403(b) and 401(a) plans administered by Lincoln Financial

All National Church Residences employees are automatically enrolled in the 403(b) savings plan at 2% contribution after 30 days of employment, unless you opt out or choose a different contribution rate. At the same time, employees are automatically enrolled in the 401(a) plan, which is the company matching and base contributions.

How much can you contribute?

- Up to 75% of your biweekly compensation pretax, up to the IRS limit (for 2023, the limit is $22,500)

- An additional $7,500 pretax “catch-up” contribution if you’re 50 years or older

How much does National Church Residences contribute?

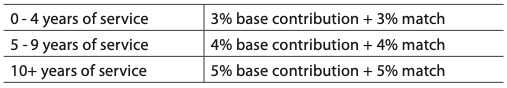

National Church Residences will make contributions based on your years of service. We call this the 3-4-5 or 401(a) Plan.

Important to know:

- You are always 100% vested in your own contributions.

- You become 100% vested in the 3-4-5 Plan base + match contributions after five years of service, which requires you to work 1,000 hours each year to earn a year of vesting service.

Numerous investment options available.

We encourage you to review your funds at least annually at lfg.com.

403(b) Roth

Visit lfg.com to learn more about the 403(b) Roth contribution option.

PROTECT THE ONES YOU LOVE

Keep your beneficiary information up to date on lfg.com.

Did you know?

Because we are a not-for-profit organization, we have 403(b) and 401(a) plans instead of a 401(k).

However, these plans work mostly the same way as a 401(k)!

OPEN ENROLLMENT HAS ENDED.

NEW HIRES, YOU HAVE THREE WAYS TO ENROLL AS SHOWN BELOW.

ALL EMPLOYEES – IF YOU HAVE QUESTIONS ABOUT YOUR BENEFITS, FEEL FREE TO CALL THE NUMBER BELOW OR SCHEDULE AN APPOINTMENT WITH A BENEFITS COUNSELOR.

- Self-Enroll on Workday:

- Need to add a dependent or beneficiary? Navigate to the Benefits app on the Home Page, click on Dependents and/or Beneficiaries under "Change", and enter the required information. Complete this step before completing Open Enrollment.

- Navigate to your Inbox and find the Open Enrollment task. Click on "Let's Get Started".

- Click on each "Card" within the enrollment to review your plan options, add/change dependents, add/change beneficiaries, and make your elections.

- Once you've made all your selections, click "Review and Sign". Review the summary, then scroll to the bottom, check "I Accept" and then "Submit". Be sure to PRINT or SAVE your Confirmation Statement for your records.

First Time Enrolling?

-

- If you have a National Church Residences email address:

Navigate to: https://ncr.okta.com. Or access by QR code here: - Username = characters before the @ sign in your email address (For example, email address jsmith2@nationalchurchresidences.org = username jsmith2)

- Password = current password used to login to your email/computer

- If you have a National Church Residences email address:

- Call 833-226-8355 (Monday - Friday from 8 a.m. to 8 p.m. EST) Benefits counselors are ready to assist you!

- Schedule an appointment with a benefits counselor below during the enrollment period.