Legal Updates and Notices

2022-2023 Legal Updates and Notices

Nation’s Best Holdings, LLC.

This notice packet includes all notices required under federal law for Nation’s Best Holdings, LLC. These notices are provided annually and it is important that you read them carefully to understand your rights under the Plan.

Enclosed Notices

- Women’s Health & Cancer Rights Act

- Michelle’s Law

- HIPAA Notice of Privacy Practices Reminder

- HIPAA Special Enrollment Rights

- Prescription Drug Coverage and Medicare

- Pre-Tax Notice

- Summary of Benefits and Coverage

- The Newborns’ and Mothers’ Health Protection Act of 1996

- CHIPRA Notice

- Paperwork Reduction Act Statement

Notice of your HIPAA Special Enrollment Rights

Our records show that you are eligible to participate in the Nation’s Best Holdings, LLC.’s Health and Welfare Plan (to actually participate, you must complete an enrollment form and pay part of the premium through payroll deduction).

A federal law called HIPAA requires that we notify you about an important provision in the plan - your right to enroll in the plan under its “special enrollment provision” if you acquire a new dependent, or if you decline coverage under this plan for yourself or an eligible dependent while other coverage is in effect and later lose that other coverage for certain qualifying reasons.

Loss of Other Coverage (Excluding Medicaid or a State Children’s Health Insurance Program). If you decline enrollment for yourself or for an eligible dependent (including your spouse) while other health insurance or group health plan coverage is in effect, you may be able to enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage (or if the employer stops contributing toward your or your dependents’ other coverage). However, you must request enrollment within 30 days after your or your dependents’ other coverage ends (or after the employer stops contributing toward the other coverage).

Loss of Coverage for Medicaid or a State Children’s Health Insurance Program. If you decline enrollment for yourself or for an eligible dependent (including your spouse) while Medicaid coverage or coverage under a state children’s health insurance program is in effect, you may be able to enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage. However, you must request enrollment within 60 days after your or your dependents’ coverage ends under Medicaid or a state children’s health insurance program.

New Dependent by Marriage, Birth, Adoption, or Placement for Adoption. If you have a new dependent as a result of marriage, birth, adoption, or placement for adoption, you may be able to enroll yourself and your new dependents. However, you must request enrollment within 30 days of the marriage or 60 days of the birth, adoption, or placement for adoption.

Eligibility for Medicaid or a State Children’s Health Insurance Program. If you or your dependents (including your spouse) become eligible for a state premium assistance subsidy from Medicaid or through a state children’s health insurance program with respect to coverage under this plan, you may be able to enroll yourself and your dependents in this plan. However, you must request enrollment within 60 days after your or your dependents’ determination of eligibility for such assistance.

To request special enrollment or to obtain more information about the plan’s special enrollment provisions, contact Human Resources.

Newborns’ and Mothers’ Health Protection Act Disclosure

Group health plans and health insurance issuers generally may not, under Federal law, restrict benefits for any hospital length of stay in connection with childbirth for the mother or newborn child to less than 48 hours following a vaginal delivery, or less than 96 hours following a cesarean section. However, Federal law generally does not prohibit the mother’s or newborn’s attending provider, after consulting with the mother, from discharging the mother or her newborn earlier than 48 hours (or 96 hours as applicable). In any case, plans and issuers may not, under Federal law, require that a provider obtain authorization from the plan or the insurance issuer for prescribing a length of stay not in excess of 48 hours (or 96 hours).

Women’s Health & Cancer Rights Act

If you have had or are going to have a mastectomy, you may be entitled to certain benefits under the Women’s Health and Cancer Rights Act of 1998 (“WHCRA”). For individuals receiving mastectomy-related benefits, coverage will be provided in a manner determined in consultation with the attending physician and the patient, for:

- All states of reconstruction of the breast on which the mastectomy was performed;

- Surgery and reconstruction of the other breast to produce a symmetrical appearance;

- Prostheses; and

- Treatment of physical complications of the mastectomy, including lymphedema.

