Life and Disability

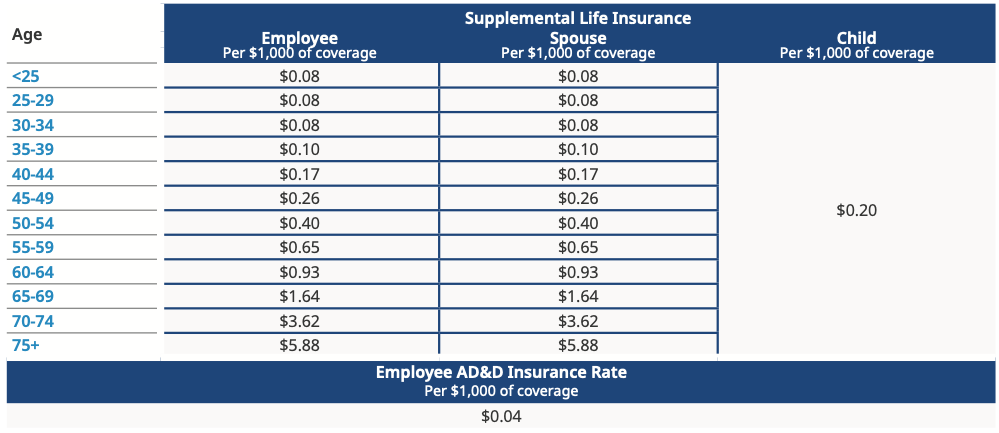

SUPPLEMENTAL LIFE AND AD&D BENEFITS

Life and accidental death and dismemberment (AD&D) insurance is an important element of your income protection planning, especially for those who depend on you for financial security.

The Kenan Advantage Group, Inc. provides you the option to purchase supplemental life and AD&D insurance for yourself, and supplemental life insurance for your spouse and dependent child(ren) through Unum.

You must purchase supplemental coverage for yourself in order to purchase coverage for your spouse and/or dependents. If you elect life insurance for your child(ren), you pay the same price to cover one child or several children. Supplemental life rates are age-banded and are listed in Paycom. Benefits will reduce by 35% at age 70 and 55% at age 75. Benefits terminate at retirement.

- Employee (life and AD&D):

- Class 1—Administrative/Salaried Employees (excluding Executives): $25,000 increments up to $750,000 or 5x

annual salary, whichever is less—guarantee issue if newly eligible: $500,000 or 3x annual salary, whichever is less - Class 2—Executives: $25,000 increments up to $750,000 or 5x annual salary, whichever is less - guarantee issue is newly eligible: $500,000 or 3x annual salary, whichever is less

- Class 3—Drivers, Technicians, and Tank Washers: $25,000 increments up to $250,000—guarantee issue if newly eligible: $100,000

- Class 1—Administrative/Salaried Employees (excluding Executives): $25,000 increments up to $750,000 or 5x

- Spouse (life only): $5,000 increments up to $150,000, not to exceed 50% of employee amount—guarantee issue if newly eligible: $25,000

- Dependent children (life only): Live birth to 26 years: $5,000, $7,500 or $10,000, not to exceed 50% of employee amount—guarantee issue: $10,000

Plan Features

For 2024, you may purchase up to the guarantee issue amount(s) without completing a statement of health (evidence of insurability). If you do not enroll for 2024, and choose to enroll during a subsequent annual open enrollment period, you will be required to submit evidence of insurability for any amount of coverage. Coverage will not take effect until approved by Unum.

Additionally, if you elect any amount of coverage for 2024, you may increase your election by one increment, up to the guarantee issue amount(s) without completing a statement of health (evidence of insurability) during each subsequent open enrollment period.

Employee premiums and age reduction schedule will be based on the employee’s age as of December 31, 2024. Spouse premiums and age reduction schedule will be based on the spouse’s age as of December 31, 2024.

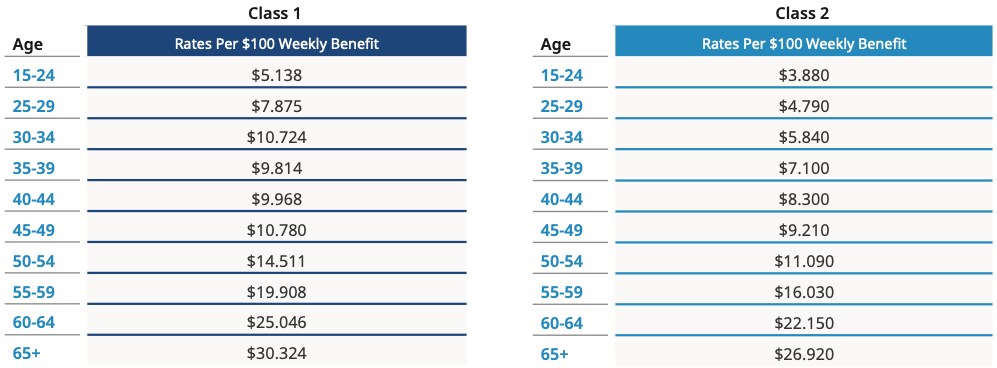

VOLUNTARY SHORT-TERM DISABILITY BENEFITS

The Kenan Advantage Group, Inc. provides you the option to purchase voluntary short-term disability (STD) insurance through Unum.

