Medical

CCMC offers four medical plan options through Cigna, which utilize two network options—the Cigna Open Access Plus (OAP) network and the Cigna LocalPlus network.

Before you enroll in medical coverage, take some time to fully understand how each plan works. See pages 9 and 10 for an overview of the plan benefits.

Cigna OAP Network

The OAP network is a broader network which includes doctors, specialists, and hospitals outside of your local area.

Here are the key features of choosing a medical plan that utilizes the OAP network:

- No referrals needed to see a specialist.

- Out-of-network services are covered, but you will have higher out-of-pocket costs and you may need to file a claim.

- It is recommended to choose a primary care provider (PCP) to coordinate your care, but it is not required.

- Prior authorizations (pre-approval) may be required for hospitalizations and some types of outpatient care.

- Plans include 24/7 emergency and urgent care coverage.

Cigna LocalPlus Network

The LocalPlus network is a more condensed network compared to the OAP network. The LocalPlus network is limited to doctors, specialists, and hospitals right where you live.

Here are the key features of choosing a medical plan that utilizes the LocalPlus network:

- No referrals needed to see in-network specialists.

- Out-of-network services will only be covered in emergencies.

- It is recommended to choose a PCP to coordinate your care, but it is not required.

- Prior authorizations (pre-approval) for hospitalizations and some outpatient procedures may be required.

- Includes 24/7 emergency and urgent care coverage.

Ask Yourself These Questions:

- Can you set aside money from your paycheck to save for out-of-pocket health care costs?

Consider the Cigna OAP HSA or Cigna LocalPlus HSA. You will have the option to fund a health savings account (HSA) that can save you money on your health care costs. - Do you prefer to pay less when you visit the doctor’s office?

Consider the Cigna OAP PPO or Cigna LocalPlus PPO. While you will pay more from your paycheck each month for coverage, you will only be responsible for a small copay or cost share when you need care.

Outpatient Precertification Services Requiring Review

- Inpatient continued stay review: Earlier outreach for inpatient discharge planning.

- Home infusion therapy: Home infusion therapy for immunotherapy, continuous medications, and pain management.

- Private duty nursing: Registered nurse, licensed practical nurse, or aid in home, often post surgery.

- Medical injectables: Review for dosage, frequency, most appropriate/cost-effective place of service to treat MS, cancer, and RA.

- Radiation therapy: Proton beam therapy, IMRT, and hyperthermia therapy.

- Medical oncology: Chemotherapy and regimen of care including medical infusion and pharmacy supportive medications.

Working Spouse/Domestic Partner Exclusion

If your legal spouse/domestic partner is offered medical insurance through his or her employer, he or she is not eligible to participate in the CCMC medical plans.

Dependent Audit

An audit will be conducted beginning early 2024 to ensure enrolled dependents are meeting all dependent eligibility requirements.

Medical Costs

Listed below are the per pay period costs (based on 24 pay periods) for medical insurance. The amount you pay for coverage is deducted from your paycheck on a pre-tax basis. The amount you pay is based on your participation in the wellness program.

Tobacco/Non-Tobacco User Contributions

CCMC feels strongly that employees should take charge of personal choices that may impact their health. Therefore, employees who certify that they are not tobacco users will enjoy lower medical contributions in 2025. To take advantage of the lower contributions, you must certify within ADP during the annual enrollment period that you do not use tobacco/nicotine.

Current tobacco users: If you certified that you were a tobacco user in 2023 and did not sign up for the tobacco cessation program by October 31, 2023, you will be charged an additional $12.50 per paycheck (up to $25 per month) for medical coverage in 2024. This charge will show on your paycheck as an additional line item deduction. Please note: You will need to recertify your tobacco use status in 2024 and complete the tobacco cessation program by October 31, 2024, if you wish to avoid the surcharge in 2025. Newly enrolled individuals: You will have three months following your benefits effective date to sign up for the tobacco cessation program in order to avoid the surcharge in 2024.

Engaged vs. Non-Engaged Rates

- Employee only and employee + child(ren): Employees will see a $25 credit on each paycheck totaling up to $50 per month for participating in the wellness program.

- Employee + spouse or family: Employees will see up to a $50 credit on each paycheck totaling up to $100 per month for their participation and their spouse’s participation in the wellness program.

