Medical

hireEZ offers three medical plan options through Cigna and Kaiser Permanente.

Before you enroll in medical coverage, take some time to fully understand how each plan works. See page 6 for an overview of the plan benefits.

Ask Yourself These Questions:

Can you set aside money from your paycheck to save for out-of-pocket health care costs?

Consider the Cigna HDHP. You will have the option to fund a health savings account (HSA) that can save you money on your health care costs.

Do you prefer to pay less when you visit the doctor’s office?

Consider the Cigna PPO or the Kaiser Permanente DHMO. While you will pay more from your paycheck each month for coverage, you will only be responsible for a small copay or cost share when you need care.

Do you or your covered family members take prescription medications on a regular basis?

Consider the Cigna PPO or the Kaiser Permanente DHMO. With this plan, you’ll consistently pay a smaller copay or cost share when you pick up your medication(s) than you would with the Cigna HDHP.

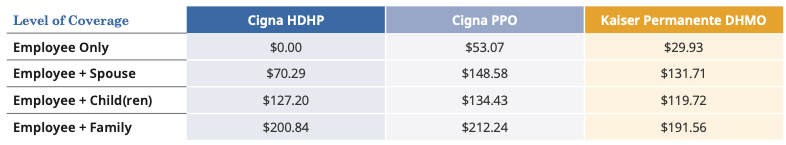

Medical, Dental, and Vision Costs

Listed below are the monthly costs for medical insurance. Cigna dental and vision insurance is included with your medical plan election at no additional cost to you. The amount you pay for coverage is deducted from each paycheck on a pre-tax basis, which means you don’t pay taxes on the amount you pay for coverage.

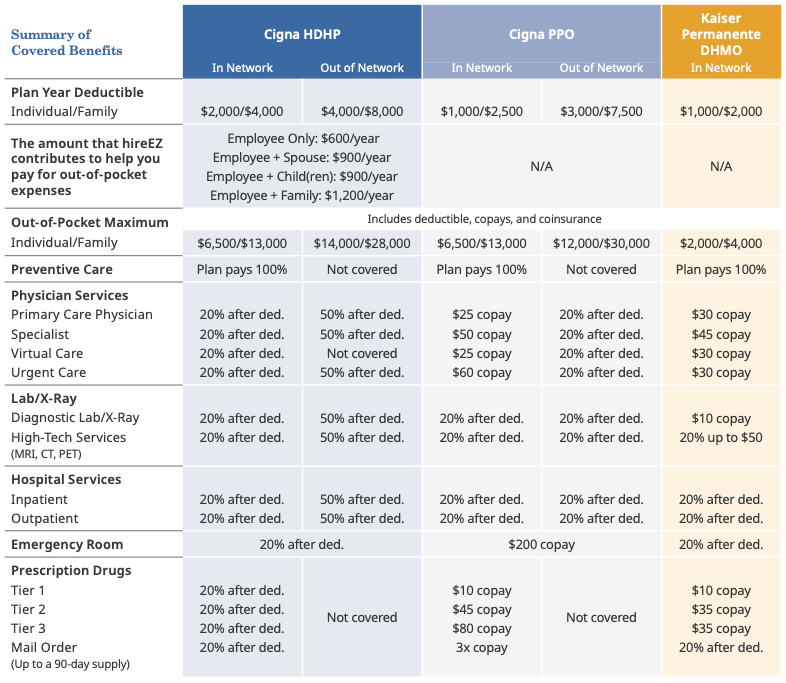

The table below summarizes the benefits of each medical plan.

- The Cigna medical plans offer in- and out-of-network benefits, providing you the freedom to choose any provider. However, you will pay less out of your pocket when you choose a Cigna network provider.

- The Kaiser Permanente DHMO medical plan provides in-network benefits only.

The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

Are You Covering Your Spouse and/or Children?

- Cigna HDHP members: If you elect employee + spouse, employee + child(ren), or family coverage, the individual deductible DOES NOT apply. The individual within an employee + spouse, employee + child(ren), or family coverage would need to meet a minimum of $3,000 for in-network or $6,000 for out-of-network toward the deductible before coinsurance would begin. The out-of-pocket maximum is applied for each individual. No one person will be required to pay more than the individual out-of-pocket maximum.

- Cigna PPO and Kaiser Permanente DHMO members: If you elect employee + spouse, employee + child(ren), or family coverage, the individual deductible and out-of-pocket maximum apply to each covered member of the family (capped at family amount).

Cigna Digital ID Cards

You no longer have to worry about misplacing your medical ID card. Access a digital medical ID card on the myCigna mobile app or visit mycigna.com. Show your digital ID card on your phone screen, print it, or email it to your doctor’s office for easy access anytime, anywhere!

Getting your digital ID card is easy! From the myCigna app or mycigna.com, select “ID Cards”. From here you can view your card and the cards of any dependents

Preventive Care

In-network preventive care is 100% free for medical plan members.

You won’t have to pay anything out of your pocket when you receive in-network preventive care. Practice preventive care and reap the rewards of a healthier future.

Preventive care helps keep you healthier long-term.

An annual preventive exam can help IDENTIFY FUTURE HEALTH RISKS and treat issues early when care is more manageable and potentially more effective.

Preventive care helps keep your costs low.

With a preventive care exam each year, you can TARGET HEALTH ISSUES EARLY when they are less expensive to treat. You can also effectively manage chronic conditions for better long-term health.

Preventive care keeps your health up to date.

