Health Savings Account (HSA)

Available with the high-deductible health plan (HDHP), administered by HSA Bank

An HSA is a savings account that you can use to pay out-of-pocket health care expenses with pre-tax dollars.

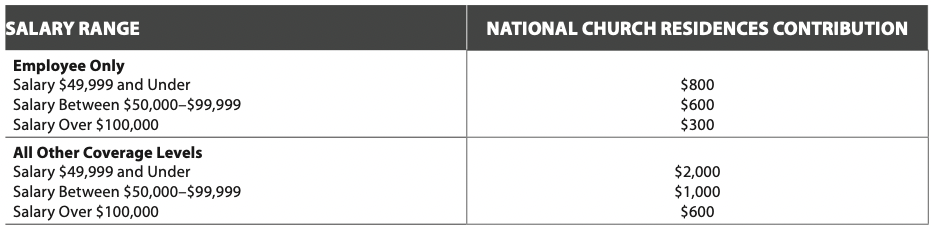

National Church Residences Contribution

If you enroll in the HDHP, National Church Residences will help you save by contributing to your account. Contribution amounts are based on your annual base salary.

2024 IRS HSA Contribution Maximums

Contributions to an HSA, including those of National Church Residences, cannot exceed the IRS allowed annual maximums.

- Individuals: $4,150

- All other coverage levels: $8,300

If you are age 55+ by December 31, 2024, you may contribute an additional $1,000.

HSA Eligibility

You are eligible to fund an HSA if:

- You are enrolled in the HDHP.

You are NOT eligible to fund an HSA if:

- You are covered by a non-HSA eligible medical plan, health care FSA, or health reimbursement arrangement.

- You are eligible to be claimed as a dependent on someone else’s tax return.

- You are enrolled in Medicare, TRICARE, or TRICARE for Life.

Refer to IRS Publication 969 for additional eligibility details. If you are over age 65, please contact Human Resources.

Save Receipts

Although you don't need to submit receipts for reimbursements because you control the money in your account, the IRS may request proof of valid HSA spending. Be sure to keep your receipts for up to seven years.

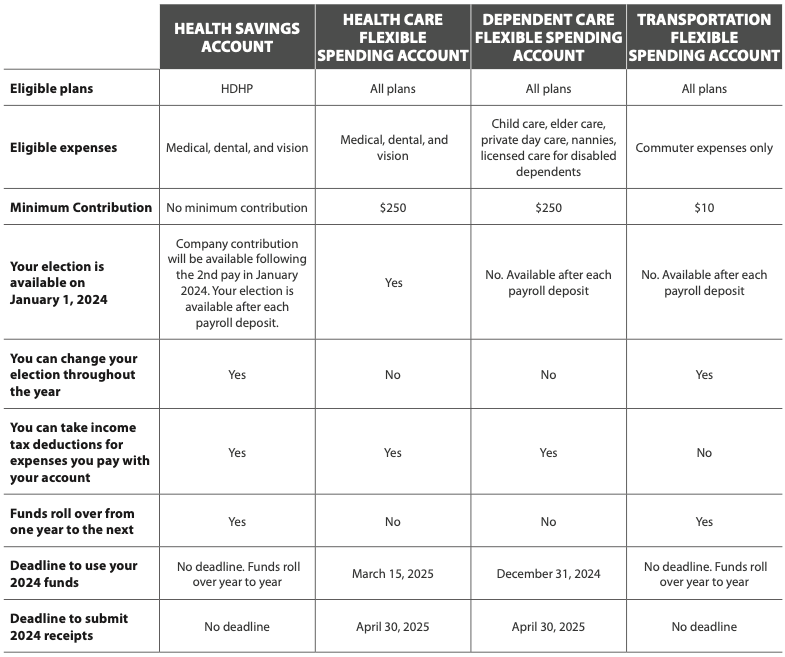

Flexible Spending Accounts (FSAs)

Three plans administered by UMR

While an HSA is a savings account, an FSA is a spending account. It’s an easy way to set aside pretax money to pay for health care or dependent care expenses—but you must use the money in your account each year.

