BUDGETING FOR YOUR CARE

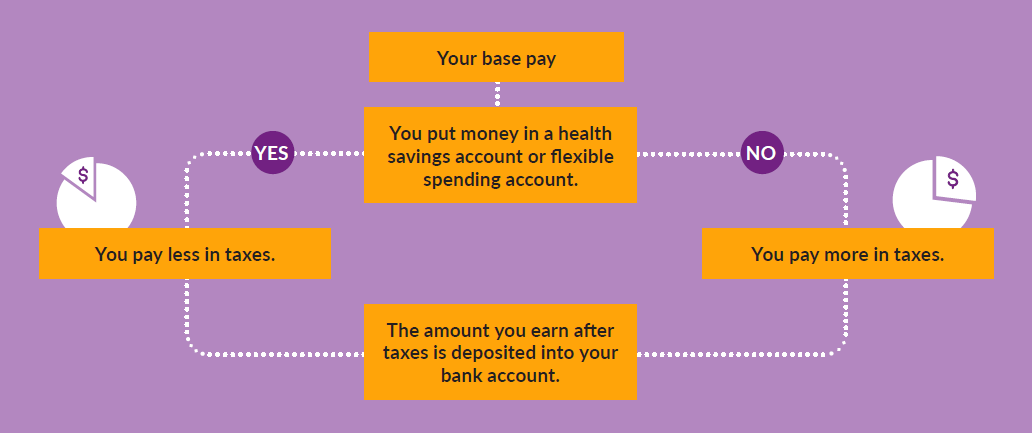

You can save about 20%* on your care by putting money in a health savings account or flexible spending account. This is because you don’t pay taxes on your contributions.

COMPARE YOUR OPTIONS

HEALTH SPENDING ACCOUNT

If you enroll in the Aetna HealthSave Plan, you may be eligible to open and fund a health savings account (HSA) through HealthEquity.

An HSA is a savings account that you can use to pay out-of-pocket health care expenses with pre-tax dollars.

Your Company CONTRIBUTION

If you enroll in the Aetna HealthSave Plan, Your Company will help you save by making a one-time contribution to your account at the beginning of the plan year:

- Employee-only: $200

- All other coverage levels: $400

Plus, Your Company will match your contributions dollar-for-dollar up to the following amounts:

- Employee-only: $800

- All other coverage levels: $1,600

2021 IRS HSA CONTRIBUTION MAXIMUMS

Contributions to an HSA (including the Your Company contribution) cannot exceed the IRS allowed annual maximums.

- Individuals: $3,600*

- All other coverage levels: $7,200*

If you are age 55+ by December 31, 2021, you may contribute an additional $1,000.

*Includes Your Company contribution.

HSA ELIGIBILITY

You are eligible to fund an HSA if you are enrolled in the Aetna HealthSave Plan and meet additional eligibility requirements.

You are eligible to open and fund an HSA if:

- You are enrolled in the Aetna HealthSave Plan.

- You are not covered by a non-HSA plan, health care FSA, or health reimbursement arrangement.

- You are not eligible to be claimed as a dependent on someone else’s tax return.

- You are not enrolled in Medicare, TRICARE, or TRICARE for Life.

- You have not received Veterans Administration Benefits in the last three months unless the condition for which you received care was service related.

Refer to healthequity.com for more details.