STD insurance is designed to help you meet your financial needs if you become unable to work due to an illness or injury.

This plan does not cover pre-existing conditions. You have a pre-existing condition if you received medical treatment, consultation, care, or services for it in the 12 months prior to your effective date of coverage; and the disability begins in the first 12 months after your effective date of coverage.

Benefits will be reduced by other income, including state-mandated short-term disability plans and any group short-term disability coverage, if applicable. For plan provision details, refer to the official plan documents.

Class 1—Administrative/Salaried Employees (excluding Executives):

- Benefit: $100 increments up to $2,500 per week, not to exceed 60% of weekly income

- Elimination period: 7 days

- Benefit duration: 25 weeks

Class 2—Drivers, Technicians, and Tank Washers:

- Benefit: $100 increments up to $1,000 per week

- Elimination period: 7 days

- Benefit duration: 25 weeks

Below are the rates per $100 of weekly benefit for short-term disability insurance.

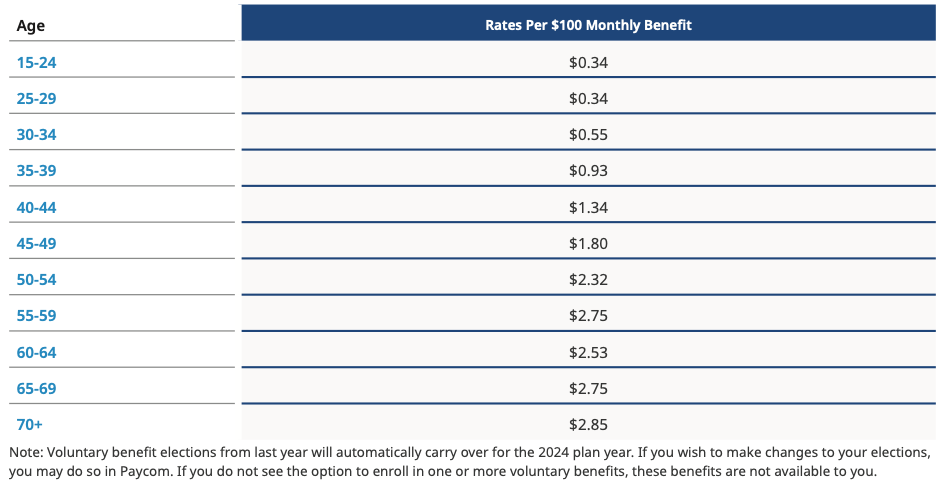

VOLUNTARY LONG-TERM DISABILITY BENEFITS

The Kenan Advantage Group, Inc. offers the option to purchase voluntary LTD insurance for additional coverage through Unum.

The Kenan Advantage Group, Inc. provides you with the option to purchase voluntary long-term disability insurance to help cover eligible expenses if your disability extends beyond the STD period.

This plan does not cover pre-existing conditions. You have a pre-existing condition if you received medical treatment, consultation, care, or services for it in the 12 months prior to your effective date of coverage; and the disability begins in the first 24 months after your effective date of coverage, unless you have been treatment-free from the condition for 12 consecutive months after your effective date.

The amount you receive from this policy may be lower if you also receive funds from other sources for your disability such as Social Security disability insurance from the government. For additional details on plan provisions, please refer to the official plan documents.

Class 1—Drivers, Technicians, and Tank Washers:

- Benefit: $100 increments up to $2,700 per month

- Elimination period: 180 days

- Benefit duration: To age 65 or longer depending on your age when you become disabled

Listed below are the rates per $100 of monthly benefit for long-term disability insurance.

Resources

Voluntary Life & AD&D Class 1 Benefit Summary

Voluntary Life & AD&D Class 2 Benefit Summary

Vol Life & AD&D Class 3 Benefit Summary

Voluntary Short Term Disability Class 1 Benefit Summary

Voluntary Short Term Disability Class 2 Benefit Summary

Voluntary Long Term Disability Class 1 Benefit Summary

How to File a Claim