Estimate carefully. You decide the amount you’d like to set aside for the year, and the money is deducted (before taxes) from your paycheck each pay period. Plan your contributions carefully. These are “use it or lose it” accounts.

Health Care FSA (not allowed if you fund an HSA)

Pay for eligible out-of-pocket medical, dental, and vision expenses with pre-tax dollars.

The health care FSA maximum contribution is $3,200 for the 2024 calendar year.

Dependent Care FSA

The dependent care FSA allows you to pay for eligible dependent day care expenses with pre-tax dollars. Eligible dependents are children under 13 years of age, or a spouse, child over 13, or elderly parent residing in your home who is physically or mentally unable to care for him or herself.

You may contribute up to $5,000 to the dependent care FSA for the 2024 plan year if you are married and file a joint return or if you file a single or head of household return. If you are married and file separate returns, you can each elect $2,500 for the 2024 plan year.

If you choose to contribute at least $1,000 to the dependent care FSA and earn under $80,000 annually, National Church Residences will match your contributions up to $1,000. Note: The maximum annual contribution includes employee and employer contributions. This means, if National Church Residences is contributing $1,000, you would only contribute $4,000.

Note about Childcare Tax Credit: Please review the Childcare Tax Credit rules from the IRS to determine whether the dependent care FSA or the Childcare Tax Credit is better for your situation. You cannot receive both.

Parking/Transportation FSA

The transportation FSA allows you to set aside money from your paycheck on a pre-tax basis to pay for expenses associated with commuting to work such as bus or train passes. Funds in your parking FSA and transportation FSA roll over from year to year as long as you remain an active employee with National Church Residences. You may change your contribution amount on a monthly basis.

You may contribute up to $315 per month to your transportation FSA for the 2024 plan year. Note: Funds cannot be used for mileage or vehicle maintenance expense and are only available to assist with the costs associated with transportation passes and paid parking.

Note for reservists and active military: If you’re called to active duty, the “use it or lose it” rule does not apply to you. You may cash out your health care FSA that will be unusable. Taxes and time limits will apply. Contact Quantum Health for help.

Save Receipts

In most cases, UMR should be able to auto-verify your claims as eligible expenses. There may be instances when you’ll need to provide proof of purchase, such as if you use a smaller, non-chain pharmacy. It’s best to save all receipts when you use your FSA funds.

BUDGET FOR YOUR CARE

You have the option to fund an HSA or FSA to help pay for health care expenses. Compare each option below to fund the account that’s best for you based on your needs.

For a list of eligible expenses, refer to IRS Publications 502 (health care FSA) and 503 (dependent care FSA) on irs.gov.

OPEN ENROLLMENT HAS ENDED.

NEW HIRES, YOU HAVE THREE WAYS TO ENROLL AS SHOWN BELOW.

ALL EMPLOYEES – IF YOU HAVE QUESTIONS ABOUT YOUR BENEFITS, FEEL FREE TO CALL THE NUMBER BELOW OR SCHEDULE AN APPOINTMENT WITH A BENEFITS COUNSELOR.

- Self-Enroll on Workday:

- Need to add a dependent or beneficiary? Navigate to the Benefits app on the Home Page, click on Dependents and/or Beneficiaries under "Change", and enter the required information. Complete this step before completing Open Enrollment.

- Navigate to your Inbox and find the Open Enrollment task. Click on "Let's Get Started".

- Click on each "Card" within the enrollment to review your plan options, add/change dependents, add/change beneficiaries, and make your elections.

- Once you've made all your selections, click "Review and Sign". Review the summary, then scroll to the bottom, check "I Accept" and then "Submit". Be sure to PRINT or SAVE your Confirmation Statement for your records.

First Time Enrolling?

-

- If you have a National Church Residences email address:

Navigate to: https://ncr.okta.com. Or access by QR code here: - Username = characters before the @ sign in your email address (For example, email address jsmith2@nationalchurchresidences.org = username jsmith2)

- Password = current password used to login to your email/computer

- If you have a National Church Residences email address:

- Call 833-226-8355 (Monday - Friday from 8 a.m. to 8 p.m. EST) Benefits counselors are ready to assist you!

- Schedule an appointment with a benefits counselor below during the enrollment period.