These benefits will be provided subject to the same deductibles and coinsurance applicable to other medical and surgical benefits provided under the plan. Therefore, the following deductibles and coinsurance apply: - PPO Plan In-Network Benefit: $1,000 individual deductible / $3,000 family deductible; 80% coinsurance. Out-of-Network Benefits: $2,000 individual deductible / $6,000 family deductible; 60% coinsurance.

- PPO Plan In-Network Benefit: $2,500 individual deductible / $7,500 family deductible; 80% coinsurance. Out-of-Network Benefits: $5,000 individual deductible / $15,000 family deductible; 60% coinsurance.

- PPO Plan In-Network Benefit: $6,000 individual deductible / $15,800 family deductible; 70% coinsurance. Out-of-Network Benefits: $10,000 individual deductible / $20,000 family deductible; 50% coinsurance.

If you would like more information on WHCRA benefits, contact Human Resources.

HIPAA Notice of Privacy Practices Reminder

Nation’s Best Holdings, LLC. Welfare Benefit Plan Protecting Your Health Information Privacy Rights

2/22/2022

Nation’s Best Holdings, LLC. is committed to the privacy of your health information. The administrators of the Nation’s Best Holdings, LLC.’s Welfare Benefit Plan use strict privacy standards to protect your health information from unauthorized use or disclosure.

The Plan’s policies protecting your privacy rights and your rights under the law are described in the Plan’s Notice of Privacy Practices. You may receive a copy of the Notice of Privacy Practices by contacting Human Resources at 409.651.5667, 9330 LBJ Freeway, Suite 850, Dallas, TX 75243.

Summary of Benefits and Coverage

Summary of Benefits Coverage for the Nation’s Best Holdings, LLC.’s PPO Plan is available by contacting Human Resources.

IMPORTANT NOTICE FROM Nation’s Best Holdings, LLC. ABOUT YOUR PRESCRIPTION DRUG COVERAGE AND MEDICARE

Please read this notice carefully and keep it where you can find it. This notice has information about your current prescription drug coverage with Nation’s Best Holdings, LLC. and about your options under Medicare’s prescription drug coverage. This information can help you decide whether or not you want to join a Medicare drug plan. If you are considering joining, you should compare your current coverage, including which drugs are covered at what cost, with the coverage and costs of the plans offering Medicare prescription drug coverage in your area. Information about where you can get help to make decisions about your prescription drug coverage is at the end of this notice.

There are two important things you need to know about your current coverage and Medicare’s prescription drug coverage:

1. Medicare prescription drug coverage became available in 2006 to everyone with Medicare. You can get this coverage if you join a Medicare Prescription Drug Plan or join a Medicare Advantage Plan (like an HMO or PPO) that offers prescription drug coverage. All Medicare drug plans provide at least a standard level of coverage set by Medicare. Some plans may also offer more coverage for a higher monthly premium.

2. Nation’s Best Holdings, LLC. has determined that the prescription drug coverage offered by the Nation’s Best Holdings, LLC.’s Health Plan is, on average for all plan participants, expected to pay out as much as standard Medicare prescription drug coverage pays and is therefore considered Creditable Coverage. Because your existing coverage is Creditable Coverage, you can keep this coverage and not pay a higher premium (a penalty) if you later decide to join a Medicare drug plan.

When Can You Join a Medicare Drug Plan?

You can join a Medicare drug plan when you first become eligible for Medicare and each year from October 15th to December 7th.

However, if you lose your current creditable prescription drug coverage, through no fault of your own, you will also be eligible for a two-(2) month Special Enrollment Period (SEP) to join a Medicare drug plan.

What Happens to Your Current Coverage if You Decide to Join a Medicare Drug Plan?

If you decide to join a Medicare drug plan, your current Nation’s Best Holdings, LLC. coverage may be affected.

If you do decide to join a Medicare drug plan and drop your current Nation’s Best Holdings, LLC. coverage, be aware that you and your dependents may not be able to get this coverage back.

When Will You Pay a Higher Premium (Penalty) to Join a Medicare Drug Plan?

You should also know that if you drop or lose your current coverage with Nation’s Best Holdings, LLC. and don’t join a Medicare drug plan within 63 continuous days after your current coverage ends, you may pay a higher premium (a penalty) to join a Medicare drug plan later.

