Critical Illness Insurance

Overview

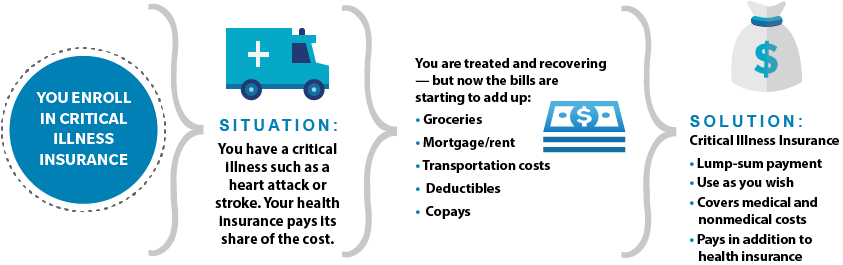

Dealing with a serious illness is a challenge in itself.

If you suffer a critical illness, you could be hit hard with medical expenses and reduced income from being out of a job. Health benefits pay part of the medical bills, income protection coverage can help protect a portion of your income, but some expenses may not be covered.

- You can choose a benefit amount between $10,000, 20,000 or $30,000 and use the money any way you see fit.

- Dependent children are automatically added to all employee certificates from newborn through age 26 years at 50% of the employee benefit with the addition of specific childhood conditions.

- Lump sum benefit payable for each covered condition.

TELL ME MORE

How Does Critical Illness Insurance Work?

Critical Illness Insurance pays you a lump sum benefit when you are diagnosed with a covered illness. You choose the level of coverage—employee coverage between $10,000, 20,000 or $30,000. You can use the money as you like.

Covered conditions include:*

- Heart attack

- Blindness

- Major organ failure

- End-stage renal (kidney) failure

- Coronary artery bypass: Major (50%), Minor (10%)

- Benign brain tumor

- Stroke

- Coma (resulting from severe injury lasting 14 consecutive days or more)

- Occupational HIV

- Cancer

- Non-invasive cancer

*Please refer to the policy for complete definition of covered critical illness.

**Carcinoma in situ is defined as cancer that involves only cells in the tissue in which it began and that has not spread to nearby tissues.

You can cover your spouse/domestic partner up to $30,000 if you are covered. Your children are automatically covered for 50% of the employee benefit amount to age 26, regardless of student or marital status.

Employees must be legally authorized to work in the U.S. and actively working at a U.S. location. Spouses and dependents must live in the U.S. to receive coverage.

THIS INSURANCE PROVIDES LIMITED BENEFITS

Underwritten by: Unum Life Insurance Company of America, Portland, Maine

This information is not intended to be a complete description of the insurance coverage available. The policy has exclusions and limitations which may affect any benefits payable. For complete details of coverage, please refer to Policy Form CI-1 or contact your insurance representative.

Unum is a registered trademark and marketing brand of Unum Group and its insuring subsidiaries.

How it works

FAQs

Who is the provider?

Unum Group has been helping customers for more than 165 years and is known for breaking new ground in the business of benefits.

How can this help me?

Gives you the comfort to recover in confidence while avoiding the financial strain a serious illness can cause.

Critical Illness insurance provides a lump-sum payment if you or a covered family member are diagnosed with a covered medical condition and meet the policy and certificate requirements.

Who can enroll?

If you are a benefit eligible employee, then you, your spouse and eligible children qualify for this coverage. You and your eligible family members just need to enroll during your employer's enrollment period and be actively at work for your coverage to be effective. Employees must be enrolled for your spouse to elect coverage. Dependent children are automatically enrolled at 50% of your covered amount.

When can I enroll?

As a new hire, you can enroll during your new hire enrollment period. Outside of your new hire enrollment period, enrollment is limited to the annual enrollment period.

What if my employment status changes?

When you leave or retire from your current employer, you can continue your coverage without interruption, subject to applicable law and the policies' terms and conditions. Although payroll deduction will no longer be available, you can opt for other payment methods such as direct bank account deduction, or home billing.

Your coverage will only end if you stop paying your premium or if your employer offers you similar coverage with a different insurance carrier.

Is there a Health Screening Benefit?

Unum will provide an annual benefit up to $100 per calendar year for taking one of the eligible screening/prevention measures. Your Be Well Benefit amount correlates to the amount of coverage you elect. The Health Screening Benefit is not available in certain states. Please review your Disclosure Statement or Outline of Coverage/Disclosure Document for specific state variations and exclusions around this benefit.

What happens if I recover and then I'm diagnosed again?

Your plan pays a reoccurrence benefit if a medical condition occurs again for the following conditions: heart attack, stroke, coronary artery bypass graft, full benefit cancer, partial benefit cancer. A reoccurrence benefit is only available if initial benefit of a covered condition has been paid. There is a benefit suspension period (waiting period) between recurrences. The reoccurrence benefit pays 100% of your coverage amount. Diagnoses must be at least 180 days apart or the conditions can’t be related to each other.