Navajo Express offers a medical plan through Imagine360.

The medical plan offers an open network, which provides you the freedom to use any provider or facility. To see plan details, cost information, and more, visit the member portal at imagine360.com/member-login/.

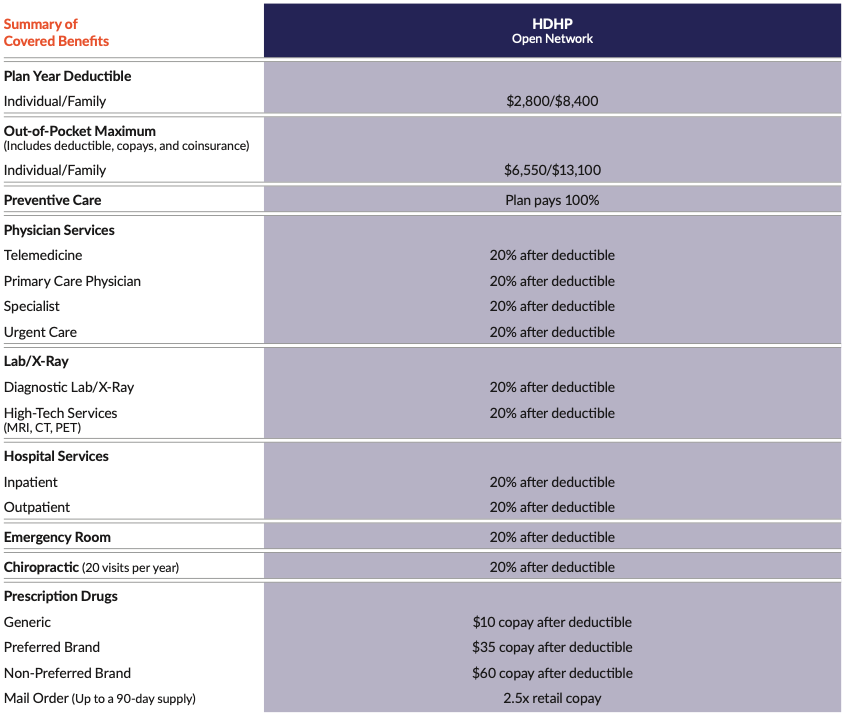

The table below summarizes the benefits of the medical plan. The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

MEDICAL BENEFITS VIDEOS

Click on each video below to learn more about your medical benefits.

Preventive care is free for medical plan members.

The Navajo Express medical plan pays 100% of the cost of preventive care. This means you won’t have to pay anything out of your pocket.

WHAT IS PREVENTIVE CARE?

The focus of preventive health care is to PREVENT illnesses, disease, and other health problems, and to DETECT issues at an early stage when treatment is likely to work best.

WHY IS PREVENTIVE CARE IMPORTANT?

It is important that you have a preventive exam each year—even if you feel healthy and are symptom free—in order to IDENTIFY FUTURE HEALTH RISKS.

WHAT’S COVERED?

Covered preventive services VARY BY AGE AND GENDER. Talk with your provider to determine which screenings, tests, and vaccines will be covered, when you should get them, and how often.

Get the most out of your health plan.

We understand—benefits are complex. The good news is that Imagine360 is committed to making it easier for you with personal, proactive support. Their 360-degree member support offers complete guidance for all your health care needs. This includes finding providers, support from licensed medical professionals to help manage medical conditions, and answering coverage and billing questions.

Their compassionate member experience team is available to listen and advocate on your behalf. They look after you and your family and make it easy for you to get the help you need.

SERVICE AND SUPPORT

Your health plan includes complete health care guidance, as well as price protection and billing assistance. Just contact the member experience team by calling the number on your Benefits ID card.

The Imagine360 team can help you with:

- Benefits information.

- Finding a doctor.

- Questions about a condition or treatment plan.

- Information about a claim or bill.

Support is available Monday–Thursday from 7 a.m.–9 p.m. CST and Friday from 7 a.m.–7 p.m. CST.

BENEFITS ID CARD

Your Benefits ID card has all the information you and your provider need.

Make sure to:

- ◦ Always present your Benefits ID card with you when you go to a health care provider.

- ◦ Ask the provider to call the phone number on the card if they have any questions about your benefits coverage.

BILLING QUESTIONS

When you work with the Imagine360 team, you’ll never stand alone in the face of resolving a bill for health care services that is more than your responsibility.

- How will you know if you’re being charged too much? After receiving medical care, you will get an explanation of benefits (EOB) specifying what you owe for services. If you receive a bill for more than this amount, contact Imagine360 immediately.

- How will Imagine360 help you? Once you receive your bill, you and your family are assigned a personal advocacy expert who will provide you with support every step of the way. After you give Imagine360 written permission to advocate on your behalf, their team begins working to resolve the claim with your health care provider.

- Who can you call with questions? Your dedicated advocacy expert is your main line of support, continually monitoring the progress of your account while proactively keeping you up to date.

- Keep an eye on your mail. If you receive any billing correspondence in the mail, send it to Imagine360 right away. Their team will take it from there, keeping you in the loop throughout the process.

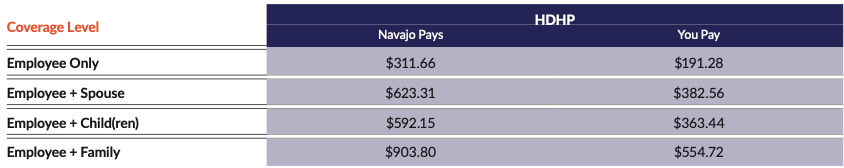

MEDICAL COSTS

Listed below are the monthly costs for medical insurance. The amount you pay for coverage is deducted from your paycheck on a pre-tax basis.

Monthly surcharges

- If you are a tobacco-user, a $75 monthly surcharge will apply.

- A working spouse surcharge of $50 per month applies if your spouse is offered medical insurance through his or her employer and enrolls in the Navajo Express medical plan.

MEDICAL COSTS

If you are a tobacco-user and enroll in the Navajo Express medical plan, a monthly surcharge of $75 will apply.

During the annual open enrollment period, you will be required to indicate whether you have used tobacco in the last six months. If you indicate that you are tobacco-free, you and your spouse (if enrolling) will be required to sign an affidavit and confirm non-tobacco use in the past six months through cotinine testing. Falsification of this certification will result in disciplinary action, up to and including termination.

If you currently use tobacco, you can qualify for the standard medical plan costs by completing a tobacco cessation program. Upon completion, your rate will be adjusted to the non-tobacco rate retroactively to August 1, 2022. You must provide proof of completion. For more information, contact Human Resources, call 800-784-8669, or visit coquitline.org.

Note: If your personal physician finds that it would be medically inappropriate for you to attempt to quit using tobacco, Navajo Express will accommodate the physician’s recommendation by waiving the tobacco-free requirement.