ACCIDENT INSURANCE

arrivia provides you the option to purchase accident insurance through Cigna.

Accident insurance can pay a set benefit amount based on the type of injury you have and the type of treatment you need. It includes a range of incidents, from common injuries to more serious events.

Why is this coverage so valuable?

- It can help you with out-of-pocket costs that your medical plan doesn’t cover, like copays and deductibles.

- You are guaranteed base coverage, without answering health questions.

- It includes a wellness benefit that pays $75 per calendar year per insured individual if a covered health screening test is performed, including: blood tests, chest x-rays, stress tests, mammograms, and colonoscopies.

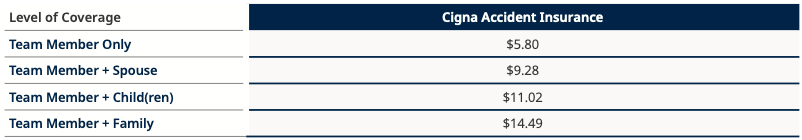

ACCIDENT INSURANCE COSTS

Listed below are the per pay period costs for accident insurance. The amount you pay is deducted on a post-tax basis.

Cigna Accidental Injury Insurance

Get more protection for the unexpected.

An accident can happen to anyone at any time. Even with medical coverage, out-of-pocket expenses can quickly add up. That’s why having Cigna Accidental Injury insurance is important.

CRITICAL ILLNESS INSURANCE

arrivia provides you the option to purchase critical illness insurance through Cigna.

If you’re diagnosed with an illness that is covered by critical illness insurance, you can receive a lump-sum benefit payment. You can use the money however you want to assist you in offsetting unexpected expenses due to a critical illness diagnosis.

Why is this coverage so valuable?

- The money can help you pay out-of-pocket expenses like copays, deductibles, and other living expenses.

- You can use this coverage more than once. Even after you receive a payout for one illness, you’re still covered for the remaining conditions and for the reoccurrence of any critical illness with the exception of skin cancer. The reoccurrence benefit pays 100% of your coverage amount. Diagnoses must be at least 180 days apart or the conditions can’t be related to each other.

- It includes a wellness benefit that pays $50 per calendar year per insured individual if a covered health screening test is performed, including: blood tests, chest x-rays, stress tests, mammograms, and colonoscopies.

Who can get coverage?

- Team member: $10,000 or $20,000; guarantee issue: $20,000 ◦ Spouse: Up to 50% of team member election

