Voluntary Benefits

CCMC offers the following voluntary benefits to support your financial wellbeing.

Supplemental Life and AD&D Insurance

CCMC provides you the option to purchase supplemental life and AD&D insurance for yourself, your spouse, and your dependent children through Reliance Standard.

You must purchase supplemental coverage for yourself in order to purchase coverage for your spouse and/or dependents. Supplemental life rates are age-banded.

- Employee supplemental life and AD&D benefit: 7x annual salary up to $500,000—guarantee issue: $100,000

- Spouse supplemental basic life benefit: $5,000

- Spouse supplemental life and AD&D benefit: $5,000 increments not to exceed $100,000 or 50% of the employee’s election—guarantee issue: $25,000

- Dependent child(ren) supplemental basic life benefit: 14 days–6 months—$100; 6 months–26 years—$2,000

- Dependent child(ren) supplemental life and AD&D benefit: 14 days–6 months—$100; 6 months–26 years—$1,000, $2,000, $4,000, $5,000, or $10,000—guarantee issue: $10,000

At this enrollment, you can elect up to the guarantee issue amount without having to complete a statement of health (evidence of insurability).

Voluntary Long-Term Disability Insurance

CCMC offers you the option to purchase voluntary long-term disability (LTD) insurance through Reliance Standard’s Matrix Absence Management. LTD insurance is designed to help you meet your financial needs if your disability extends beyond the STD period.

- Benefit: 60% of base monthly pay up to $6,000

- Benefit duration: Social security normal

- Elimination period: 90 days

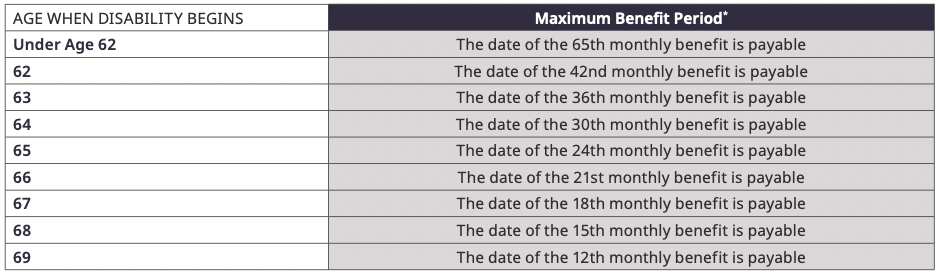

You can enroll in LTD regardless of age, however there is a maximum benefit period per age as seen below:

*Or the later of your social security normal retirement age.

You may use disability benefits to pay for your necessary expenses while you are unable to work, such as mortgage payments, medical expenses, childcare, and more. If you are enrolled and become unable to work due to an accident, illness, injury, or pregnancy, you must apply for benefits as soon as you are able after your event. Please notify Matrix soon as possible to ensure you qualify for coverage and receive timely payouts.

Accident Insurance Benefits

Accident insurance helps protect against the financial burden that accident-related costs can create. This means that you will have added financial resources to help with expenses incurred due to an injury, to help with ongoing living expenses, or to help with any purpose you choose. Claims payments are made in flat amounts based on services incurred during an accident. You also receive a $50 wellness benefit every year when you complete a health screening.

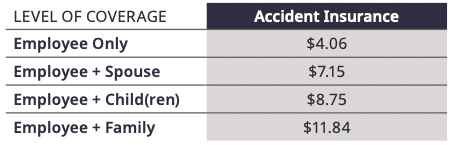

Accident insurance costs

Listed to the right are the per pay period costs (based on 24 pay periods) for accident insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

Critical Illness Benefits

Critical illness insurance provides a financial, lump-sum benefit upon diagnosis of a covered illness. These covered illnesses are typically very severe and likely to render the affected person incapable of working. Because of the financial strain these illnesses can place on individuals and families, critical illness insurance is designed to help you pay your mortgage, seek experimental treatment, or handle unexpected medical expenses. Pre-existing conditions are excluded if you have been diagnosed with the illness six months before gaining coverage and attempt to file a claim during your first six months of coverage.

For critical illness insurance rates, please see the benefit summary available on employeeconnects.com/ccmc.

- Employee: $10,000, $20,000 or $30,000—guarantee issue: $30,000

- Spouse: 50% of employee's election—guarantee issue: $15,000

- Dependent children: Up to age 26: 25% of employee's election—guarantee issue: 25% of employee's election

- Health screening benefit: $50 per insured individual to a maximum of four benefits per year

Hospital Indemnity Benefits

Hospital indemnity insurance will pay benefits that help you with costs associated with a hospital visit such as a covered accident, illness, or childbirth. This benefit pays you a lump-sum upon admittance so that you can choose how best to cover your expenses. You also receive a $50 wellness benefit every year when you complete a health screening.

- Hospital admission: $1,000 per admission

- Daily hospital confinement: $100 per day*

- Hospital intensive care unit confinement: $200 per day* *Up to 60 days per calendar year

Hospital indemnity costs

Listed to the right are the per pay period costs (based on 24 pay periods) for hospital indemnity insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

Resources

Cigna - Critical Illness Summary of Benefits

Cigna - Accident Summary of Benefits

Cigna - Accidental Injury Wellness Incentive Benefit

Cigna - Hospital Indemnity Summary of Benefits

Cigna - Critical Ilness Wellness incentive Benefit

Cigna - Hospital Indemnity Wellness Incentive Benefit

Cigna - How To File A Claim Flyer

Cigna - Supplemental Health Insurance Flyer

Cigna - How To File A Wellness Incentive Benefit Claim

Cigna - Supplemental Health Insurance Value Add Flyer

Vol AD&D Highlight Sheet for CCMC

SUPP Life Highlight Sheet for CCMC

Vol LTD Highlight Sheet for CCMC

How To Enroll

To enroll in benefits, log into workforcenow.adp.com and follow these steps:

- Enter your User ID and Password, and then click "Sign In."

Note: If this is your first time logging in, click the "Sign Up" button. If you are unsure of the registration code, please contact People Operations. - You will be asked questions regarding you and your family, including their birthdates and possibly their Social Security numbers and phone numbers.

- Don't forget to designate your beneficiaries, including primary and secondary, if applicable.

- Compare your plan options and choose the best benefit plan for you and your family. When you are ready to confirm your selections, click "Submit Enrollment."