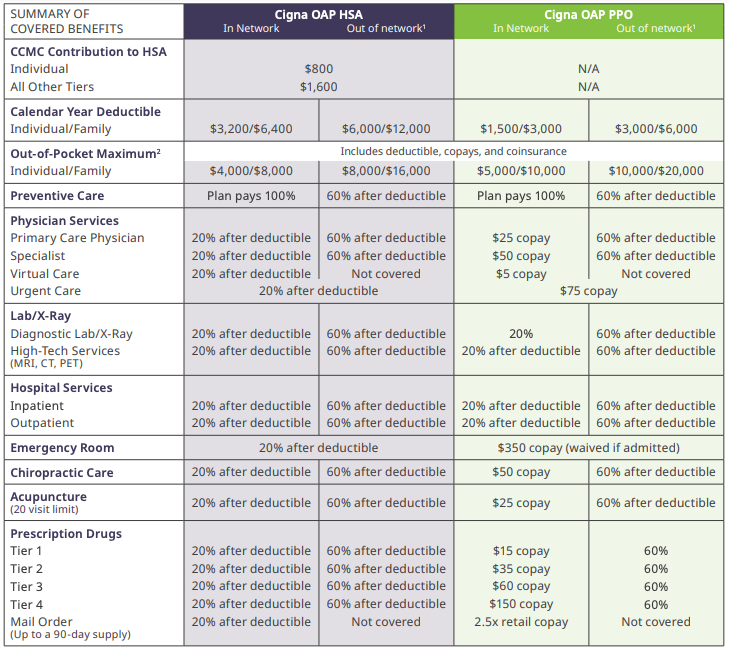

The Cigna OAP plans offer in- and out-of-network benefits, providing you the freedom to choose any provider. However, you will pay less out of your pocket when you choose a Cigna provider.

The table below summarizes the benefits of each medical plan. The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

(1) Out-of-network reimbursement based on the allowable amount determined using the median amount negotiated with in-network providers, the maximum reimbursable charge, or Medicare reimbursement as basis for payment. Members will be balance billed for out-ofnetwork services. (2) Plan maximum benefit payment is unlimited.

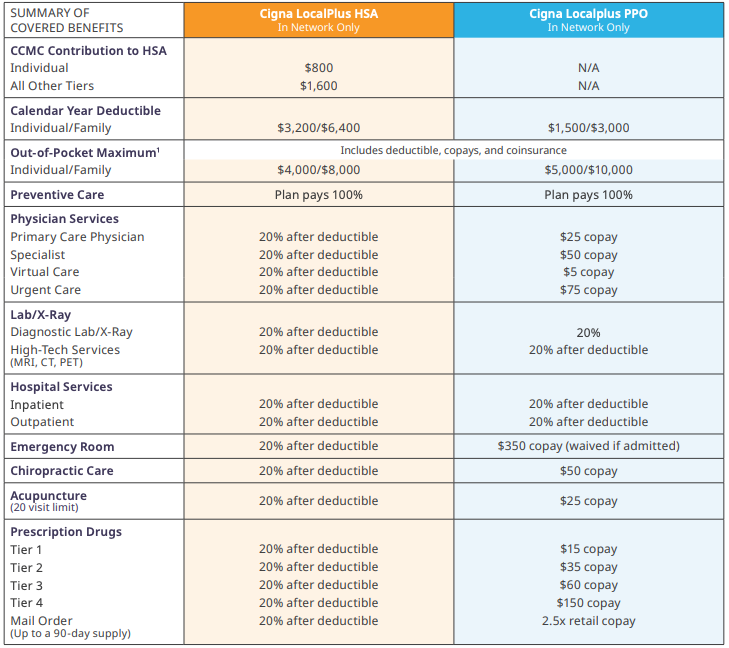

The Cigna LocalPlus plans offer in-network benefits only.

The table below summarizes the benefits of each medical plan. The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

(1) Plan maximum benefit payment is unlimited.

Understanding the Cigna High-Deductible Health Plan

With a high-deductible health plan (HDHP), when you need care, you pay for all services out of your pocket until you reach your deductible. Once you reach your deductible, you pay a portion of the cost for all other services. The out-of-pocket maximum is the most you’ll pay in a plan year for services covered by your plan. Once this limit is reached, the plan pays 100% for covered services for the rest of the plan year.

What you pay for

For all other services you’ll pay the network discounted rate until you reach your deductible. Once you reach your deductible, you’ll pay a portion of all other services until you reach your out-of-pocket maximum (OOPM).

How you pay

You will receive a bill from your provider that shows the amount you owe. You can use HSA funds to pay the bill or you can pay the bill out of your pocket.

Tracking expenses

Log into your Cigna account to stay on top of what you’ve paid, what is due, and how close you are to reaching your deductible and OOPM. When you receive services that count toward your deductible or your OOPM, you’ll get an explanation of benefits. This is not a bill.

Value of the Localplus Plans

The LocalPlus network provides easy access to a select group of quality doctors and hospitals near where you live and work, all at a lower cost.

- When you are in a LocalPlus network area, you must receive care from a health professional or facility in this network to receive in-network coverage (except in the case of a medical emergency).

- If you are away from home and need care, just look for a participating LocalPlus doctor in the area; if one isn’t available, you can use doctors or hospitals in our Cigna Away From Home Care network.

