MRDA offers three medical plan options through Kaiser: a traditional PPO plan and two high-deductible health plans (HDHPs).

Before you enroll in medical coverage, take some time to fully understand how each plan works.

Helpful Kaiser Resources

2022 PPO SBC

2022 PPO Summary

2022 PPO Evidence of Coverage

2022 HSA SBC

2022 HSA Summary

2022 HSA Evidence of Coverage – Individual

2022 HSA Evidence of Coverage – Family

2022 CA Kaiser HMO HSA SBC

2022 CA Kaiser HMO HSA Summary

2022 CA Kaiser HMO HSA Evidence of Coverage

2022 CA Kaiser HMO HSA Chiropractic/Acupuncture Rider Evidence of Coverage

Reimbursement Form for Medical Claims (PPO and HSA)

Mail-Order Pharmacy New Prescription Form (PPO and HSA)

Reimbursement Form for Medical Claims (CA Kaiser HMO HSA)

Finding a Provider (PPO and HSA)

SBC Glossary

Tier 4 – PPO Formulary

Tier 3 – HSA Formulary

Tier 3 – CA Kaiser HMO HSA Formulary

Preventive Medications Flyer (HSA)

Preventive Medications Flyer (CA Kaiser HMO HSA)

Transferring Your Medication to Kaiser Permanente (PPO and HSA)

Enrollment Guide (PPO and HSA)

Enrollment Guide (CA Kaiser HMO HSA)

Kaiser Permanente Facilities Guide

Kaiser Urgent Care Locations

MyStrength Flyer (PPO and HSA)

Preauthorization and Notifications Requirements (PPO and HSA)

Care While Traveling (PPO and HSA)

Care While Traveling (CA Kaiser HMO HSA)

Accessing Your Estimates Online (CA Kaiser HMO HSA)

Disclosure Information (PPO and HSA)

