Life Insurance

Basic Life and AD&D

Maxar provides Basic Life Insurance and Basic AD&D Insurance policies for all eligible employees. The benefit for each policy is 2 times your annual earnings to a maximum of $1,000,000. Premiums for coverage over $50,000 are considered a taxable benefit, and will appear on your W-2. When you reach age 65, life benefits reduce to 65%. When you reach age 70, life benefits reduce to 50%.

NOTE: ALL ELIGIBLE EMPLOYEES ARE AUTOMATICALLY ENROLLED IN STD, PREMIUM TAXED LTD, LIFE, AND AD&D COVERAGE. EMPLOYEES WORKING A MINIMUM OF 15 REGULARLY SCHEDULED HOURS PER WEEK AVERAGED OVER THE PAST 12 MONTHS ARE ELIGIBLE.

Supplemental Life

Maxar offers Supplemental Life insurance for employees, spouses, and children through Lincoln. Employees working a minimum of 15 regularly scheduled hours per week averaged over the past 12 months are eligible. When you reach age 65, life benefits reduce to 65%. When you reach age 70, life benefits reduce to 50%.

- An Employee may elect coverage in $10,000 increments up $1,000,000.

- Guaranteed issue insurance is available to new employees within 31 days of hire date.

- The guaranteed issue amount for employees is $350,000.

- An Employee can then elect Spouse coverage in $5,000 increments up to a maximum of $500,000. Coverage cannot exceed 50% of the amount of your supplemental life insurance coverage.

- The guaranteed issue amount is $50,000 for spouses.

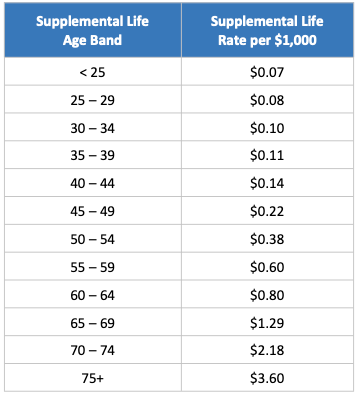

Supplemental Life Premium

Monthly Premium Per $1,000 of coverage for Employee, Spouse/Domestic Partner.

Coverage for children is $10,000 each with a monthly premium of $0.20, regardless of the number of children covered.

Additional Required Forms

If you elect amounts over the guaranteed issue or request coverage more than 31 days after your date of hire, you will be required to complete an Evidence of Insurability (EOI) form in order to apply for medical underwriting through Lincoln.

Access your Evidence of Insurability (EOI) Online:

- Log in to mylincolnportal.com.

First time user? Register using company code MAXAR - Click Complete Evidence of Insurability / Statement of Health

- Answer the questions asked

- Electronically sign and submit

- Save your confirmation report

In most cases, you may be auto-approved for coverage. If not, Lincoln will review your application and contact you if any additional information is required. You will be mailed the outcome of your EOI to your home address.

Special Note:

The policy will not be contested, except for nonpayment of premium, after it has been in force for two years from the date of issue. The coverage of any Covered Person shall not be contested, except for nonpayment of premium, on the basis of a statement made relating to insurability of the Covered Person after such coverage has been in force for two years during the Covered Person’s lifetime.

Resources

LifeKeys Brochure

EOI Instructions

LFG_Report a Claim Employee Flyer

Online Will Prep

Maxar Technologies Holdings Inc._Optional Life CL 3_Benefit Summary

Maxar Technologies Holdings Inc._Family ADD CL 3_Benefit Summary

Maxar Technologies Holdings Inc._Optional Life CL 2_Benefit Summary

Maxar Technologies Holdings Inc._Basic Life and ADD CL 2 Benefit Summary

Maxar Technologies Holdings Inc._Basic Life and ADD CL 3_Benefit Summary

Open Enrollment for 2024 benefits has ended. If you are a new hire or if you have experienced a qualifying life event, please follow the instructions below.

You have three ways to enroll or make changes due to a qualifying life event:

- Contact the Benefits Concierge Center at (855) 720-5757. Benefits counselors are ready to assist you.

- Book an appointment with a benefits counselor below.

- Self-enroll by logging into the Workday system.