Yearly check-ins with your doctor keeps your health

on track with AGE-AND GENDER-SPECIFIC EXAMS, VACCINATIONS, AND SCREENINGS that could save your life.

Some services are generally not considered preventive if you get them as part of a visit to diagnose, monitor, or treat an illness or injury. Please be aware that you will be responsible for the cost of any non-preventive care services you receive at your preventive care exam based on your plan design.

Learn more about preventive care at mycigna.com or kp.org.

Virtual Care

Get the care you need when and wherever you need it. Whether you’re on the go, at home, or at the office, care comes to you in the form of virtual care.

Get care for non-emergency conditions.

Virtual care can connect you to a doctor, without an appointment, from your phone, computer, or tablet. Receive care for common health issues like allergies, asthma, sore throat, fever, headache, rashes, and much more.

Receive mental health support and counseling.

Licensed counselors and psychiatrists can help diagnose, treat, and even prescribe medication when needed for depression and anxiety, substance abuse and panic disorders, PTSD, men and women’s issues, grief and loss, and more.

Talk with a doctor by phone or video, 24/7.

Use virtual care to prioritize your health by getting the care you need when you need it. Cigna members: Visit mycigna.com or call 866-494-2111. Kaiser Permanente members: Visit kp.org or call 800-464-4000.

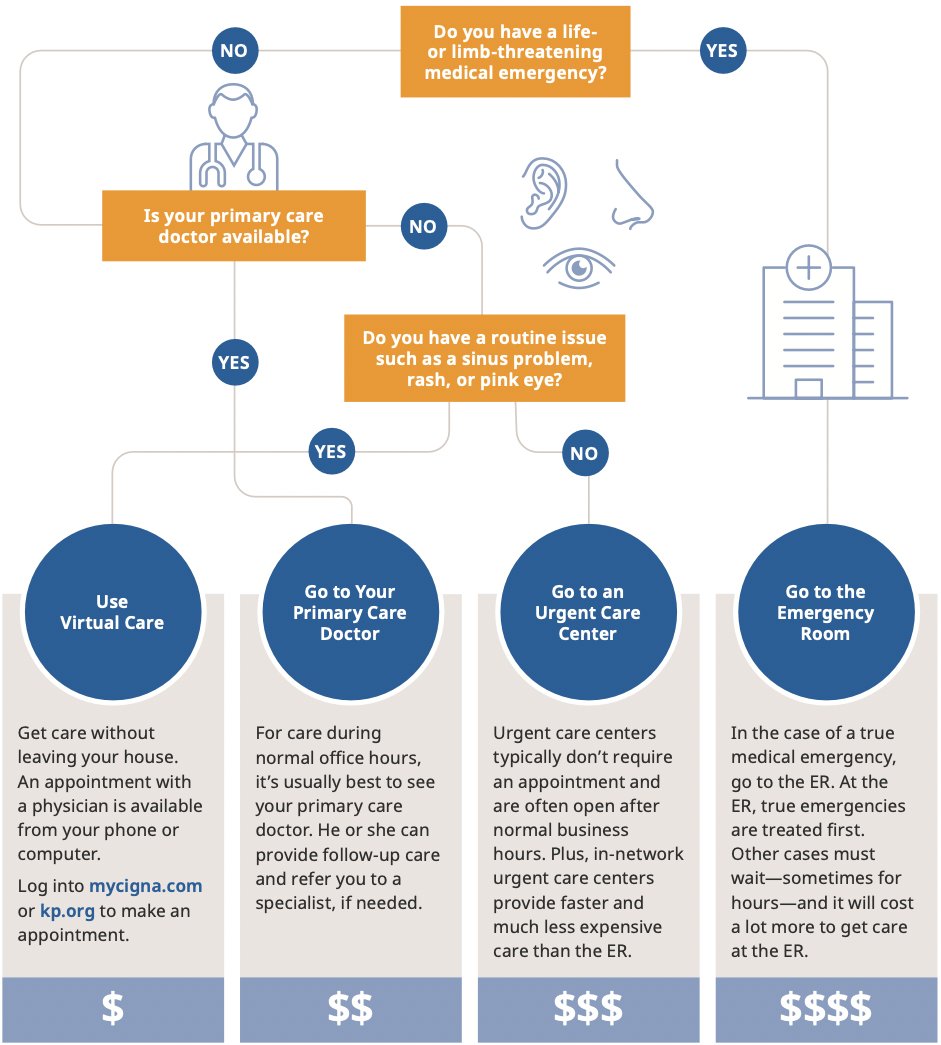

Know Where to Go for Care

Where you go for medical services can make a big difference in how much you pay and how long you wait to see a health care provider. Use the chart below to help you choose where to go for care.

Resources

2024 Cigna HDHP Benefit Summary

2024 Cigna HDHP SBC

2024 Cigna OAP Benefit Summary

2024 Cigna OAP SBC

2024 Kaiser Southern California Disclosure 1

2024 Kaiser Northern California Disclosure 1

2024 Kaiser Northern Southern California Disclosure 2

2024 Kaiser Northern California SBC

2024 Kaiser Southern California SBC

OPEN ENROLLMENT BEGINS ON 11/20 AND ENDS ON 12/4.

You have three ways to enroll:

- Self-enroll in your benefits via Workforce Now. Navigate directly by clicking here: ADP Portal.

- Call the Benefits Concierge Center at 866-331-2709. The Concierge Center is open Monday-Friday, 8am-8pm EST.

- Schedule an appointment with a Benefits Counselor by clicking below.