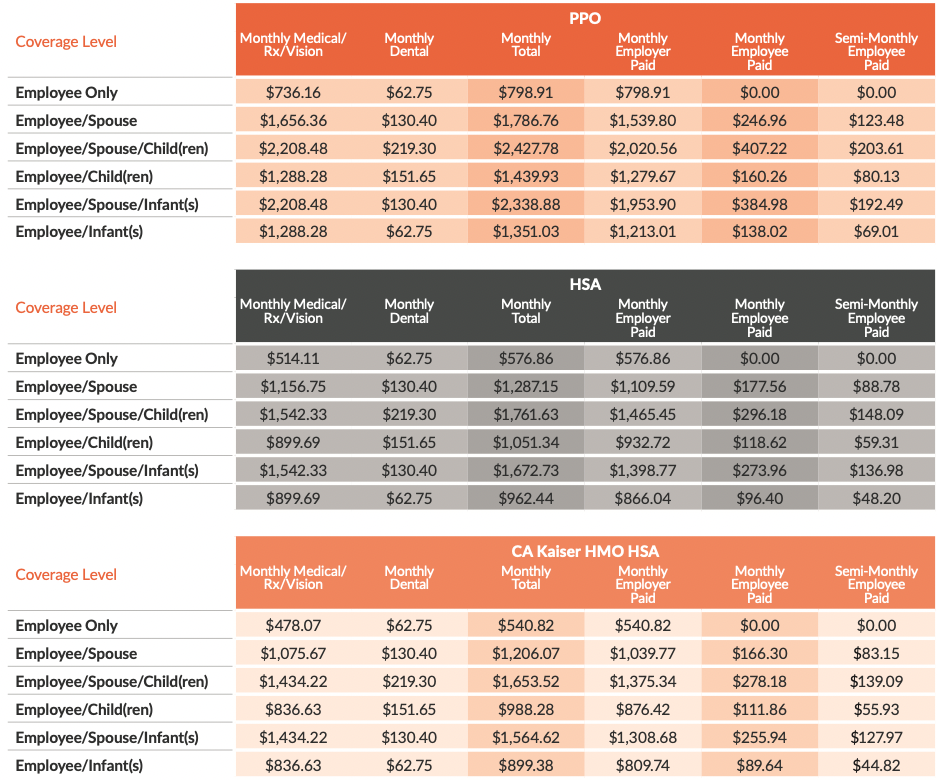

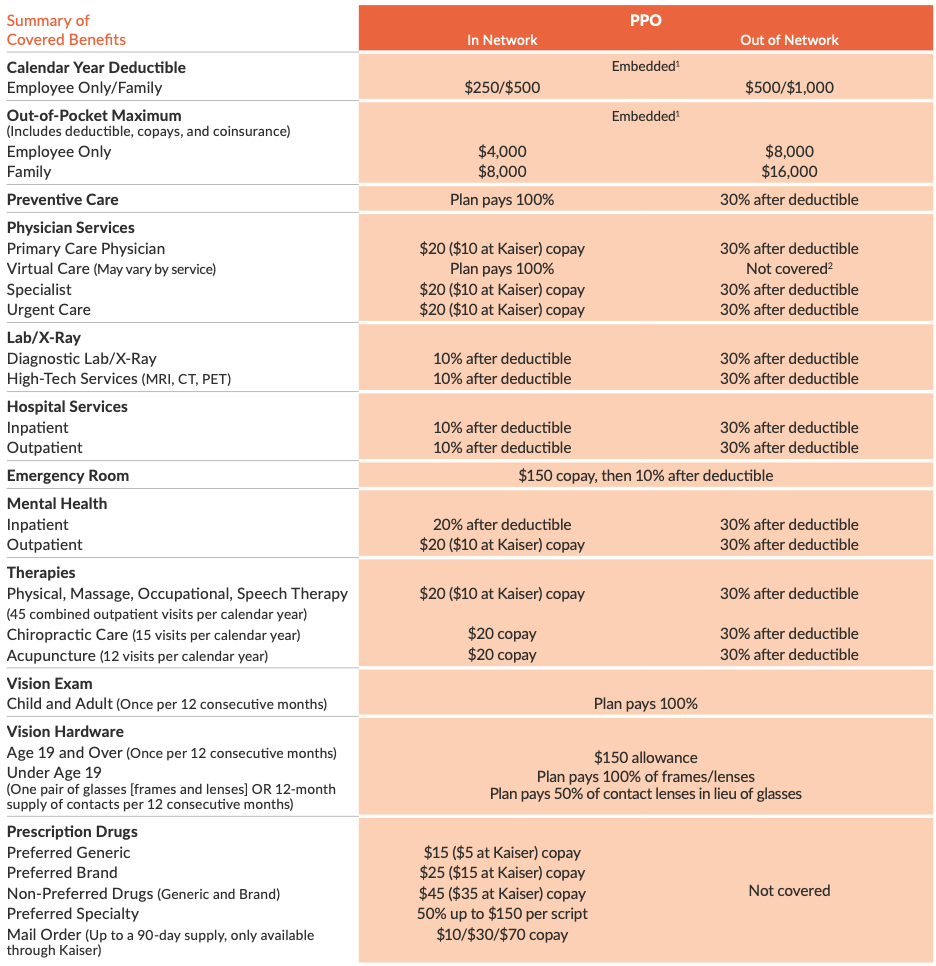

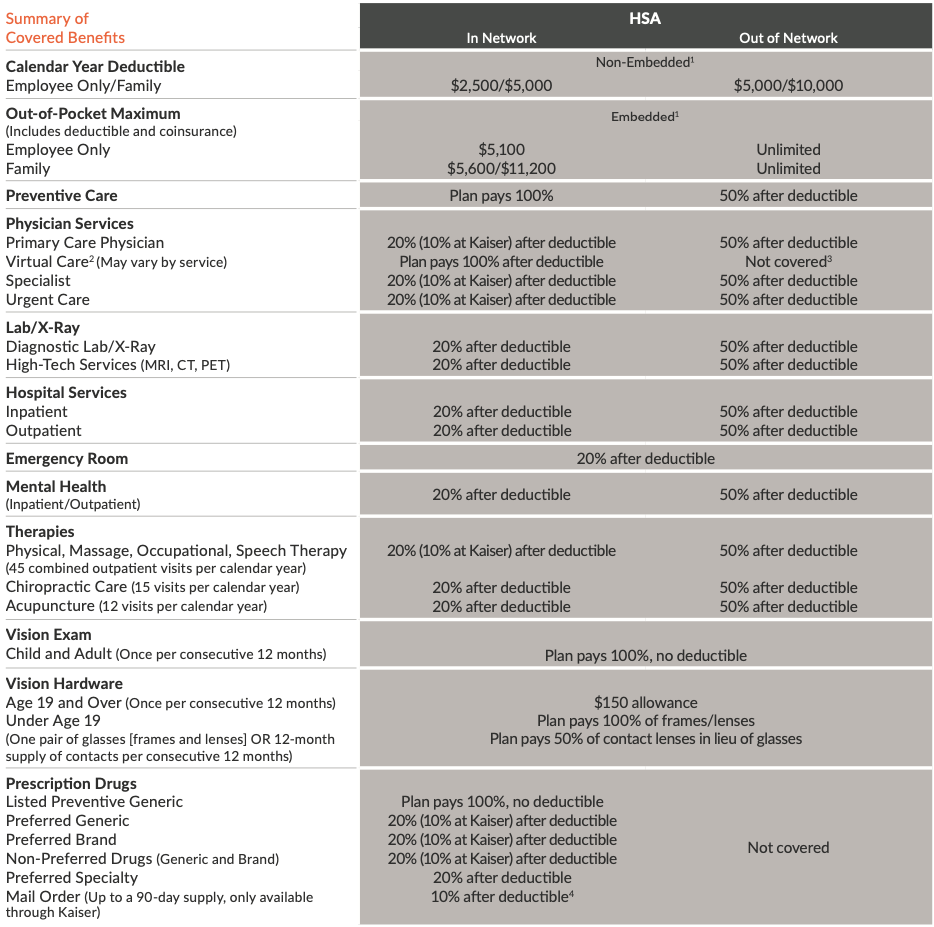

BENEFIT PLAN COSTS

Listed below are the monthly costs for medical and dental insurance. MRDA will pay 100% of premiums for employees and 75% for their dependents. The amount you pay for coverage is deducted from your paycheck on a pre-tax basis, unless you request to pay your premiums through post-tax deductions.

