Voluntary Benefits

The City of Portland is committed to providing employees with options to guard against life’s unexpected illnesses and injuries. To that end, City of Portland will begin offering the option of enrolling in Critical Illness Insurance, Accidental Injury Insurance and Hospital Indemnity Insurance through Cigna. These benefits are 100% employee paid and are portable. This means you can take the coverage with you if you leave City of Portland.

Critical illness insurance

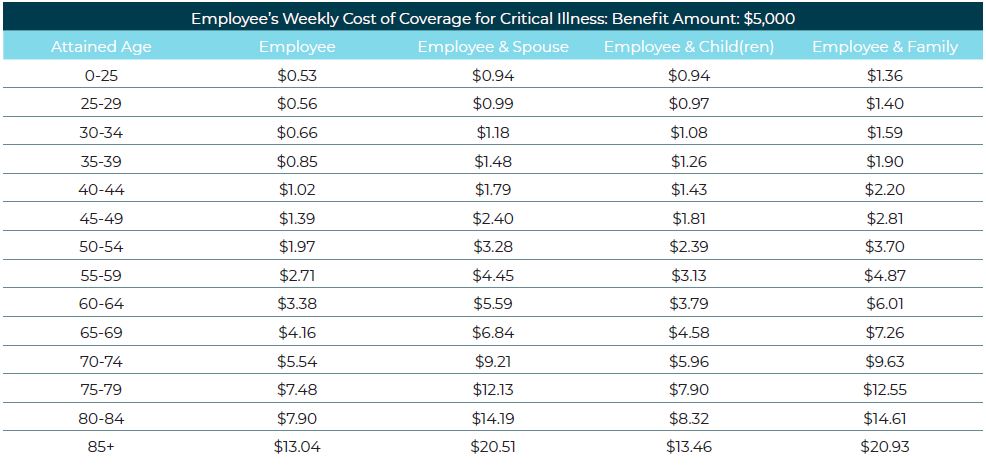

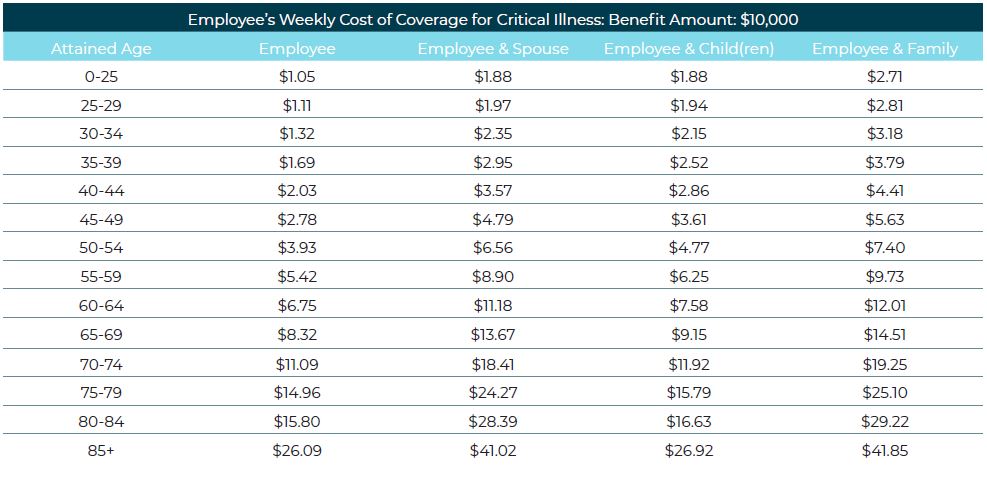

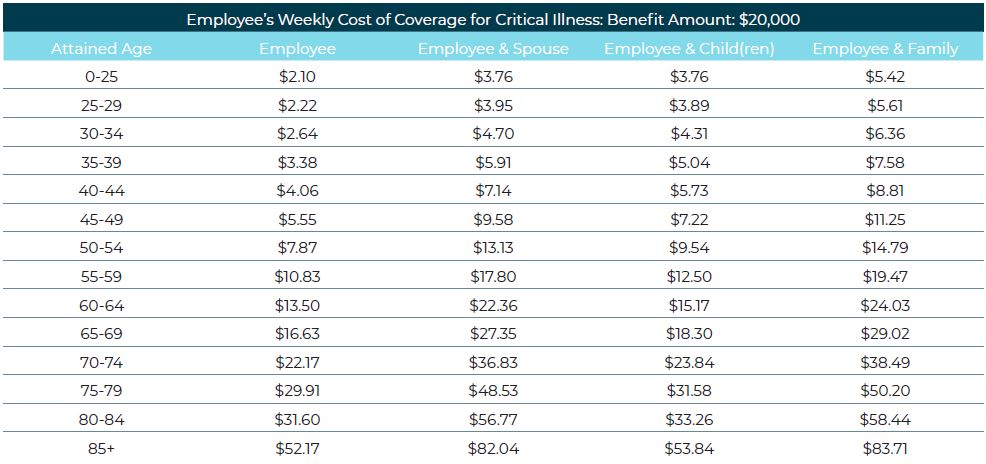

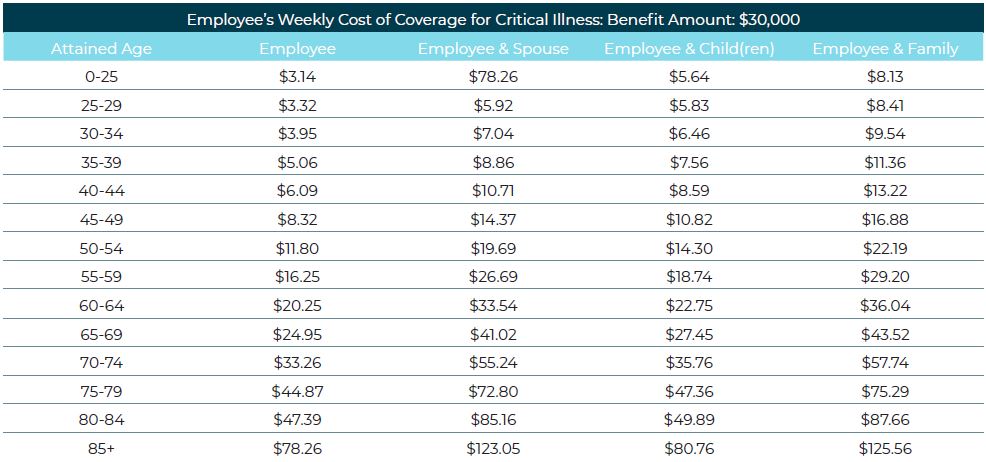

Critical Illness Insurance pays a lump sum benefit at the diagnosis of a covered illness such as cancer or heart attack. You choose the level of coverage - $5,000, $10,000, $20,000 or $30,000. Critical Illness insurance is through Cigna.

Health Screening Benefit

Annual health screenings are a vital part of a preventive illness measure taken to ensure a long and healthy life for you and your family. Regular health exams and tests can help find problems early, increasing your chances for treatment and a cure. By getting the right health services, screenings, and treatments, you are taking steps that help your chances for living a longer, healthier life.

The Cigna Critical Illness Insurance plan features a Health Screening Benefit, which provides you with $50 annually for receiving a health screening. Examples of screenings include mammograms and certain blood tests.

Costs are subject to change. Actual per pay period premiums may differ slightly due to rounding.

The policy’s rate structure is based on attained age, which means the premium can increase due to the increase in your age.

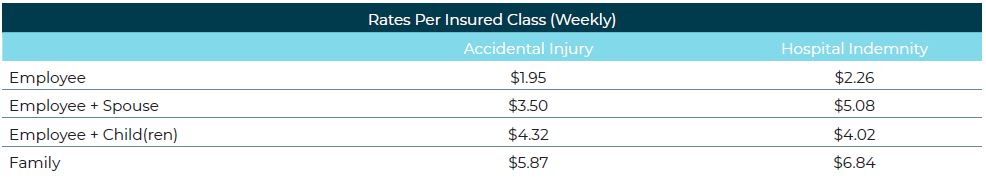

Accidental Injury Insurance