If you go 63 continuous days or longer without creditable prescription drug coverage, your monthly premium may go up by at least 1% of the Medicare base beneficiary premium per month for every month that you did not have that coverage. For example, if you go nineteen months without creditable coverage, your premium may consistently be at least 19% higher than the Medicare base beneficiary premium. You may have to pay this higher premium (a penalty) as long as you have Medicare prescription drug coverage. In addition, you may have to wait until the following October to join.

For More Information About This Notice or Your Current Prescription Drug Coverage...

Contact the person listed below for further information. NOTE: You’ll get this notice each year. You will also get it before the next period you can join a Medicare drug plan, and if this coverage through Nation’s Best Holdings, LLC. changes. You also may request a copy of this notice at any time.

For More Information About Your Options Under Medicare Prescription Drug Coverage...

More detailed information about Medicare plans that offer prescription drug coverage is in the “Medicare & You” handbook. You’ll get a copy of the handbook in the mail every year from Medicare. You may also be contacted directly by Medicare drug plans.

For More Information About Medicare Prescription Drug Coverage:

Visit www.medicare.gov.

Call your State Health Insurance Assistance Program (see the inside back cover of your copy of the “Medicare & You”

handbook for their telephone number) for personalized help.

Call 1.800.MEDICARE (1.800.633.4227). TTY users should call 1.877.486.2048.

If you have limited income and resources, extra help paying for Medicare prescription drug coverage is available. For information about this extra help, visit Social Security on the web at www.socialsecurity.gov, or call them at 1.800.772.1213 (TTY 1.800.325.0778).

Remember: Keep this Creditable Coverage notice. If you decide to join one of the Medicare drug plans, you may be required to provide a copy of this notice when you join to show whether or not you have maintained creditable coverage and, therefore, whether or not you are required to pay a higher premium (a penalty).

Date:

Name of Entity/Sender: Contact – Position/Office: Address:

Phone Number:

February 22, 2022

Nation’s Best Holdings, LLC.

Human Resources

9330 LBJ Freeway, Suite 850, Dallas, TX 75243 409.651.5667

Premium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP)

If you or your children are eligible for Medicaid or CHIP and you’re eligible for health coverage from your employer, your state may have a premium assistance program that can help pay for coverage, using funds from their Medicaid or CHIP programs. If you or your children aren’t eligible for Medicaid or CHIP, you won’t be eligible for these premium assistance programs but you may be able to buy individual insurance coverage through the Health Insurance Marketplace. For more information, visit www.healthcare.gov.

