Health Savings Account

You can save about 20%* on your care by putting money in a health savings account (HSA) or flexible spending account (FSA). This is because you don’t pay taxes on your contributions. Please note, your deductions lower your federal tax withholding as well as Social Security and Medicare.

COMPARE YOUR OPTIONS

*Percentage varies based on your tax bracket.

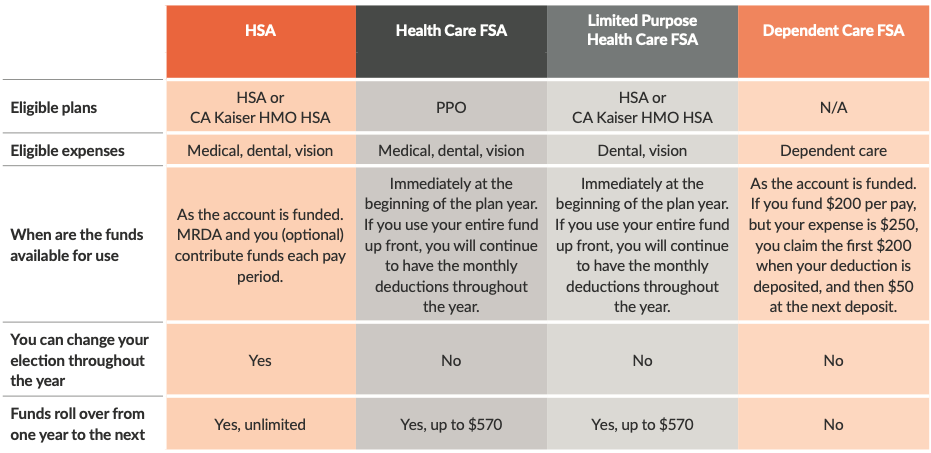

If you enroll in the HSA or CA Kaiser HMO HSA plans, you may be eligible to open and fund a health savings account (HSA) through HealthEquity.

Similar to a flexible spending account (FSA), you can set money aside in this account on a pre-tax basis to use for healthcare expenses. Yet, it is different from an FSA in that it is a bank account that you own. If you leave the company, you take it with you. If you do not use the funds by the end of the year, it remains in your account for future use.

The HSA is set up in your name through HealthEquity. They will hold the funds, but you are responsible for managing them. The HSA is a tax-qualified account (similar to an IRA). You may make deposits on a pre-tax basis, subject to certain limits, and the money grows tax-free. Use of the funds for anything other than a qualified expense is a taxable event.

HEALTH SAVINGS ACCOUNT ELIGIBILITY

You are eligible to open an HSA if ALL of your answers to the following questions are NO.

- Are you enrolling in a standard health plan (not a high-deductible health plan)?

- Are you Medicare eligible (or 65 and older)?

- Can you be claimed as a tax dependent by another party?

- Do you have medical coverage through your spouse or another plan that is not a qualified high-deductible health plan?

- Does your spouse participate in a full health care flexible spending account (FSA) plan?

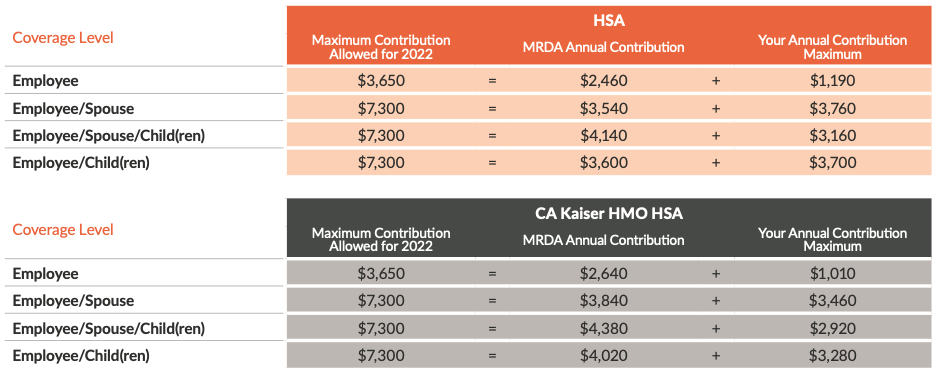

2022 IRS HEALTH SAVINGS ACCOUNT CONTRIBUTION MAX

Contributions (including employer contributions) to an HSA cannot exceed the IRS allowed annual maximums.

- Individuals: $3,650

- All other coverage levels: $7,300

If you are age 55+ by December 31, 2022, you may contribute an additional $1,000.

The IRS allowed annual maximum of $7,300 applies to you and your spouse, even if you contribute to separate HSAs. The amount you fund between BOTH accounts cannot exceed $7,300. Be sure to include any contributions made to your spouse’s HSA (including employer contributions) when calculating your own contributions.

MRDA CONTRIBUTION