Disability Insurance

Short Term Disability (STD)

- Employees working a minimum of 15 regularly scheduled hours per week averaged over the past 12 months are eligible.

- Provided by Maxar at no cost to you, the Short-Term Disability (STD) benefit provides salary continuation in the event of a non-

work related illness or injury. - A portion of your income is protected beginning on the 8th consecutive day of illness or injury, as defined by a qualified

physician. Your 7-day waiting period is waived if you are hospitalized. - Employees are eligible to receive up to 6 weeks of salary continuation at 100% of their salary and thereafter, up to 6 weeks paid

at 66.67%. - Short Term Disability will run concurrently with any applicable leave of absence.

- This benefit is offset by any applicable state disability payments.

Long Term Disability (LTD)

- Maxar provides Long-Term Disability (LTD) coverage through Lincoln. Employees working a minimum of 15 regularly scheduled hours per week averaged over the past 12 months are eligible.

- If you are unable to work due to disability for longer than 13 weeks, you will be eligible to receive tax-exempt compensation through LTD.

- If an illness or injury extends beyond the period covered by STD, and you are totally disabled as defined by a qualified physician, you may be eligible for LTD benefits.

- This plan does not cover pre-existing conditions. This means a condition resulting from an Injury or Sickness for which you were diagnosed or received Treatment within three months prior to your effective date of coverage.

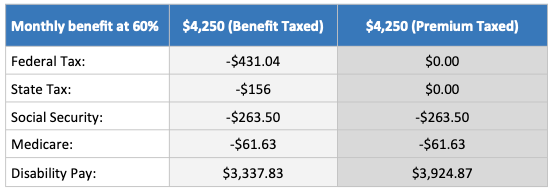

- LTD covers 60% of monthly salary to a maximum of $25,000 per month.

- You may choose either premium taxed or benefit taxed LTD. Maxar will pay for this benefit, however you have the option to

either pay taxation on the premium, which will make your LTD tax free in the event of a claim (Premium Taxed), OR you can choose to have the benefit in the event of a claim taxed, which makes your premium free to you (Benefit Taxed). You must pick one or the other, you may not waive this coverage. - While Maxar pays the premiums for LTD coverage, if you elect premium taxed, the premiums will be reported as taxable income on your W-2 at the end of the year in order to provide a tax-free benefit.

Disability Insurance

Add a header to begin generating the table of contents

Resources

Open Enrollment for 2024 benefits has ended. If you are a new hire or if you have experienced a qualifying life event, please follow the instructions below.

You have three ways to enroll or make changes due to a qualifying life event:

- Contact the Benefits Concierge Center at (855) 720-5757. Benefits counselors are ready to assist you.

- Book an appointment with a benefits counselor below.

- Self-enroll by logging into the Workday system.