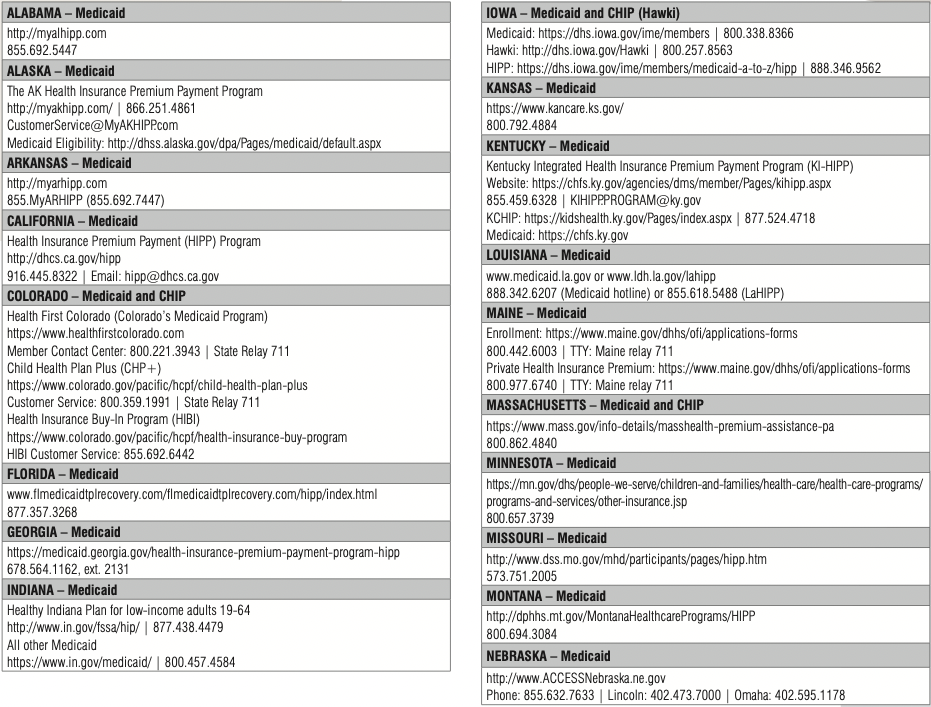

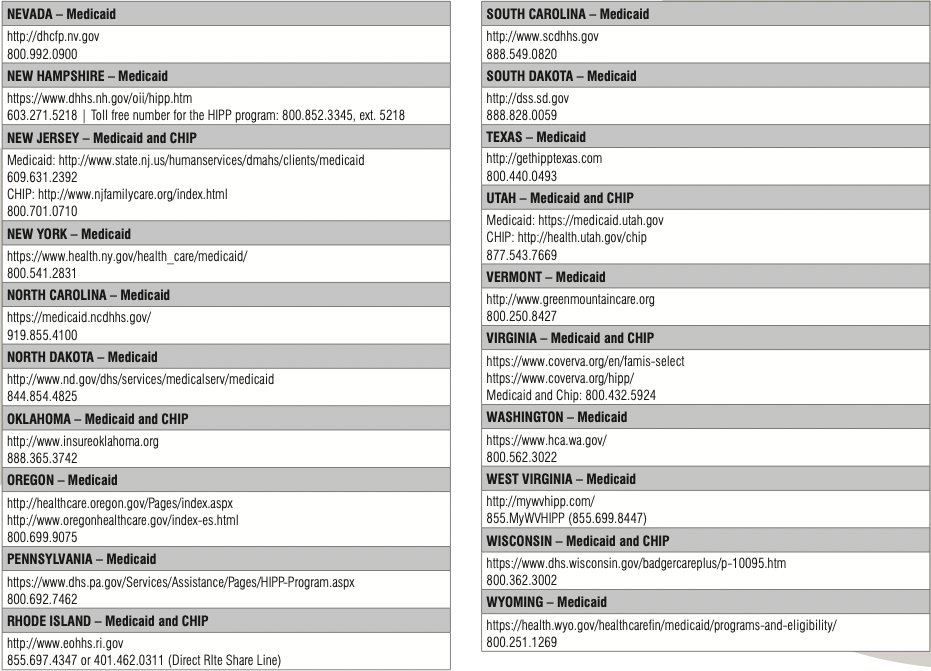

If you or your dependents are already enrolled in Medicaid or CHIP and you live in a state listed below, contact your State Medicaid or CHIP office to find out if premium assistance is available.

If you or your dependents are not currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligible for either of these programs, contact your State Medicaid or CHIP office or dial 877.KIDS.NOW or www.insurekidsnow.gov to find out how to apply. If you qualify, ask your state if it has a program that might help you pay the premiums for an employer-sponsored plan.

If you or your dependents are eligible for premium assistance under Medicaid or CHIP, as well as eligible under your employer plan, your employer must allow you to enroll in your employer plan if you aren’t already enrolled. This is called a “special enrollment” opportunity, and you must request coverage within 60 days of being determined eligible for premium assistance. If you have questions about enrolling in your employer plan, contact the Department of Labor at www.askebsa.dol.gov or call 866.444.EBSA (3272).

If you live in one of the following states, you may be eligible for assistance paying your employer health plan premiums. The following list of states is current as of October 15, 2021. Contact your state for more information on eligibility.

