Voluntary Benefits

SUPPLEMENTAL LIFE AND AD&D INSURANCE

Monte Nido & Affiliates provides you the option to purchase supplemental life and AD&D insurance for yourself, your spouse, and your dependent children through Lincoln Financial Group. You must purchase supplemental coverage for yourself in order to purchase coverage for your spouse and/or dependents. Benefits will reduce to 65% at age 65 and to 50% at age 70.

Supplemental life rates are age-banded. Please refer to the official plan documents for rates and additional information.

- Employee: $10,000 increments up to $500,000 or 5x annual salary, whichever is less—guarantee issue: $150,000

- Spouse: $5,000 increments up to $500,000 or 100% of the employee’s election, whichever is less—guarantee issue: $25,000

- Dependent children: $10,000—guarantee issue: $10,000

If you elect supplemental coverage when you’re first eligible to enroll, you may purchase up to the guarantee issue amount(s) without completing a statement of health (evidence of insurability). If you do not enroll when first eligible, and choose to enroll during a subsequent annual open enrollment period, you will be required to submit evidence of insurability for any amount of coverage. Coverage will not take effect until approved by Lincoln Financial Group.

SUPPLEMENTAL LONG-TERM DISABILITY INSURANCE

Monte Nido & Affiliates provides you the option to purchase supplemental long-term disability (LTD) insurance through Lincoln Financial Group. LTD insurance is designed to help you meet your financial needs if your disability extends beyond the STD period.

- Benefit: 60% of monthly earnings up to $10,000

- Elimination period: 90 days

- Benefit duration: Social security normal retirement age

ACCIDENT INSURANCE

Accident insurance can help you pay for injuries that occur on or off the job— whether common or severe. If you enroll now, you are guaranteed base coverage without having to answer any medical questions. You’ll receive 24 hour coverage and your benefit will pay a lump- sum directly to you in the event of a covered accident.

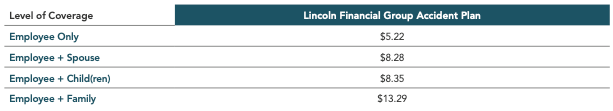

ACCIDENT COSTS

Listed below are the per pay period costs for accident insurance. The amount you pay for coverage is deducted from your paycheck on a pot-tax basis.

HOSPITAL INDEMNITY

This option will pay benefits that help you with costs associated with a hospital visit such as a covered accident, illness, or childbirth. This benefit pays you a lump- sum upon admittance so that you can choose how best to cover your expenses.

HOSPITAL INDEMNITY COSTS

Listed below are the per pay period costs for hospital indemnity insurance. The amount you pay for coverage is deducted from your paycheck on a pot-tax basis.

CRITICAL ILLNESS

This option will pay a lump- sum benefit directly to you if you are diagnosed with a serious illness. When you enroll, receive up to $30,000 guaranteed issue coverage to ensure you peace of mind in the event of a serious illness. You must be actively working when diagnosed to receive this benefit.

CRITICAL ILLNESS COSTS

Please see per pay premium rates located in ADP during the enrollment process.

WELLNESS BENEFITS

You or your covered spouse or child are eligible for the following wellness benefits when a covered health screening test is performed:

- Accident insurance: $100 per insured individual per calendar year

- Critical illness insurance: $50 per insured individual per calendar year

IDENTITY THEFT PROTECTION

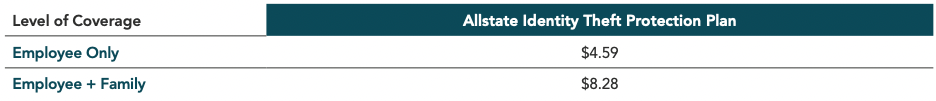

Monte Nido & Affiliates provides you the option to purchase identity theft protection services through Allstate. With identity theft protection you can track and monitor your personal data, catch fraud early, protect against online threats such as viruses, receive notifications for financial transactions, and much more. For more information, call 800-789-2720 or visit myaip.com.

Listed below are the per pay period costs for hospital indemnity insurance. The amount you pay for coverage is deducted from your paycheck on a pot-tax basis

STUDENT LOAN SUPPORT

Monte Nido & Affiliates provides you and your family members access to SoFi, the largest provider of student loan refinancing. Get tips and insights about refinancing student loans and interest rates, plus best practices for eliminating student debt. Receive a rate discount of .125% when you refinance through sofi.com/montenido.

RETIREMENT

Monte Nido & Affiliates offers a 401(k) retirement savings plan, which is administered by Fidelity Investments.

The Monte Nido & Affiliates 401(k) retirement savings plan offers a convenient way for you to save for your retirement through either pre- tax or post-tax payroll contributions. All employees age 21 or over are eligible to participate in the plan as of the first day of the month following their date of hire. This includes full time, part time and per diem employees.

Contributions from your pay are made up to the IRS annual limit. If you are 50 years of age or older (or if you will reach age 50 by the end of the year), you may make a catch-up contribution in addition to the normal IRS annual limit.

The company has committed to making a discretionary matching contribution to those who are contributing to the plan. This discretionary match is based on Monte Nido & Affiliates exceeding its financial goals. To qualify for the match, you need to be an active employee at the end of the calendar year, have made contributions to the plan during the calendar year, and Monte Nido & Affiliates needs to exceed its fiscal goal. To maximize your match, contribute at least 6% throughout the year.

To enroll in the 401(k) plan, click on the My Benefits link on the Home page in ADP. For assistance with retirement planning, please contact our provider, Fidelity at netbenefits.com.

Resources

Life and AD&D Insurance Summary

Voluntary Life Coverage Rates

Voluntary AD&D Insurance

Health Assessment Benefit Claims Employee Flyer

Monte-Nido Long Term Benefit Summary

Accident Insurance Flyer

Hospital Indemnity Flyer

Critical Illness Flyer

Allstate Identity Protection FAQ

Sofi Student Loan Support Flyer

Discovery Benefits - WEX

HOW TO ENROLL

Self-enroll in your benefits through ADP.

Review the available plan options and log into www.workforcenow.adp.com.

To start the enrollment process, navigate to Myself > Benefits > Enrollments.

Add or edit your dependents and beneficiaries.

You will need a social security number and date of birth to add a dependent or beneficiary.

Elect or decline coverage.

Review your elections before you submit.

Once you have finalized your enrollment, print your confirmation statement or send it to yourself via email and keep for your records.