Voluntary Benefits

The Kenan Advantage Group, Inc. is pleased to offer the following voluntary benefits.

CRITICAL ILLNESS INSURANCE

Critical illness insurance is designed to supplement your health insurance coverage by helping you pay for direct and indirect costs associated with a critical illness, like heart attack, stroke, or major organ failure. Benefits are paid in a lump sum for use at the claimant’s discretion.

This plan includes a $50 wellness benefit payable once per year, per individual, for a covered health screening test.

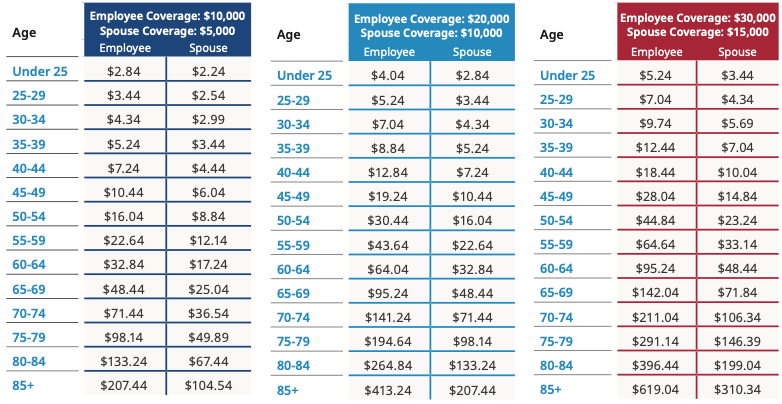

- Employee: $10,000, $20,000, or $30,000

- Spouse: 50% of employee election

- Child(ren): 50% of employee election (your child(ren) are automatically covered at no cost if you elect coverage for yourself)

Below are the monthly premiums for critical illness insurance.

ACCIDENT INSURANCE

Accident insurance is designed to supplement your health insurance coverage by paying a specific benefit amount for expenses resulting from both on- and off-the-job injuries or accidents, including fractures, burns, concussions, and more. Benefits are paid in a lump sum.

This plan includes a $50 wellness benefit payable once per year, per individual, for a covered health screening test.

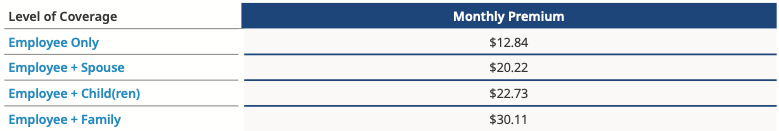

Below are the monthly premiums for accident insurance.

HOSPITAL INDEMNITY INSURANCE

Hospital indemnity insurance is designed to supplement your health insurance coverage by providing financial protection for covered individuals that incur a hospitalization. Benefits include $1,000 for each covered hospital admission (once per year), $100 for each day of your covered hospital stay (up to 60 days), and $200 for each day spent in intensive care (up to 15 days). Benefits are paid in a lump sum.

This plan does not cover pre-existing conditions. You have a pre-existing condition if you received medical treatment, consultation, care, or services for it in the 12 months prior to your effective date of coverage; and the date of loss occurs during the first 12 months after your effective date.

This plan includes a $50 wellness benefit payable once per year, per individual, for a covered health screening test.

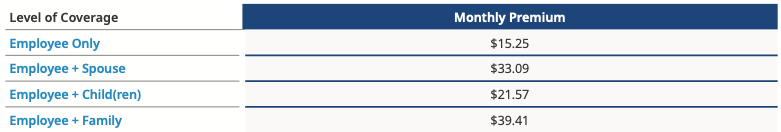

Below are the monthly premiums for hospital indemnity insurance.

PET INSURANCE

You have the option to purchase pet insurance at discounted group rates through Nationwide.

What is covered:

- Accidental injuries

- Illnesses

- Exam fees

- Surgeries

- Medications

- Ultrasounds

- Hospital stays

- X‐rays and other diagnostics

Pet insurance does not cover preventive services, including annual wellness exams and vaccinations. Additionally, pet insurance does not cover pre-existing conditions.

Call 877-738-7874 or visit benefits.petinsurance.com/thekag for a quote or to enroll.