HSA / FSA

Consumer Driven Health Plan (CDHP) & Health Savings Account (HSA)

What is a CDHP HSA?

A Consumer Driven Health Plan (CDHP) offers comprehensive health care coverage at a lower premium and higher deductible than traditional health care plans. A CDHP also features a Health Savings Account (HSA) that enables you to pay for current, qualified health care expenses and save for future expenses on a tax-free basis. You have the opportunity to set aside funds in your HSA before taxes through convenient payroll deductions. Maxar also contributes funds to your HSA to help your account grow.

How the plan works

The CDHP, along with your HSA, puts health care spending in your hands, allowing you to choose how to spend your health care dollars. You can either pay for eligible services by using funds in your HSA, or you can pay for them out of your own pocket. Note: You can only use HSA funds that are available in your account. You can always reimburse yourself later once you have accumulated funds in your account.

HSA Funding

Your Contributions

There are several ways to contribute money into your HSA:

- Pre-tax contributions through payroll deductions

- Catch-up contributions up to $1,000 per year if you are over age 55 (until

you enroll in Medicare)

Company Contribution

Maxar will contribute $800 annually for individuals and $1,600 for all other tiers to supplement your own contributions as you work to make the account grow. You must open your HSA through Optum Bank (via www.optumbank.com) prior to December 1st, 2024 in order to receive any contributions (via payroll deduction or from Maxar) for the calendar year. If your account is opened after December 1st, 2024, you will forfeit any Maxar contributions for the calendar year. Maxar’s contribution will be funded per pay period in 2024 (pro-rated if enrolling mid-year).

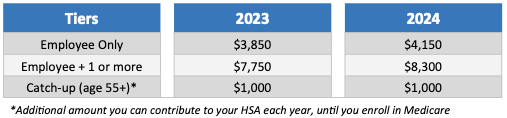

Annual Contribution Limits

It is important to note that your contributions, when combined with those contributed by Maxar, may not exceed the IRS annual maximum:

Transition from General Purpose Health FSA to HSA

Maxar’s Health FSA includes a grace period. If you have an election for Health FSA Benefits that is in effect on the last day of a Plan Year, you cannot elect HSA Benefits or otherwise make contributions to an HSA for any of the first three calendar months following the close of that Plan Year, the exception is if you have a zero balance at the close of that plan year. You may enroll in Maxar’s CDHP effective January 1st but due to IRS guidelines you would not be eligible to establish an HSA until April 1st and contribute 3/4 of the IRS annual maximum contribution. You may use the account to file qualified eligible medical expenses dated after April 1st. Expenses incurred prior to your HSA being established are not considered qualified.

Qualified Expenses

HSAs enable you to pay for the following qualified health care expenses on a tax-free basis:

- Qualified expenses not covered by insurance, as defined by the IRS, online at https://www.irs.gov/pub/irs-pdf/p502.pdf

- COBRA premiums

- Qualified long-term care insurance and expenses

- Health insurance premiums when receiving unemployment compensation

- Medicare/retiree health insurance premiums (excluding Medicare Supplement/Medigap insurance premiums)

HSA Advantages

Triple Tax Advantage

- You contribute pre-tax funds through payroll deductions, meaning the money comes out of your paycheck before federal

income tax is calculated. This, in turn, reduces the amount of taxable income, so less tax is withheld from your paycheck. - Funds grow tax-free, and unused funds roll over year to year.

- You can withdraw funds tax-free to pay for qualified health care expenses now and in the future—even in retirement.

Control

You own and control the money in your HSA. You decide how you want to spend it or if you want to spend it. You can use it to pay for doctor’s visits, prescriptions, braces, glasses—even laser vision correction surgery.

Investment Opportunities

Once you reach and maintain a minimum threshold, you can make investments to help your money grow tax-free.

Savings Potential

There is no “use it or lose it” rule. Your account grows over time as you continue to roll over unused dollars from year to year.

Portability

Your HSA is yours for life. The money is yours to spend or save, regardless of whether you change health plans,* retire or leave the company.

*You must be enrolled in a qualified health plan to contribute to an HSA.

