Accident Insurance

OVERVIEW

Motor vehicle and other unexpected accidents cause 45 million trips to the emergency room each year—costing on average $1,350 per visit.* Your major medical insurance will help with many of your expenses, but wouldn’t you feel better knowing you’ll have extra help paying some of your bill?

Accident insurance pays you benefits for specific injuries and events resulting from a covered accident. The amount paid depends on the type of injury and care received. Features of this insurance include:

- Employee-discounted group rates: You pay just $7.61 monthly

- Spouse/domestic partner and children can be protected too

- Provided by a leading accident insurance provider: Unum

- Guaranteed acceptance with no medical exam if you enroll during the Enrollment Period

Thanks to your employer’s group rates, you’ll pay less for this coverage than you would for individual coverage you’d find on your own. See below for your affordable rate.

*National Hospital Ambulatory Medical Care Survey: 2009 Emergency Department Summary Tables (based on 136 million total annual ER visits).

American Hospital Association Resource Center, April 2012.

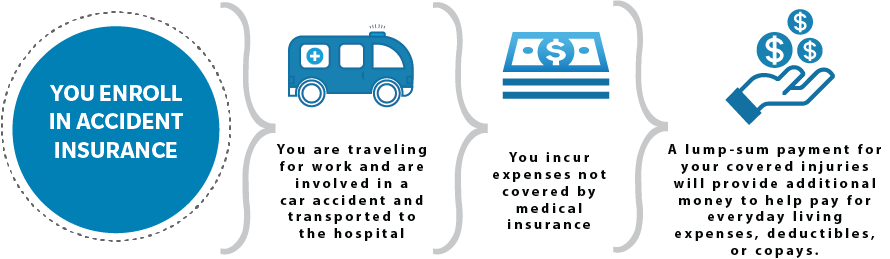

HOW IT WORKS

FAQS

Answers about the plan, including eligibility, options, enrollment, customer service and more.

Who is the provider?

Unum Group has been helping customers for more than 165 years and is known for breaking new ground in the business of benefits.

How can this help me?

Most families don’t budget for the costs associated with accidents. When an accident does occur, the last thing on your mind is the charges accumulating while at the emergency room:

- Ambulance ride

- Casts

- Use of the emergency room

- Wheelchairs

- Surgery and Anesthesia

- Crutches

- Stitches

- Bandages

These costs can add up fast. Most families have medical insurance that will cover a majority of the expenses. But, what about the out-of-pocket medical expenses, such as lost wages an employee or spouse/domestic partner loses when out of work or staying home to care for an injured family member? You hope that an accident never happens, but at some point you very well may take a trip to your local emergency room. If that time comes, wouldn’t it be nice to have an insurance plan that pays you a benefit regardless of any other insurance you have? Accident insurance does just that, providing a cash benefit to cover the costs associated with unexpected trips to the emergency room.

Who is eligible?

You and your eligible family members just need to enroll during your enrollment period and be actively at work for your coverage to be effective. Dependents to be enrolled may not be subject to a medical restriction as set forth on the enrollment form and in the Certificate. Some states require the insured to have medical coverage.

When can I enroll?

As a new hire, you can enroll during your new hire enrollment period. Outside of your new hire enrollment period, enrollment is limited to the company’s annual enrollment period.

What if my employment status changes?

When you leave or retire from your current employer, you can continue your coverage without interruption, subject to applicable law and the policies' terms and conditions. Although payroll deduction will no longer be available if you retire or leave your company, you can opt for other payment methods such as direct checking or bank account deduction, credit card billing or home billing. Higher rates may apply.

Will my rates increase as I get older or if I file a claim?

No, your rates will not increase due to age, health or individual claims.

What types of accidents and injuries am I covered for?

Once you’re enrolled in this coverage, you’ll collect benefits for more than 50 different covered events, including:

- Fractures

- Dislocations

- Second and third degree burns

- Skin grafts

- Torn knee cartilage

- Concussions

- Cuts/lacerations

- Eye injuries

- Coma

- Broken teeth

You’ll also receive a lump-sum payment when you have these covered medical services/treatments as a result of a covered accident:

- Ambulance

- Emergency care

- Inpatient surgery

- Outpatient surgery

- Medical Testing Benefits including:

- EEG

- MRIs

- CT or CAT scans

- Physician follow-up visits

- Transportation

- Lodging

- Therapy services including:

- Physical, Speech and Occupational therapy

Some variations apply with these services & treatments. The above are used for illustrative purposes. Please refer to you schedule of benefits for specific services and treatments covered in your plan.

Will I have to take a medical exam to get this coverage?

No! Medical exams are never required.