Accidents happen every 2 seconds at home and every 9 seconds on the road. Those accidents are expensive - even with medical coverage, additional expenses can add up quickly. To help you cover the cost of unforeseen events, City of Portland offers you the opportunity to enroll in Accidental Injury Insurance through Cigna. This program pays an after tax, lump sum benefit directly to you. You have a choice of two plans, each plan covers a multitude of medical services, treatments and care for common accidents and injuries. Examples of covered incidents include hospitalizations, broken bones, and certain surgeries.

Costs are subject to change. Actual per pay period premiums may differ slightly due to rounding.

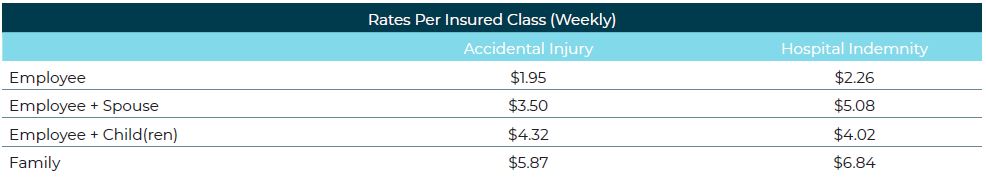

Hospital Indemnity Insurance

Hospital stays are rarely an enjoyable experience. Costs can add up quickly — medical bills; travel, food and lodging costs; plus, the day to-day expenses that don’t stop while you’re in the hospital. The financial pressures can be overwhelming. That’s where the Cigna Hospital Indemnity plan can help.

The plan pays a daily benefit if you have a covered stay in a hospital. The benefit amount is determined by the type of facility and the number of days you stay.

Costs are subject to change. Actual per pay period premiums may differ slightly due to rounding.

Critical Illness Resources

Accidental Injury Insurance Resources

Hospital Indemnity Insurance Resources

Benefit counselors are standing by between 8:00 AM – 8:00 PM EST. (language support is available).

- Call (866) 245-0753. Benefit counselors are standing by between 6:00 AM – 6:00 PM EST. (language support is available)

- Access PlanSource:

To Login, go to www.plansource.com/login and enter your username and password.- Username: Your username is the first initial of your first name, up to the first six letters of your last name, and the last four digits of your SSN. For example, if your name is Taylor Williams, and the last four digits of your SSN are 1234, your username would be twillia1234.

- Password: Your initial password is your birthday in the YYYYMMDD format. For example, if your birthdate is June 4, 1979, your password would be 19790604.

- The first time you log in, you will be prompted to change your password.

- Schedule an appointment with a benefits counselor by clicking below.