Voluntary Benefits

Denver Health offers the following voluntary benefits to support your financial well-being.

voluntary LIFE AND AD&D INSURANCE

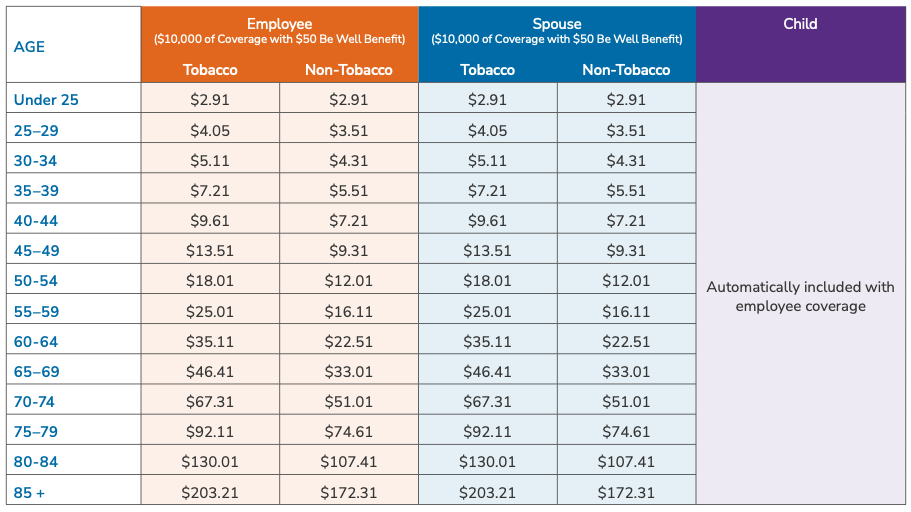

Denver Health provides you the option to purchase voluntary life and AD&D insurance for yourself, your spouse and your dependent children through Unum.

You must purchase voluntary coverage for yourself in order to purchase coverage for your spouse and/or dependents. Voluntary life rates are age-banded. Benefits will reduce to 65% at age 70 and to 50% at age 75.

- Employee: Increments of $10,000 up to $500,000—guarantee issue: $250,000

- Spouse: Increments of $10,000 up to $500,000 or 100% of employee election, whichever is less—guarantee issue: $50,000

- Dependent children: Live birth to 14 days: $1,000; 14 days to age 26: Up to $10,000—guarantee issue: $10,000

If you elect voluntary coverage when you’re first eligible to enroll, you may purchase up to the guarantee issue amount(s) without completing a statement of health (evidence of insurability). If you do not enroll when first eligible or are currently enrolled and choose to increase coverage during a subsequent annual open enrollment period, you will be required to submit evidence of insurability for any amount of coverage. Coverage will not take effect until approved by Unum.

ACCIDENT INSURANCE

Denver Health provides you the option to purchase accident insurance through Unum. Accident insurance helps protect against the financial burden that accident-related costs can create. This means that you will have added financial resources to help with expenses incurred due to an injury, to help with ongoing living expenses or to help with any purpose you choose. Claims payments are made in flat amounts based on

services incurred during an accident.

How Accident Insurance Works

Listed below is an example of benefits provided if you

were to experience a traffic accident.

Accident Insurance Costs

Listed below are the per pay period costs for accident insurance.

HOSPITAL INDEMNITY INSURANCE

Hospital indemnity insurance is designed to complement medical coverage costs by paying a cash benefit following a hospitalization. This option will pay benefits that help you with costs associated with a hospital visit such as a covered accident, illness, or childbirth. This benefit pays you a lump-sum upon admittance so that you can choose how best to cover your expense.

The plan pays a $50 benefit once per calendar year when you or your dependents complete a covered wellness screening.

Listed below are benefits covered by the hospital indemnity insurance plan (exclusions apply):

Hospital Indemnity Insurance Costs

Listed below are the per pay period costs for hospital indemnity insurance.

CRITICAL ILLNESS INSURANCE

Denver Health provides you the option to purchase critical illness insurance through Unum. Critical illness insurance provides a financial, lump-sum benefit upon diagnosis of a covered illness. These covered illnesses are typically very severe and likely to render the affected person incapable of working. Because of the financial strain these illnesses can place on individuals and families, critical illness insurance is designed to help you pay your mortgage, seek experimental treatment, or handle unexpected medical expenses.

Critical Illness Insurance Costs

Listed below are the monthly costs for critical illness insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

PET INSURANCE

Denver Health provides you with the option to purchase pet insurance through Nationwide. Pet insurance is designed to help you save up to 25% on veterinary expenses with contracted veterinarians. Pet insurance provides coverage for a wide range of veterinary services, such as wellness visits, vaccinations, surgical procedures, medical care following accidents and illnesses and more. Participating veterinarians can be found at petinsurance.com/denverhealth. Contact Nationwide at

877-738-7874 for a quote.

LEGAL PROTECTION

Denver Health provides you with the option to purchase a legal plan through MetLife. Whether you’re buying or selling a home, starting a family, or caring for aging parents, MetLife Legal Plans provide protection at every step. For $17.50 per month, you, your spouse, and your dependents will receive unlimited legal assistance for all legal matters covered under the plan—with no waiting periods, no deductibles, and no claim forms when using a network attorney.

Register at members.legalplans.com to see coverages and select an attorney or call 800-821-6400 for assistance.

HOME AND AUTO INSURANCE

Denver Health provides you with the option to purchase auto, home, and renters insurance through Farmers Group Select. The auto and home insurance plans offer special group rates to insure your property against personal liability. You may elect this benefit at any time and payments are made through convenient payroll deductions.

Enroll at farmers.com.

ID THEFT PROTECTION

Denver Health provides you with the option to purchase identity theft protection through Norton LifeLock. You have two plan options to choose from at special group discounted rates (see per pay period costs below). You may either elect coverage for yourself or your entire family (including children of any age). You may elect this benefit at any time and payments are made through convenient payroll deductions. Visit Norton.com/PremPremierPlus.