MEDICAL INSURANCE—PPO

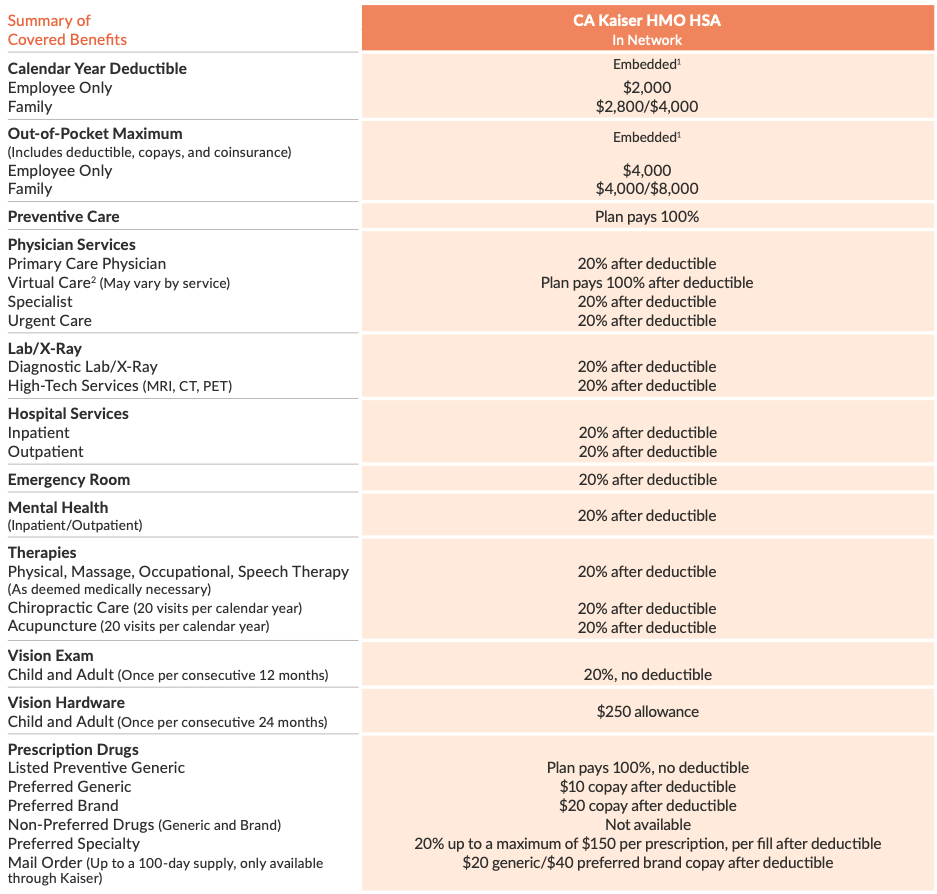

The table below summarizes the benefits of the PPO medical plan.

The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

(1) The PPO deductible and out-of-pocket (OOP) maximum are embedded. This means if you cover a member of your family, the individual deductible and out-of-pocket maximum apply to each covered member of the family. The total family deductible will not exceed $500 and the family OOP maximum will not exceed $8,000 (in-network). (2) Excepting video visits, which members pay 30% after deductible (plus any applicable balance billing).

MEDICAL INSURANCE—HSA

The table below summarizes the benefits of the HSA medical plan.

The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

(1) Embedded vs. non-embedded: The HSA deductible is non-embedded which means if you cover a member of your family, the entire family deductible must be met prior to the plan paying. The HSA out-of-pocket (OOP) maximum is embedded, which means if an individual meets the individual OOP maximum, the individual will receive 100% coverage for the remainder of the year. Once the family OOP maximum is met, everyone receives 100% coverage for the remainder of the year. (2) Virtual care is almost always cheaper than going in person, whether your deductible has been met or not. (3) Excepting video visits, which members pay 50% after deductible (plus any applicable balance billing). (4) Members only pay for two months of medication vs. three months.

MEDICAL INSURANCE—CA KAISER HMO HSA

The table below summarizes the benefits of the CA Kaiser HMO HSA plan.

The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

(1) The CA Kaiser HMO HSA deductible and out-of-pocket (OOP) maximum are embedded. This means if you cover a member of your family, the individual deductible ($2,800) and OOP maximum ($4,000) apply to each covered member of the family. The total family deductible will not exceed $4,000, and the family OOP maximum will not exceed $8,000 (in-network). (2) Virtual care is almost always cheaper than going in person, whether your deductible has been met or not.

NETWORK REMINDERS AND TIPS

Your network will depend on what plan you choose. Make sure to check if your provider is listed as in-network for your plan before you make an appointment.

