BENEFITS BUILT FOR YOU

At Mitutoyo Research & Development America, Inc. (MRDA), we care about you. That’s why we offer benefits that support your physical, emotional, and financial health.

This overview, in addition to information provided by the carriers, is intended to help you make this important decision. Please read the information provided thoroughly so that you can make the choices that work best for you and your family.

Required Notices and Summary Plan Descriptions (SPDs)

SUMMARY FOR 2024

MRDA will continue to pay 100% of each employee’s monthly medical (including vision) and dental premiums and pay 75% of the monthly premiums for your covered dependents.

The medical plans will be staying with Kaiser Permanente (Kaiser) with the same options as last year. Below are highlights for each plan:

PPO Plan: $250/$500 Deductible, $4,000/$8,000 Out-of-Pocket Maximum, $20 copay

- Annual out-of-pocket maximum for out-of-network providers: Unlimited

- Whether you use a Kaiser or non-Kaiser provider, your office visit copay will be $20

- Prescription drug copays: $15 generic/$25 preferred brand/$45 non-preferred brand or generic for 30-day supply

- If you have your prescription filled at a Kaiser pharmacy, copays will be reduced to $5/$15/$35 (30-day supply)

- Prescription mail order copays: $10/$30/$70 for 90-day supply

- Diagnostic lab and X-ray: deductible applies and then is covered at 90%

- Hearing hardware: $3,000 per ear every 36 months, deductible does not apply (new)

HSA Plan: Employee Only Plan deductible: $2,500, With Family Plan deductible: $5,000, then coinsurance 20%

- Employee Only Plan out-of-pocket maximum: $5,100

- With Family Plan out-of-pocket maximum: $5,600 individual/$11,200 whole family (i.e. one family member pays no more than $5,600)

- Annual out-of-pocket maximum for out-of-network providers: Unlimited

- Whether you use a Kaiser or non-Kaiser provider, coinsurance will be 20% after deductible met (new)

- If you have your prescription filled at a Kaiser pharmacy, prescription drug coinsurance will be reduced from 20% to 10% after deductible met

- Hearing hardware: $3,000 per ear every 36 months, after deductible met (new)

Kaiser HMO HSA Plan: Employee Only Plan deductible: $2,500, With Family Plan deductible: $5,000, then coinsurance 20% (same as the other HSA plan)

- Because this is an HMO plan, all non-emergency services are limited to Kaiser Health Plan providers. Upon enrollment, you will either be assigned or may select a primary care physician (PCP) for yourself and each covered family member

- Employee Only Plan out-of-pocket maximum: $4,500

- With Family Plan out-of-pocket maximum: $8,500, whole family (i.e. one family member or combination of all family members pay up to $8,500)

- Prescription drug copays at Kaiser pharmacy: $15 generic/$30 preferred brand/$50 non-preferred brand or generic for 30-day supply after deductible met

- Prescription mail order copays: $45/$90/$150 for 90-day supply (no discount) after deductible met

- Hearing hardware: $3,000 per ear every 36 months, after deductible met (new)

Vision Exam (included in all three plans)

- Annual eye exam covered in full (once per consecutive 12 months)

Vision Hardware (included in all three plans)

Pediatric (Under Age 19)

- Eyeglasses: Frame and lenses are covered in full for

one pair per calendar year - Contact lenses (non-eye pathology): Contact lens fitting and evaluation exams are covered in full, but a 12-month supply of contact lenses are covered at 50% coinsurance per year in lieu of glasses

- A member is limited to either an annual frame/lens or annual contact lens benefit, not both

Adult (Age 19 and Over)

- $150 allowance per consecutive 12 months for

eyeglass frames and lenses and/or contact lenses (has to be purchased within a single transaction) - Contact lenses (non-eye pathology): Contact lens fitting and evaluation exam costs count toward the $150 hardware allowance

WHEN TO ENROLL

MRDA’s open enrollment period is in the winter every year with a January 1 plan renewal date.

- Current employees: Open enrollment is the time each year when you may make benefit choices for the coming year. This is your annual opportunity to change plans and/or add or drop yourself, spouse, child(ren) from your health coverage.

- New hires: Enrollment must be completed and submitted no more than 30 days after your initial eligibility date or you may not be able to enroll until the plan’s next open enrollment period.

CHANGING YOUR BENEFITS

Once you enroll in your benefits, you cannot make changes until the next annual open enrollment period unless you qualify for Special Enrollment, as described below.