To see if any other states have added a premium assistance program since October 15, 2021, or for more information on special enrollment rights, contact either:

U.S. Department of Labor

Employee Benefits Security Administration www.dol.gov/agencies/ebsa 866.444.EBSA (3272)

Paperwork Reduction Act Statement

U.S. Department of Health and Human Services

Centers for Medicare & Medicaid Services www.cms.hhs.gov 877.267.2323, Menu Option 4, Ext. 61565

According to the Paperwork Reduction Act of 1995 (Pub. L. 104-13) (PRA), no persons are required to respond to a collection of information unless such collection displays a valid Office of Management and Budget (OMB) control number. The Department notes that a Federal agency cannot conduct or sponsor a collection of information unless it is approved by OMB under the PRA, and displays a currently valid OMB control number, and the public is not required to respond to a collection of information unless it displays a currently valid OMB control number. See 44 U.S.C. 3507. Also, notwithstanding any other provisions of law, no person shall be subject to penalty for failing to comply with a collection of information if the collection of information does not display a currently valid OMB control number. See 44 U.S.C. 3512.

The public reporting burden for this collection of information is estimated to average approximately seven minutes per respondent. Interested parties are encouraged to send comments regarding the burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to the U.S. Department of Labor, Employee Benefits Security Administration, Office of Policy and Research, Attention: PRA Clearance Officer, 200 Constitution Avenue, N.W., Room N-5718, Washington, DC 20220 or email ebsa.opr@dol.gov and reference the OMB Control Number 1210-0137.

Pre-Tax Contributions

In most cases, Nation’s Best Holdings, LLC. employees’ contributions for health coverage are deducted from their paychecks on a pre-tax basis meaning before federal income taxes, state income taxes (in most cases), and FICA taxes are calculated. Internal Revenue Code (I.R.C) Section 152 defines what dependent contributions are eligible for pre-tax deductions. The IRS does not allow employees’ contributions for dependent health coverage to be deducted on a pre- tax basis unless the dependent(s) meet the definition of a tax dependent under I.R.C. Section 152. If they do not meet the definition of a tax dependent, they may be either ineligible for the Plan, or in some cases, the IRS taxes the additional fair market value of these benefits and treats it as Imputed Income. Contributions for medical, dental and vision coverage for eligible dependents that do not meet the definition of a tax dependent will be made on a post-tax basis and the Imputed Income will be included on your paycheck and IRS Form W-2.

Michelle’s Law

Michelle’s Law requires group health plans to provide continued coverage for a dependent child covered under the plan if the child loses eligibility under the Nation’s Best Holdings, LLC.’s Welfare Benefit Plan because of the loss of student status resulting from a medically necessary leave of absence from a post-secondary educational institution. If your child is covered under the Nation’s Best Holdings, LLC.’s Welfare Benefit Plan, but will lose eligibility because of a loss of student status caused by a medically necessary leave of absence, your child may be able to continue coverage under our plan for up to one year during the medically necessary leave of absence. This coverage continuation may be available if on the day before the medically necessary leave of absence begins your child is covered under the Nation’s Best Holdings, LLC.’s Welfare Benefit Plan and was enrolled as a student at a post-secondary educational institution.

A “medically necessary leave of absence” means a leave of absence from a post-secondary educational institution (or change in enrollment status in that institution) that: (1) begins while the child is suffering from a serious illness or injury, (2) is medically necessary, and (3) causes the child to lose student status as defined under our plan.

The coverage continuation is available for up to one year after the first day of the medically necessary leave of absence and is the same coverage your child would have had if your child had continued to be a covered student and not needed to take a medical leave of absence. Coverage continuation may end before the end of one year if your child would otherwise lose eligibility under the plan – for example, by reaching age 26.

If your child is eligible for this coverage continuation and loses coverage under the plan at the end of the continuation period, COBRA continuation may be available at the end of the Michelle’s Law coverage continuation period.

If you have any questions concerning this notice or your child’s right to continued coverage under Michelle’s law, please contact Human Resources.

OPEN ENROLLMENT FOR 2024-2025 BENEFITS BEGINS ON 1/29 AND ENDS ON 2/15.

You have three ways to enroll!

- Call 866-430-3009 Monday - Friday from 7 a.m. to 7 p.m. CST during your enrollment eligibility period. Benefits counselors are ready to assist you.

- Schedule an appointment below with a benefits counselor during the enrollment period.

- Self-enroll by registering as a New User here: https://workforcenow.adp.com