- If you choose to go outside the LocalPlus network—or outside the Cigna Away From Home Care network when LocalPlus isn’t available—your care will not be covered by the plan (except in the case of a medical emergency).

Find a LocalPlus doctor:

- Go to cigna.com.

- Click on “Find a Doctor.”

- Click on “For plans offered through your employer or school.”

- Enter the requested details for your search.

- Select “LocalPlus” and click “Select.”

- Click on “Search” to see a list of network providers near you.

Are You Covering Your Spouse and/or Children?

If you elect employee + spouse, employee + child(ren), or family coverage, the individual deductible and out-of- pocket maximum apply to each covered member of the family (capped at family amount).

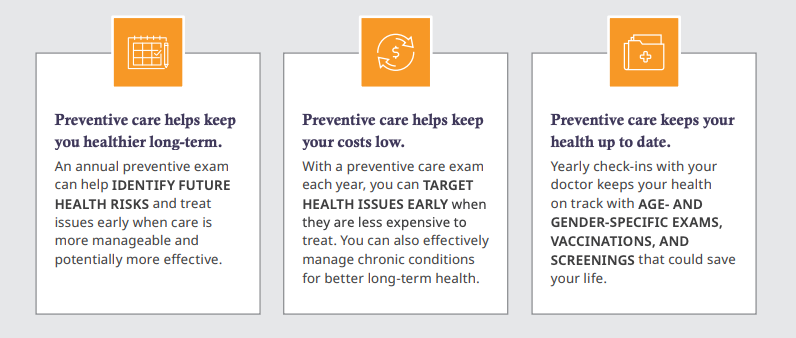

Preventive Care

In-network preventive care is 100% free for medical plan members.

You won’t have to pay anything out of your pocket when you receive in-network preventive care. Practice preventive care and reap the rewards of a healthier future.

Virtual Care

You have access to virtual care through MDLIVE. Get the care you need when and wherever you need it. Whether you’re on the go, at home, or at the office, care comes to you in the form of virtual care.

Get care for non-emergency conditions.

Virtual care can connect you to a doctor, without an appointment, from your phone, computer, or tablet. Receive care for common health issues like allergies, asthma, sore throat, fever, headache, rashes, and much more.

Receive mental health support and counseling.

Licensed counselors and psychiatrists can help diagnose, treat, and even prescribe medication when needed for depression and anxiety, substance abuse and panic disorders, PTSD, men and women’s issues, grief and loss, and more.

Talk with a doctor by phone or video, 24/7.

Use virtual care to prioritize your health by getting the care you need when you need it. Visit mdliveforcigna.com, download the MDLIVE mobile app, or call 888-726-3171 to get started.

Find a provider:

- Medical providers: Locate the “Talk to a doctor or nurse 24/7” callout and click “Connect Now.”

- Behavioral health providers: Go to “Find Care & Costs” and enter “Virtual Counselor” under “Doctor by Type.”

