Life and AD&D Insurance

Depending on your personal situation, basic life and AD&D insurance might not be enough coverage for your needs. To protect those who depend on you for financial security, you may want to purchase supplemental coverage.

SUPPLEMENTAL LIFE AND AD&D INSURANCE

Isola provides you the option to purchase supplemental life and AD&D insurance for yourself, your spouse, and your dependent children through The Standard.

You must purchase supplemental coverage for yourself in order to purchase coverage for your spouse and/or dependents. Supplemental life rates are age-banded. Benefits will reduce to 65% at age 65.

Note: If you elect supplemental coverage when you’re first eligible

to enroll, you may purchase up to the guarantee issue amount(s) without completing a statement of health (evidence of insurability). If you do not enroll when first eligible, and choose to enroll during a subsequent annual open enrollment period, you will be required to submit evidence of insurability for any amount of coverage. Coverage will not take effect until approved by The Standard.

- Employee life benefit: $10,000 increments up to a maximum of $600,000—guarantee issue: $250,000

- Employee AD&D benefit: $10,000 increments up to a maximum of $600,000—guarantee issue: $250,000

- Spouse life benefit: $5,000 increments up to $250,000—guarantee issue: $20,000

- Spouse AD&D benefit: $5,000 increments up to $250,000—guarantee issue: $20,000

- Dependent children life benefit: 15 days to 26 years old—$20,000

- Dependent children AD&D benefit: 15 days to 26 years old—$20,000

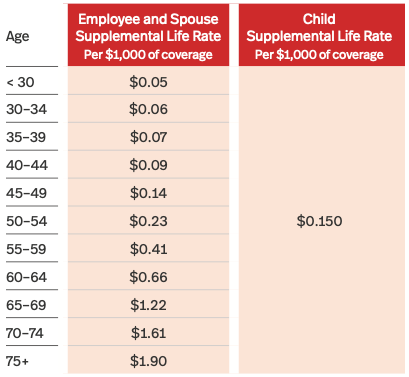

SUPPLEMENTAL LIFE AND AD&D INSURANCE RATES

Listed below are the monthly rates for supplemental life and AD&D insurance. The amount you pay for supplemental life and AD&D insurance is deducted from your paycheck on a post-tax basis. Spouse life rates are based on the employee’s age. Your costs will be displayed in Plan Source.

Monthly Supplemental AD&D Rates

- Employee: $0.020 (per $1,000 of coverage)

- Spouse: $0.020 (per $1,000 of coverage)

- Child: $0.051 (per $1,000 of coverage)

Disability Insurance

Disability insurance is designed to help you meet your financial needs if you become unable to work due to an illness or injury.

LONG-TERM DISABILITY INSURANCE

Isola provides you the option to purchase long-term disability (LTD) insurance through The Standard. LTD insurance is designed to help you meet your financial needs if your disability extends beyond the STD period.

- Benefit: 60% of your monthly earnings up to $10,000 per month

- Waiting period: 90days

- Benefit duration: Determined by your Social Security normal retirement age and the date your disability begins(1)

- Rate: $0.56 of monthly income(2)

(1) Refer to your The Standard Group Summary Plan Description for complete details.

(2) Your costs will be displayed in Plan Source.

Accident Insurance

Isola provides you the option to purchase accident insurance through The Hartford.

Accident insurance helps protect against the financial burden that accident-related costs can create. This means that you will have added financial resources to help with expenses incurred due to an injury, to help with ongoing living expenses, or to help with any purpose you choose. Claims payments are made in flat amounts based on services incurred during an accident.

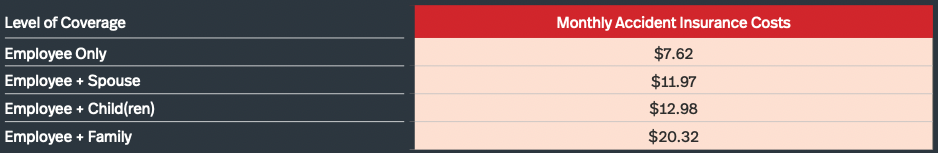

ACCIDENT INSURANCE COSTS

Listed below are the monthly costs for accident insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

Hospital Indemnity Insurance

Isola provides you the option to purchase hospital indemnity insurance through The Hartford.

This plan provides a lump-sum benefit due to a hospitalization. If you elect coverage for yourself, you can elect coverage for your spouse and child(ren). This plan also inculdes a $50 wellness benefit.

The hospital indemnity plan includes:

- Hospital confinemen tbenefit

- Critical care unit benefit

- Rehabilitation facility benefit

Please refer to the official plan documents for rates and a full list of covered injuries and expenses.

HOSPITAL INDEMNITY INSURANCE COSTS

Listed below are the monthly costs for hospital indemnity insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

Critical Illness Insurance

Isola provides you the option to purchase critical illness insurance through The Hartford.

Critical illness insurance provides a financial, lump-sum benefit upon diagnosis of a covered illness. These covered illnesses are typically very severe and likely to render the affected person incapable of working. Because of the financial strain these illnesses can place on individuals and families, critical illness insurance is designed to help you pay your mortgage, seek experimental treatment, or handle unexpected medical expenses.

This plan includes coverage for invasive and non-invasive cancers as well as skin cancer.

- Employee: Increments of $10,000 up to $30,000—guarantee issue: $30,000

- Spouse: 50% of employee's election—guarantee issue: $15,000

- Dependent children: 25% of employee's election—guarantee issue: $7,500

- Wellness benefit: $50

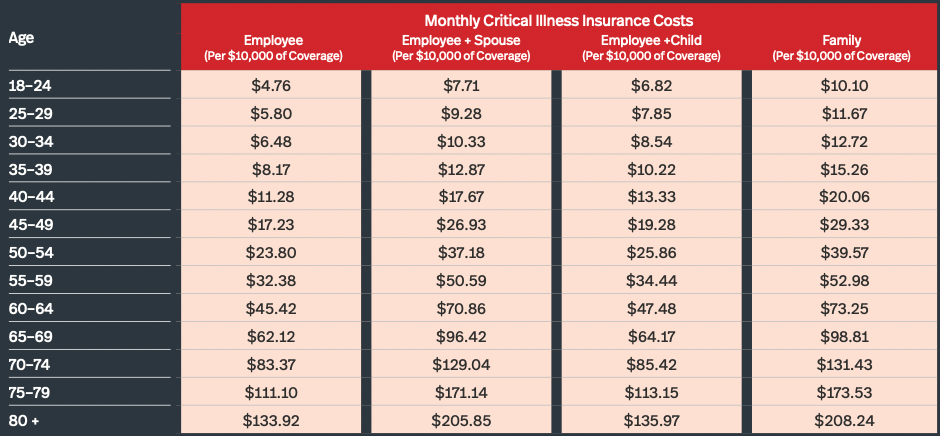

CRITICAL ILLNESS INSURANCE COSTS

Listed below are the monthly costs for critical illness insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis. Rates are based on the employee’s age.