FLEXIBLE SPENDING ACCOUNTS

You can save about 20%* on your care by putting money in a health savings account (HSA) or flexible spending account (FSA). This is because you don’t pay taxes on your contributions. Please note, your deductions lower your federal tax withholding as well as Social Security and Medicare.

*Percentage varies based on your tax bracket.

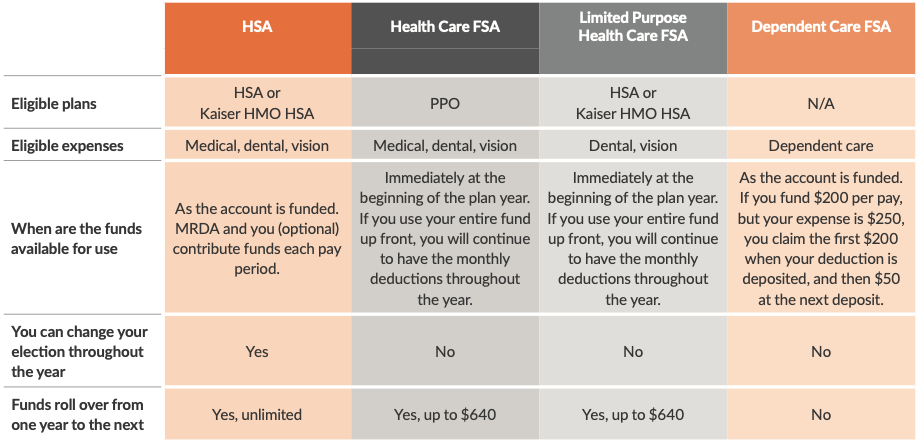

MRDA offers three flexible spending account (FSA) options, which are administered by Navia Benefit Solutions.

An FSA allows you to place money in a tax-sheltered, short-term account for use in paying for approved qualified health care or dependent care expenses. The amount you designate for the year will be deducted pre-tax from your paycheck in equal amounts throughout the plan year. Once you incur expenses, you can request reimbursement from your account, or use the debit card to pay for the expense.

The expenses you claim must be incurred during the plan year (January 1–December 31, 2024). You will have an additional 90 days to submit and be reimbursed for expenses after the end of the plan year. Expenses must be incurred on or before December 31, 2024, and reimbursement requests must be submitted to Navia Benefit Solutions no later than March 31, 2025.

HEALTH CARE FSA

Pay for eligible out-of-pocket medical, dental, and vision expenses with pre-tax dollars. If you, your spouse, or any employer is funding a health savings account (HSA) during the plan year, you are not eligible for the health care FSA (but you can enroll in the limited purpose health care FSA).

The health care FSA maximum contribution is $3,200 for the 2024 calendar year.

LIMITED PURPOSE HEALTH CARE FSA

If you, your spouse, or any employer is funding a health savings account (HSA) during the plan year, you are not eligible to fund a health care FSA. However, you can fund a limited purpose health care FSA, which can only be used to reimburse dental and vision expenses.

The limited purpose health care FSA maximum contribution is $3,200 for the 2024 calendar year.

DEPENDENT CARE FSA

The dependent care FSA allows you to pay for eligible dependent day care expenses with pre-tax dollars. Eligible dependents are children under 13 years of age, or a child over 13, spouse, or elderly parent residing in your house who is physically or mentally unable to care for himself or herself.

You may contribute up to $5,000 to the dependent care FSA for the 2024 calendar year if you are married and file a joint return or if you file a single or head of household return. If you are married and file separate returns, you can each elect $2,500 for the 2024 calendar year. In order to be eligible, both the employee and spouse must be working, looking for work, or a full-time student.

CARRYOVER FEATURE

Up to $640 of unused health care FSA (including limited purpose health care FSA) dollars may be carried over and be available for expenses incurred in the following year. Up to $640 will be available after the end of the claims run-out period which is March 31, 2025 (the claims run-out period is the extra time in the new year to submit expenses incurred the prior year). The amount carried over does not affect your ability to elect the maximum annual election allowed each plan year. For example, if you had $640 of unused funds at the end of 2024, the carry over balance will be added to your 2025 election, giving you up to a total of $3,840 in 2025 (assuming the annual maximum stays at $3,200).

This carryover provision does not apply to the dependent care FSA.