Hospital Indemnity Insurance

Overview

Hospital Indemnity Insurance can complement your health insurance to help you pay for the costs associated with a hospital stay. It can also provide funds for the out-of-pocket expenses your medical plan may not cover, such as co-insurance, co-pays and deductibles.

How does it work?

Hospital Insurance helps covered employees and their families cope with the financial impacts of a hospitalization. You can receive benefits when you’re admitted to the hospital for a covered accident, illness or childbirth.

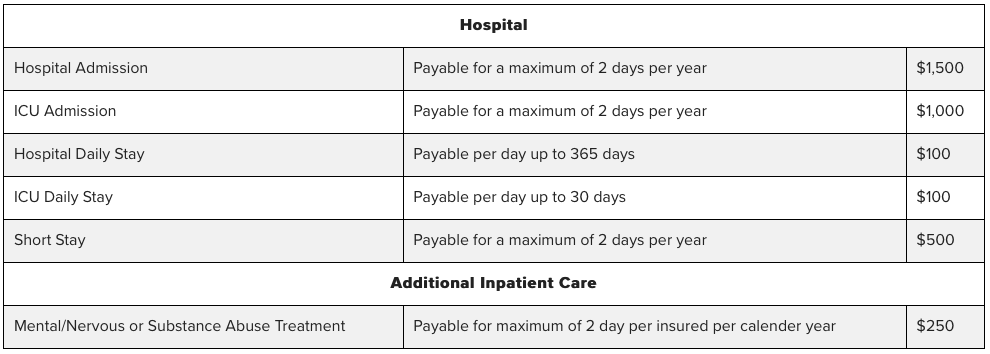

You may receive a benefit for the following:

Advantages of the plan

- You can buy coverage for your spouse and dependent children

- For active associates this plan includes convenient payroll deduction, so you don’t have to remember to write a check for your premiums

- Coverage is portable. You may take the coverage with you if you leave the company or retire without having to answer new health questions

The average price of a hospital stay is $10,000 (1)

Not counting ambulance, intensive care treatment and dozens of other expenses medical insurance may not cover. With Hospital Indemnity Insurance, you collect a lump sum each day you’re in the hospital – for any reason.

That money can help offset the hospital bill, take care of day-to-day expenses, or pay for anything you need.

- Pays when you’re hospitalized, regardless of the reason

- Lump sum paid directly to you

- Pays benefits in addition to your medical insurance

- No proof of good health needed to enroll

- You can keep your coverage if you leave your employer

1 Anne Pfuntner, Lauren M. Wier, M.P.H., and Claudia Steiner, M.D., M.P.H., Agency for Healthcare Research and Quality, “Costs for Hospital Stays in the United States, 2011,”

https://www.hcup-us.ahrq.gov/reports/statbriefs/sb168-Hospital-Costs-United-States-2011.pdf

TELL ME MORE

Be Well Benefit

Every year, each family member who has Hospital coverage can also receive $50 for getting a covered Be Well screening test, such as:

- Annual exams by a physician include sports physicals, wellchild visits, dental and vision exams

- Screenings for cancer, including pap smear, colonoscopy

- Cardiovascular function screenings

- Screenings for cholesterol and diabetes

- Imaging studies, including chest X-ray, mammography

- Immunizations including HPV, MMR, tetanus, influenza

FAQs

Who is the provider?

Unum Group has been helping customers for more than 165 years and is known for breaking new ground in the business of benefits.

What is Hospital Indemnity Insurance?

Hospital Indemnity Insurance pays a daily benefit if you have a covered stay in a hospital, critical care unit, or rehabilitation facility. The benefit amount is determined based on the type of facility and the number of days you stay. Payments are made directly to you, not to the doctors, not to the hospitals nor to any other healthcare providers. Hospital Indemnity Insurance is a limited benefit policy. It is not health insurance and does not satisfy the requirement of minimum essential coverage under the Affordable Care Act.

Features of Hospital Indemnity Insurance include:

- Flexibility: You can use the benefit money for any purpose you like

- Payroll deductions: Premiums paid through payroll deductions

- Cost-effective coverage: Rates are typically lower when you purchase coverage through your employer

- Portable: Should you leave your current employer or retire, you can take the policy with you and select from a variety of payment plans

- Guaranteed coverage: As long as you are actively at work, your coverage is guaranteed without any medical exams to take or health questions to answer

How can Hospital Indemnity Insurance help?

Below are a few examples of how your Hospital Indemnity Insurance benefit could be used (coverage amounts may vary):

- Medical expenses, such as deductibles and copays

- Travel, food and lodging expenses for family members

- Child care

- Everyday expenses like utilities and groceries

Who is eligible for Hospital Indemnity Insurance?

- You—must meet actively-at-work definition

- Your spouse/domestic partner—Coverage is only available if Employee coverage is elected.

- Your child(ren)— to age 26. Coverage is available only if Employee coverage is elected.