HealthEquity HSA Member Flyer

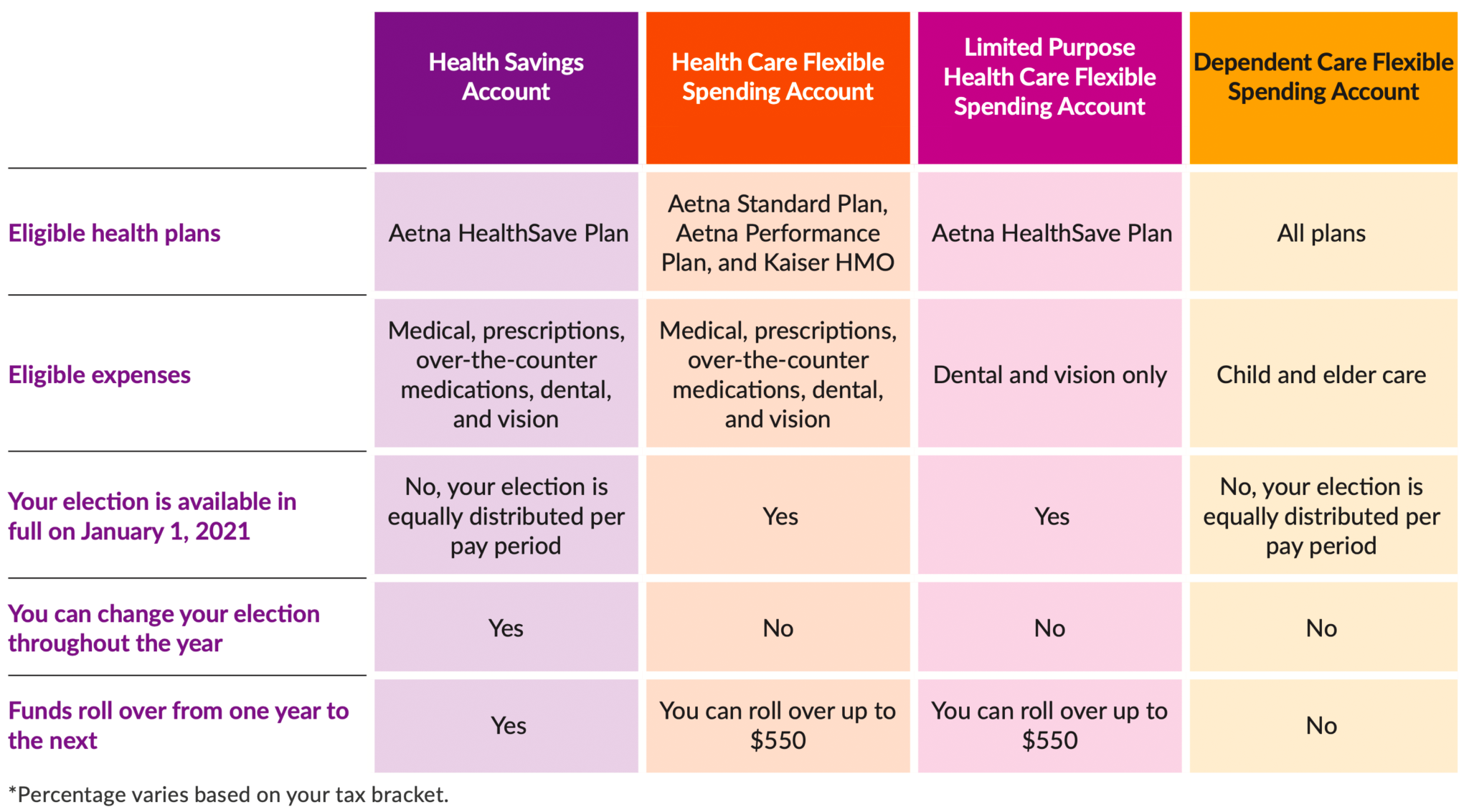

FLEXIBLE SPENDING ACCOUNTS

Your Company offers flexible spending account (FSA) options, which are administered by HealthEquity.

These accounts allow you to pay for eligible health care and dependent care expenses with pre-tax dollars. Log into your account at healthequity.com to: view your account balance(s), calculate tax savings, view eligible expenses, download forms, view transaction history, and more.

HOW DOES AN FSA WORK?

You decide how much to contribute to each FSA on a calendar year basis up to the maximum allowable amounts. Your annual election will be divided by the number of pay periods and deducted evenly on a pre-tax basis from each paycheck throughout the year.

You will receive a debit card from HealthEquity, which can be used to pay for eligible health care expenses at the point of service. If you do not use your debit card, or if you have dependent care expenses to be reimbursed, submit a claim form and a bill or itemized receipt from the provider to HealthEquity. Keep all receipts in case HealthEquity requires you to verify the eligibility of a purchase.

HEALTH CARE FSA (NOT ALLOWED IF YOU FUND AN HSA)

The health care FSA allows you to set aside money from your paycheck on a pre-tax basis (before income taxes are withheld) to pay for eligible out-of-pocket expenses, such as deductibles, copays, and other health-related expenses that are not paid by the health, dental, or vision plans.

The health care FSA maximum contribution is $2,750 for the 2021 calendar year. In order to participate in the health care FSA, you must contribute at least $5 per pay period.

At the end of the plan year, you can roll over $550 from your health care FSA to use in future years. Any amount in excess of $550 will be forfeited.

LIMITED PURPOSE HEALTH CARE FSA (IF YOU FUND AN HASA)

If you fund an HSA, you are not eligible to fund a health care FSA. However, you can fund a limited purpose health care FSA, which can only be used to reimburse dental and vision expenses.

The limited purpose health care FSA maximum contribution is $2,750 for the 2021 calendar year.

At the end of the plan year, you can roll over $550 from your limited purpose health care FSA to use in future years. Any amount in excess of $550 will be forfeited.

DEPENDENT CARE FSA

The dependent care FSA allows you to set aside money from your paycheck on a pre-tax basis

for day care expenses to allow you and your spouse to work or attend school full time. Eligible dependents are children under 13 years of age, or a child over 13, spouse, or elderly parent residing in your house who is physically or mentally unable to care for himself or herself. Examples of eligible expenses are day care facility fees, before- and after-school care, and in-home babysitting fees (income must be reported by your care provider).

You may contribute up to $5,000 to the dependent care FSA for the 2021 calendar year if you

are married and file a joint return or if you file a single or head of household return. If you are married and file separate returns, you can each elect $2,500 for the 2021 calendar year. In order to participate in the dependent care FSA, you must contribute at least $10 per pay period.

Health Equity - Limited Purpose FSA Member Flyer - Carryover

Health Equity Dependent Care FSA Member Flyer

Health Equity FSA Member Flyer - Carryover