helping to ease the financial impact of a hospitalization. It provides a lump-sum payment that can be used for hospital admission, accident-related inpatient rehabilitation, hospital stays, or any other expenses that you incur.

What’s included?

- $2,000 for each covered hospital admission (once per year).

- $100 for each day of your covered hospital stay, up to 60 days (once per year).

- $200 for each day you spend in intensive care, up to 15 days (once per year).

- It includes a wellness benefit that pays $50 per calendar year per insured individual if a covered health screening test is performed, including: blood tests, chest X-rays, stress tests, mammograms, and colonoscopies.

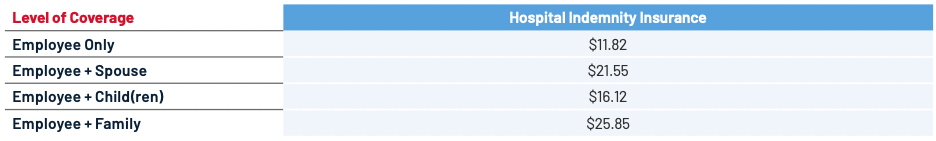

Hospital Indemnity Insurance Costs

Listed below are the biweekly (24 pay periods) costs for hospital indemnity insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

Resources

DURING OPEN ENROLLMENT (11/7-12/3) YOU HAVE THREE WAYS TO ENROLL:

- Call 833-557-0382 to speak to a professional benefits counselor.

- Schedule an appointment below with a benefits counselor during the enrollment period.

- Enroll for benefits online at employeenavigator.com/benefits/account/login. Look for the Enroll Now! menu item. If you are a new user, register at employeenavigator.com/benefits/account/register

Your Company Identifier is: CreTestSol