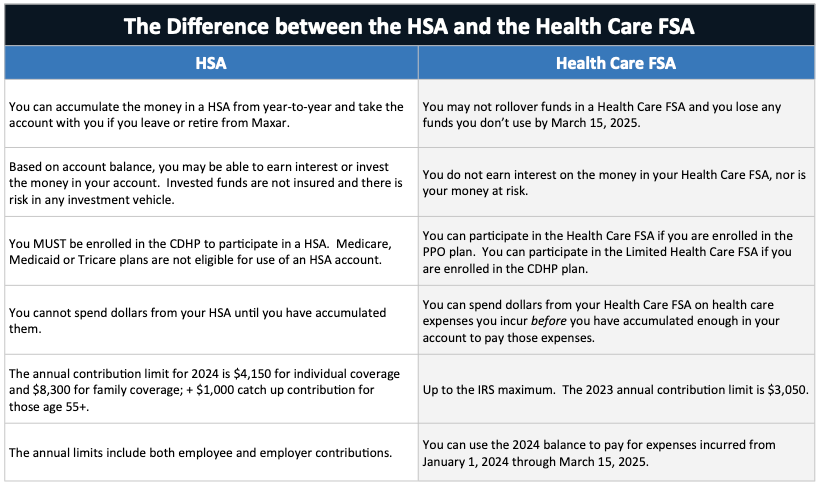

Flexible Spending Accounts (FSA)

Flexible Spending Accounts (FSA), allow employees to set aside pre-tax money from their paychecks to pay for eligible out of pocket expenses for healthcare, dependent care and transit/parking. Because the money put into these accounts is not considered taxable, employees save by paying less Federal, State and FICA taxes. Depending on personal circumstances, these plans can mean a significant tax savings. All FSAs are administered by Discovery Benefits.

Take note if you have a domestic partner—IRS rules do not recognize expenses for domestic partners as reimbursable under these accounts.

Health Care Flexible Spending Account

Contribute anywhere from $120 up to the IRS maximum. The 2024 maximum is $3,200 per household (per calendar year) for reimbursement of health-related expenses you may need to pay for out of pocket. Expenses can be incurred from January 1, 2024 to March 15, 2025 as long as you are an active participant in the plan. You have access to your full plan year election amount of Health Care FSA funds immediately.

Examples of Eligible Expenses

- Copays, coinsurance and deductibles

- Dental and orthodontia expenses

- Contact lenses, eyeglasses, vision surgery

- Hearing aids

- Chiropractic care

- Over the counter medications, with a prescription

You can find a complete list of eligible expenses at: https://www.irs.gov/pub/irs-pdf/p969.pdf

Use It or Lose It!

IRS regulations require that expenses must be incurred between January 1, 2024 to March 15, 2025 and submitted for reimbursement by March 31, 2025. Plan carefully prior to participation in order to avoid forfeitures of contributions. Changes to elections mid-year cannot be made without a Qualified Life Event (QLE). For further details, please refer to the Summary Plan Description.

Limited Purpose Health Care FSA

If you enroll in the CDHP medical coverage, you have the option of electing a Limited Purpose Health Care FSA. Under the Limited Purpose Health Care FSA you can be reimbursed for dental and vision expenses you may need to pay for out of pocket.

For further details please refer to the Summary Plan Description.

Dependent Care Flexible Spending Account

Contribute anywhere from $120 up to $5,000 per household (per calendar year) towards out of pocket dependent care expenses for children under age 13 and disabled dependents of any age. Expenses can be incurred from January 1, 2024 to March 15, 2025 as long as you are an active participant in the plan. Dependent care expenses are only reimbursable up to what has been deducted from payroll and deposited to your account.

- Licensed day care centers for children and disabled dependents*

- Costs for family or adult day care facilities*

- Babysitters outside or inside your home while you are working*

- Day camp expenses (but not overnight camp)*

You can find a complete list of eligible expenses at: https://www.irs.gov/pub/irs-pdf/p969.pdf

Use It or Lose It!

IRS regulations require that expenses must be incurred between January 1, 2024 to March 15, 2025 and submitted for reimbursement by March 31, 2025. Plan carefully prior to participation in order to avoid forfeitures of contributions. Changes to elections mid-year cannot be made without a Qualified Life Event (QLE). For further details, please refer to the Summary Plan Description.

*Must provide tax ID# or SSN

Transportation & Parking Flexible Spending Accounts

Maxar offers a plan, administered by WEX, whereby employees can set aside a portion of their pay, via pre-tax payroll deductions, for the payment of Mass Transit or Parking expenses. You may adjust or discontinue your participation in the plan whenever you experience a change in transportation or parking expenses. Employees may designate up to the IRS maximum or the 2023 maximum below:

A monthly maximum of $300 for Mass Transit

A monthly maximum of $300 for Parking

IRS Section 132(f) provides that eligible expenses include (1) transportation in a commuter highway vehicle between home and work, (2) any transit pass, and (3) qualified parking.

For further details please refer to the Summary Plan Description

Examples of Eligible Expenses

Resources

Open Enrollment for 2024 benefits has ended. If you are a new hire or if you have experienced a qualifying life event, please follow the instructions below.

You have three ways to enroll or make changes due to a qualifying life event:

- Contact the Benefits Concierge Center at (855) 720-5757. Benefits counselors are ready to assist you.

- Book an appointment with a benefits counselor below.

- Self-enroll by logging into the Workday system.