Voluntary Benefits

Maxar employees have the opportunity to purchase additional coverage through VOYA. The premium is paid through a convenient payroll deduction on a post-tax basis.

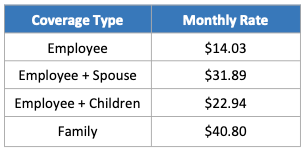

Group Accident Plan

- The Accident Plan pays you a lump-sum benefit for specific injuries and events resulting from a covered accident.

- The plan does not coordinate or offset with any other coverage you may have in place.

- Coverage is also available for your spouse and dependent children up to age 26.

- The plan includes an annual wellness benefit of $100 for you and your spouse, and $50 for each of your children, with a maximum of $200 for children. Wellness benefit claims can be filed online at www.voya.com or by calling 877-236-7564.

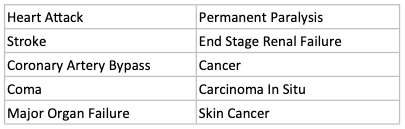

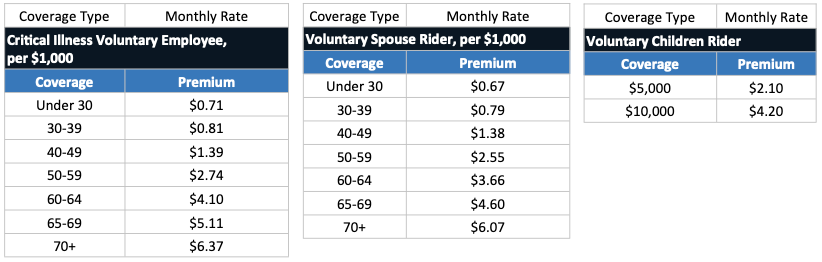

Critical Illness Plan

- The Critical Illness Plan pays you a lump-sum benefit if you are diagnosed with a covered illness or condition.

- You may elect coverage in the amount of $10,000, $15,000, $20,000 or $30,000.

- Coverage is also available for your spouse at $5,000, $10,000, $15,000 amounts and dependent children up to age 26 in

the amount of $5,000 or $10,000. - The plan includes an annual wellness benefit of $100 for you and your spouse, and $50 for each of your children, with a

maximum of $200 for children. Wellness benefit claims can be filed online at www.voya.com or by calling 877-236-7564. - Covered conditions include:

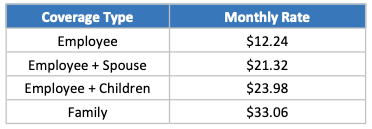

Hospital Confinement Indemnity Insurance

Hospital stays are rarely an enjoyable experience and in most cases you are feeling ill or are receiving some type of treatment. Costs for these type of services can add up quickly and the financial pressure of a hospital stay can be stressful. Hospital Confinement Indemnity Insurance can assist with these costs.

What is Hospital Confinement Indemnity Insurance?

Hospital Confinement indemnity Insurance pays a daily benefit if you have a covered stay in a hospital, critical care unit or rehabilitation facility that begins on or after your coverage effective date. The benefit amount is determined by the type of facility and the number of days you stay. This plan is not health insurance, as it just pays a lump sum directly to you to assist with hospital care costs.

How can Hospital Confinement indemnity Insurance help?

- Medical expenses, such as deductibles and copays

- Travel, food and lodging expenses for family members (your spouse and your children)

- Child care

- Everyday expenses like utilities and groceries

Resources

Open Enrollment for 2024 benefits has ended. If you are a new hire or if you have experienced a qualifying life event, please follow the instructions below.

You have three ways to enroll or make changes due to a qualifying life event:

- Contact the Benefits Concierge Center at (855) 720-5757. Benefits counselors are ready to assist you.

- Book an appointment with a benefits counselor below.

- Self-enroll by logging into the Workday system.