- Dependent children: Up to 25% of team member election

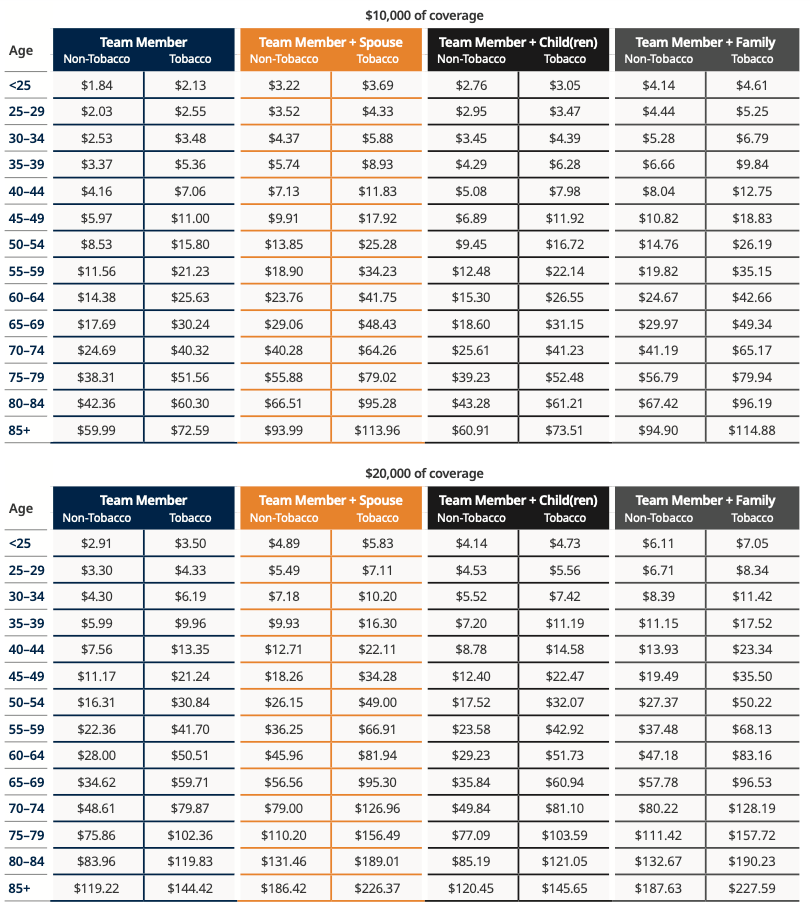

CRITICAL ILLNESS INSURANCE COSTS

Listed below are the per pay period costs for critical illness insurance. Rates are based on the team member's age and coverage amount.

Cigna Critical Illness Insurance

Unexpected Critical Illness can be costly.

Being diagnosed with a critical illness can happen to anyone at any time. Even with medical coverage, out-of-pocket expenses can quickly add up. That’s why having Cigna Critical Illness insurance is important.

PET HEALTHCARE

arrivia provides you the option to purchase pet insurance through Figo.

Pet insurance helps you keep your pets healthy whether it’s sprains, stitches, x-rays, or teeth cleanings. Seek treatment from any licensed veterinarian, then submit your bill for reimbursement. Please note that this offering will be directly billed to participants through Figo and not as a part of payroll deduction.

Figo pet insurance will cover:

- Emergencies and hospitalizations

- Surgeries

- Veterinary specialists

- Hereditary and congenital conditions • Chronic conditions

- Dental illness and injury

- Prescriptions

- Imaging

- Knee conditions

- Prosthetics and orthopedics

- Hip dysplasia

- Preventive care*

- And more

*Preventive services are included with the routine wellness plan add-on.

ENROLL YOUR PET TODAY.

Choose and customize a plan with deductible and reimbursement levels that meet your needs. Scan the QR code to the left to get started. For questions or enrollment assistance, call 844-738-3446, text 844-262-8133, or email support@insurefigo.com.

LEGAL COVERAGE

arrivia provides you the option to purchase legal coverage through MetLife Legal Plan.

The plan features comprehensive benefits including:

- Covered legal services

- Office consultation and telephone advice

- Identify theft and debt collection defense

- In-person consultations

- Tax audits and immigration assistance

- Document preparation

- Refinancing and home equity loans

- Representation for living wills, power of attorney, and trusts

The per-pay-period costs for legal coverage is $10.41. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

ONE MEDICAL CONCIERGE MEDICAL SERVICE

arrivia provides you and your eligible dependents the option to purchase a discounted membership to One Medical—a primary care practice that expands the reach of your medical benefits.

One Medical provides you with access to exceptional care that fits your life. As an arrivia team member, you and your family receive an exclusive 25% off the annual membership fee ($199).

Activate your membership by accessing the “Sign up today” link on onemedical.com or by downloading the mobile app. Use the discount code ARRIVIA25 during checkout.

Get Care When You Need It

Download the One Medical mobile app to connect with a provider 24/7 or to locate a One Medical provider near you.

With One Medical, you can access care for:

- Annual wellness visits

- Chronic condition management (i.e. diabetes, arthritis)

- Behavioral health concerns

- Common illnesses such as cold, flu, and COVID-19

- Minor cuts and injuries

One Medical Is Available Nationwide

- Prescription renewals

- Allergies and skin issues

- Stomach flu, vomiting, and headaches • UTIs

- And more

Whether you’re at home or on the go, you can access to exceptional care from a One Medical provider. Visit onemedical.com/locations for a full list of One Medical network facilities.

Questions? Email access@onemedical.com or visit onemedical.com/now to get started.

DOWNLOAD THE ONE MEDICAL MOBILE APP FOR ACCESS TO:

24/7 free on-demand care.

Connect with a provider for free through the One Medical mobile app when you’re sick or have an urgent medical question.

Care on the go.

You always have care at your fingertips when you venture from home. Book a same- day or next-day appointment at one of the 125+ locations nationwide.

Virtual physical and mental health care.

See a provider in-person or from your mobile device for physical and mental health concerns anytime, anywhere.