A qualifying family status change includes:

- Marriage or divorce/legal separation

- Birth or adoption of a child

- Death of a covered member

- Change in CHIPRA eligibility

- Commencement of a Qualified Medical Child Support Order

- Employment status change for you or your spouse

- Change in Medicare or Medicaid eligibility

Generally, you must notify Human Resources within 30 days of the qualifying status change in order to make a change to your benefits. All status changes require documentation and the type of benefit change requested must correspond with the event. If the qualifying event is due to loss of coverage other than loss of state medical assistance and/or CHIPRA, the application must be submitted within 30 days of the event.

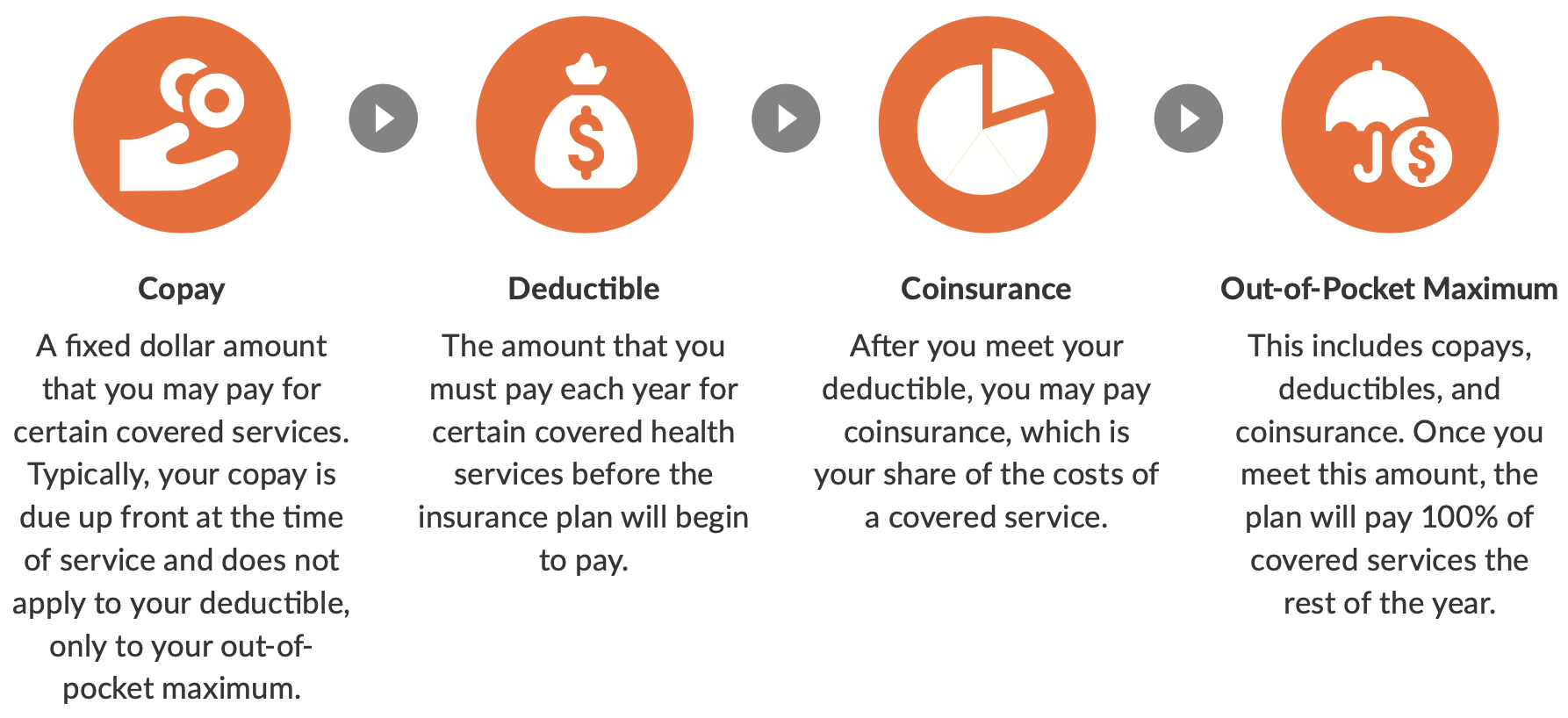

KEY TERMS TO KNOW