PPO and HSA

CA Kaiser HMO HSA

Available network(s)

First Choice Health Network

fchn.com/providersearch

(Non-Kaiser Network Providers in WA, OR, MT, ID, AK)

First Health Network

myfirsthealth.com

(Non-Kaiser Network Providers in Other States, including CA)

Kaiser HMO Network

kp.org/doctors

(Kaiser Network Providers)

Kaiser HMO Network

kp.org/doctors

(Kaiser Network Providers)

Referral required to see a specialist

To see a Non-Kaiser Specialist: No

To see a Kaiser Specialist: Yes

Yes

PPO/HSA

When you see an in-network provider (under First Health, First Choice Health, or Kaiser HMO network), the provider’s bill is discounted, and both the plan and your share of the cost are paid based on the discounted rate. This saves you money and keeps the program costs down.

When you use an out-of-network provider, your benefits will be paid at a lower level based on the allowable charge for the service. Any excess between the billed charge and the plan’s allowable charge may be billed to you in addition to the higher coinsurance responsibility. This is commonly referred to as “balance billing.”

If your dependent(s) live in Washington, Alaska, Oregon, Idaho, or Montana (for example, if your child attends an out-of-state school), they can use the First Choice Health network. If they live in any other states, they can use the First Health network as well. You can also use these networks when you are traveling in the United States.

- When you want to see non-Kaiser providers: When you are asked what insurance you have, you should say “Kaiser”. Many non-Kaiser providers will say “we are not contracted with Kaiser”, then you will need to say it is covered by the “First Health” network which is printed on your ID card (or “First Choice Health” network when you are in WA, OR, MT, ID, AK). When your health care providers need to verify your enrollment, they should call Kaiser Provider Assistance Unit at 888-767-4670. Please write this number on your ID card for easy access.

- When you want to use a non-Kaiser pharmacy: When you are asked what insurance you have, you should say “Kaiser”. Many non-Kaiser providers or pharmacies will say “we are not contracted with Kaiser”, then you will need to say it is covered by the “OptumRx” network which is printed on your ID card. You may also need to provide the RxBIN and/or RxPCN numbers listed on your ID card. In order to make sure that your non-Kaiser pharmacy is contracted with “OptumRx”, first register yourself at optumrx.com/public/landing. Once you sign in, you can select “Pharmacy Locator” and search for a pharmacy.

- When you want to see Kaiser providers or use Kaiser pharmacies: Since these plans are based in Washington, your Kaiser ID card/number will not work for Kaiser providers and pharmacies outside of Washington state. Before you access care for the first time in another Kaiser service area (including California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, Washington state (Clark and Cowlitz counties), and Washington D.C.), call Kaiser Washington Member Services at 888-901-4636 to get a visiting member ID number for that region. Since there is no physical ID card for visiting member IDs, please save your ID number.

CA KAISER HMO HSA

When you select the CA Kaiser HMO HSA plan, you may only see providers in Kaiser facilities, except for emergency services.

- When you are traveling: Before you access care for the first time in another Kaiser service area (including Northern California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, Washington, and Washington D.C.), call the Away from Home Travel Line at 951-268-3900 to confirm the services that will be available in the area you are traveling to. You’ll receive a medical record number (MRN) or health record number (HRN) for the other Kaiser service area and information on making an appointment. If you are traveling outside of a Kaiser service area, the only access you will have will be for emergency services.

NEW KAISER MEMBERS

If you are new to the Kaiser family and on the PPO or HSA, visit healthy.kaiserpermanente.org/washington/new-members or call 888-844-4607 or 206-630-0029. For the CA Kaiser HMO HSA, visit healthy.kaiserpermanente.org/southern-california/new-members.

UNDERSTANDING THE MEDICAL PLANS

DIAGNOSTIC X-RAY AND LAB

For high-end radiology, please note that prior authorization is required for CT, MRI, MRA, PET, and Dexa scans. The doctor’s office is responsible for submitting this request for authorization before the procedure is performed. We recommend you call customer service to verify it has been approved.

URGENT CARE/EMERGENCY ROOM

It is highly recommended that, if possible and appropriate, you use urgent care offices when the needed care is not a true emergency. Seeking non-emergency services in an emergency room (ER) can easily cost you double or triple what an urgent care visit would cost.