All permanent employees working 18.75 hours or more per week except project employees are eligible to purchase group term life insurance through Maine Public Employees Retirement System (underwritten by The Hartford). Employees have 31 days from their date of hire to enroll without providing evidence of insurability (EOI). To enroll or upgrade coverage, an EOI application must be forwarded to MainePERS. Coverage is effective upon approval. To decrease or cancel coverage, a cancellation/reduction MainePERS form needs to be completed.

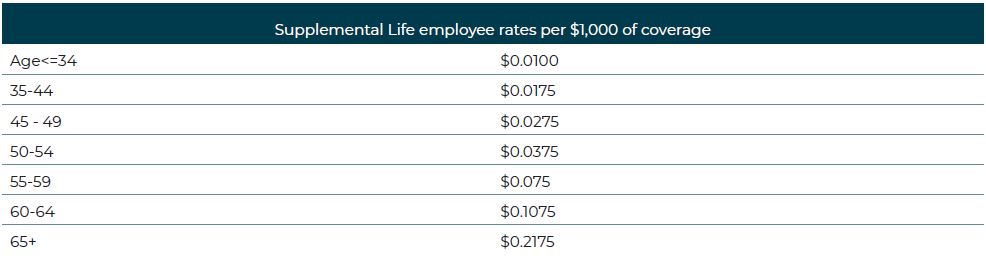

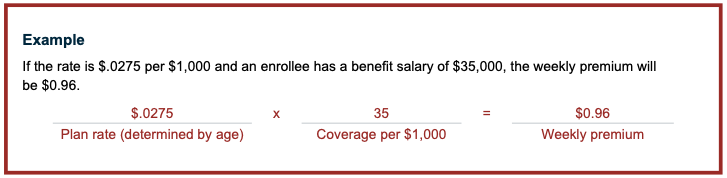

Coverage is purchased in increments of the employee’s annual salary rounded up to the nearest $1,000. Employees may purchase basic life and then either an additional one times, two times, or three times their salary. The cost for basic is $.12 per $1,000 coverage per week. Rates for supplemental insurance for all participants are “age-based.”

Dependent coverage is available with the purchase of basic coverage. There are two plans:

Plan A @ $.49 per week which provides $5,000 for spouse, $5,000 for children 6 months or older, $1,000 for children 0-6 months.

Plan B @ $.85 per week which provides $10,000 for spouse, $5,000 for children 6 months or older, $2,500 for children 0-6 months.

Payroll deductions are on a pre-tax federal, state, and medicare basis, taken out 4 weeks of each month (months in which there are 5 pay-dates, no deduction on the fifth pay-date).

Age reduction schedule

- Ages 65 to 69: Benefit decrease to 65% of original benefit.

- Ages 70+: Benefit decrease to 50%.

Accidental death and dismemberment

SUPPLEMENTAL LIFE AND AD&D

Employees may purchase basic life and then either an additional one times, two times, or three times their salary, If you did not enroll in this coverage when you were first eligible, you will be subject to medical underwriting evidence of insurability.

Life Insurance Resources

Click here for access to more information and resources that may be available in additional languages.