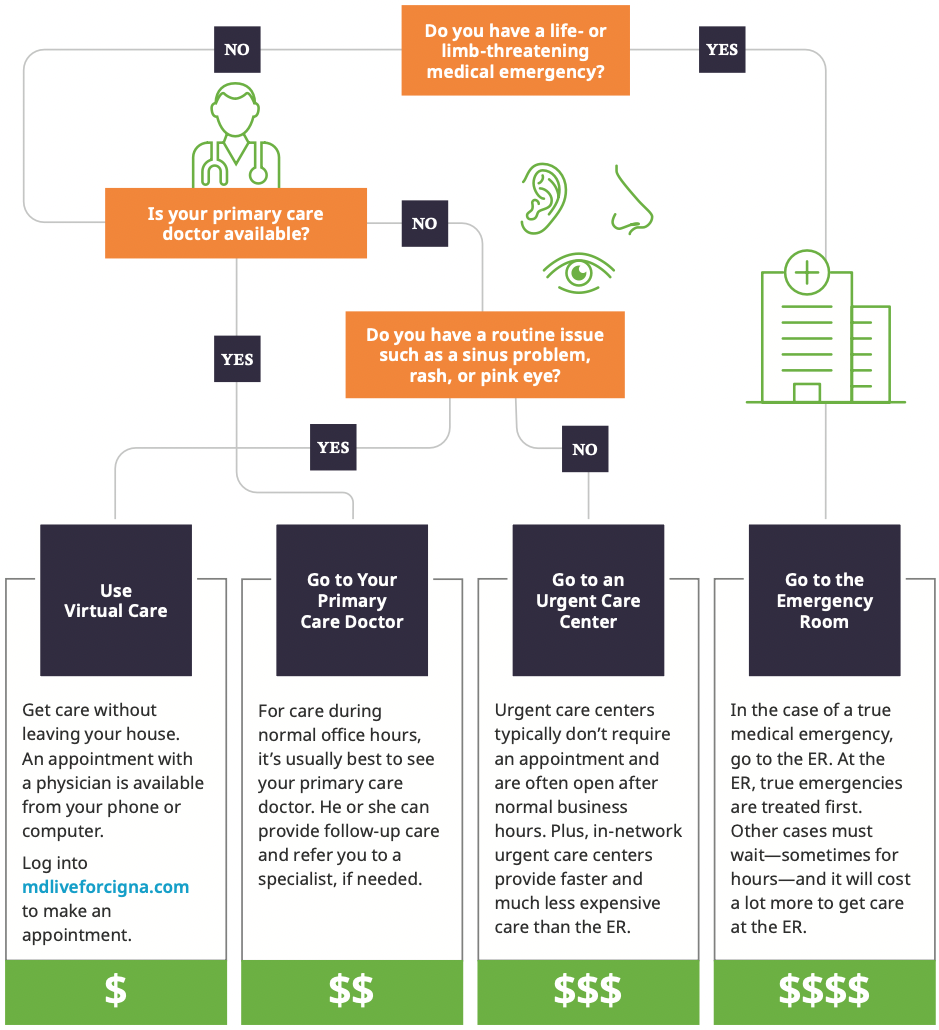

Know Where to Go for Care

Where you go for medical services can make a big difference in how much you pay and how long you wait to see a health care provider. Use the chart below to help you choose where to go for care.

Prescription Home Delivery

Do you have medications that you take regularly? If so, save time—and maybe money too—by using the Cigna mail-order pharmacy. The mail-order pharmacy fills three-month prescriptions—meaning less time spent requesting refills and often a decreased cost per dose. Additionally, these orders are conveniently delivered to your doorstep.

Call Cigna at 800-285-4812 and have the following information handy to sign up:

⸰ Name and Cigna ID ⸰ Doctor name and phone number ⸰ Prescription name and strength ⸰ Payment method

Cigna member costs for a three month supply on the PPO plan options:

⸰ Generic: $38 copay ⸰ Brand Non-Preferred: $150 copay ⸰ Brand Preferred: $88 copay ⸰ Specialty: Not available

90-Day Prescription Supplies

To save money on your prescriptions, visit an in-network pharmacy such as CVS, Wal-Mart, and Kroger, and request a 90-day supply of your routine medications. You will make fewer trips to the pharmacy and you will be less likely to miss a dose of your medication, which will lead to better health.

Specialty Medications

Specialty medications are limited to a 30-day supply to reduce potential waste and save you money. 30-day specialty drugs are charged at the same level copay as retail prescriptions.

Save On Specialty

Specialty drugs can be expensive. With SaveonSP, you can access assistance programs available from pharmaceutical manufacturers. These programs are essential to help you afford your specialty medications.

SaveonSP can help you save on medications for:

- Multiple sclerosis

- Oncology

- Hepatitis C

- Rheumatoid arthritis

- Inflammatory bowel disease

- Psoriasis

If your medications qualify for the SaveonSP program, you will receive a letter in the mail.

Patient Assurance Program

Eligible employees with diabetes will not pay more than $25 for a 30-day supply of insulin as well as non-insulin diabetes therapies including, DPP-4 inhibitors, GLP-1 agonists, and SGLT2 inhibitors.

Cigna Vision Benefits

If you enroll in a CCMC medical plan, an in-network eye exam will be covered 100% every two years. To locate an in-network Cigna vision provider, visit mycigna.com.

Resources

Cigna OAP HSA

Cigna OAP PPO

Cigna LocalPlus HSA

Cigna LocalPlus PPO

Summary of Benefits and Coverage - LocalPlus in HSA

Benefits Summary - LocalPlus

Summary of Benefits and Coverage - Open Access Plus

Benefits Summary - Open Access Plus

Summary of Benefits and Coverage - Choice Fund Open Access Plus HSA

Summary of Benefits and Coverage - LocalPlus IN

Benefit Summary - Choice Fund Open Access Plus HSA Plan

Summary of Benefits and Coverage - Choice Fund Open Access Plus HSA

Benefit Summary - LocalPlus IN

Benefit Summary - Open Access Plus Plan

How To Enroll

To enroll in benefits, log into workforcenow.adp.com and follow these steps:

- Enter your User ID and Password, and then click "Sign In."

Note: If this is your first time logging in, click the "Sign Up" button. If you are unsure of the registration code, please contact People Operations. - You will be asked questions regarding you and your family, including their birthdates and possibly their Social Security numbers and phone numbers.

- Don't forget to designate your beneficiaries, including primary and secondary, if applicable.

- Compare your plan options and choose the best benefit plan for you and your family. When you are ready to confirm your selections, click "Submit Enrollment."