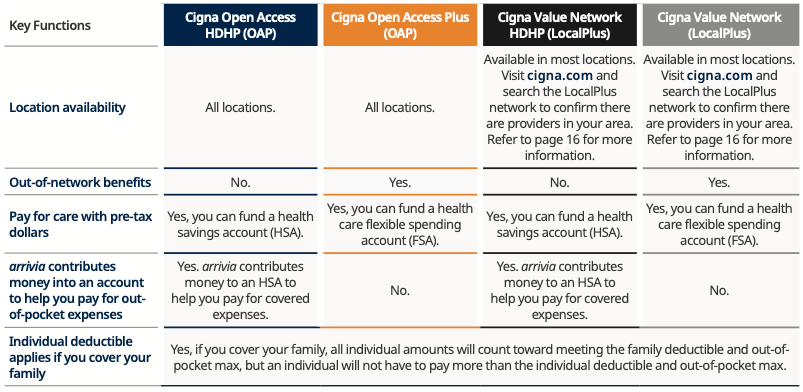

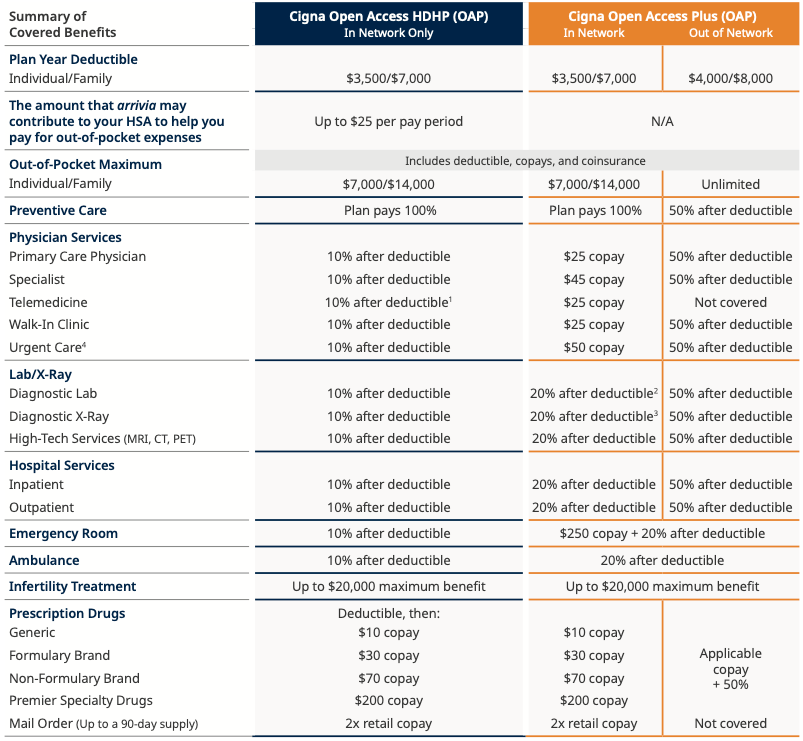

CIGNA OPEN ACCESS NETWORK

The Cigna Open Access Plus (OAP) Network offers in- and out-of-network benefits, providing you the freedom to choose any provider. However, you will pay less out of your pocket when you choose a network provider.

Please note: The Cigna Open Access HDHP (OAP) does not have out-of-network benefits—you must see an in- network provider to receive care. Locate a Cigna network provider at cigna.com.

The table below summarizes the benefits of each medical plan. The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

(1) A per consult fee of $49 for MDLIVE applies until deductible is satisfied. (2) Plan pays 100% if lab work is done at a physician’s office or independent lab facility. (3) Plan pays 100% if services are performed in a physician’s office. (4) Virtual urgent care is covered at 100%.

Open Access Plus HDHP - Summary of Benefits and Coverage

Open Access Plus HDHP - Benefit Summary

Open Access Plus - Summary of Benefits and Coverage

Open Access Plus - Benefit Summary

LocalPlus IN HDHPQ - Summary of Benefits and Coverage

LocalPlus IN HDHPQ - Benefit Summary

LocalPlus Plan - Summary of Benefits and Coverage

LocalPlus Plan - Benefit Summary

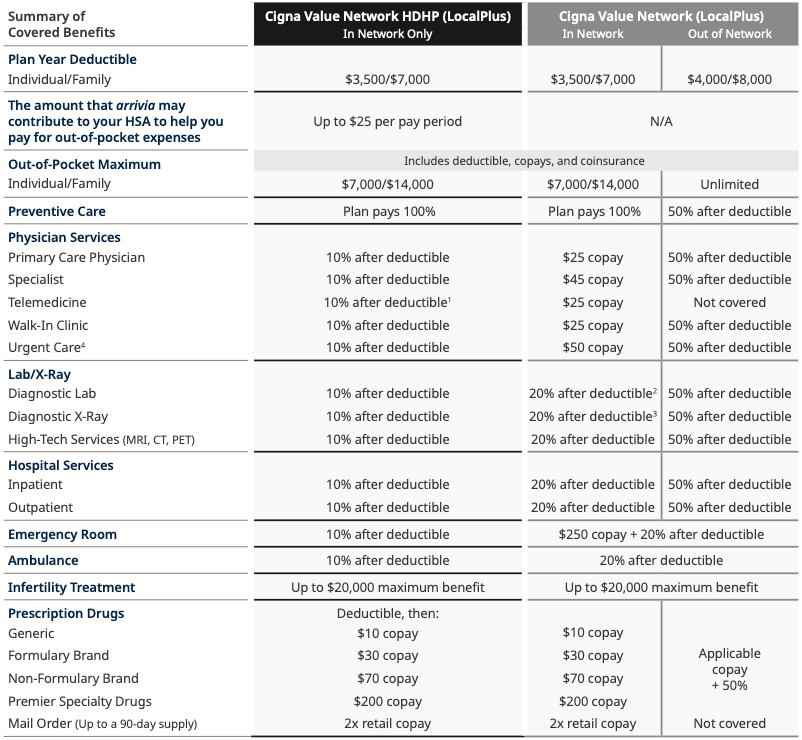

CIGNA LOCALPLUS NETWORK

The Cigna Value Network (LocalPlus) offers in- and out-of-network benefits, providing you the freedom to choose any provider within the LocalPlus network. However, you will pay less out of your pocket when you choose a Cigna provider. Please note: The Cigna Value Network HDHP (LocalPlus) does not have out-of-network benefits—you must use an in-network provider to receive care.

Important: The LocalPlus Network may not be available in all areas. Please do a provider search at cigna.com before electing this plan to confirm there are providers in your area.

The table below summarizes the benefits of each medical plan. The coinsurance amounts listed reflect the amount you pay. Please refer to the official plan documents for additional information on coverage and exclusions.

(1) A per consult fee of $49 for MDLIVE applies until deductible is satisfied. (2) Plan pays 100% if lab work is done at a physician’s office or independent lab facility. (3) Plan pays 100% if services are performed in a physician’s office. (4) Virtual urgent care is covered at 100%.

HOW THE PLANS WORK

KEY TERMS TO KNOW

Take the first step to understanding your benefits by learning these four common terms.

Copay

A fixed dollar amount you may pay for certain covered services. Typically, your copay is due at the time of service.

Deductible

The amount you must pay each year for certain covered health services before your insurance plan will begin to pay.

Coinsurance

After you meet your deductible, you may pay coinsurance, which is your share of the costs of a covered service.

Out-of-Pocket Maximum

This includes copays, deductibles, and coinsurance. Once you meet this amount, the plan pays 100% of covered services the rest of the year.

MEDICAL COSTS

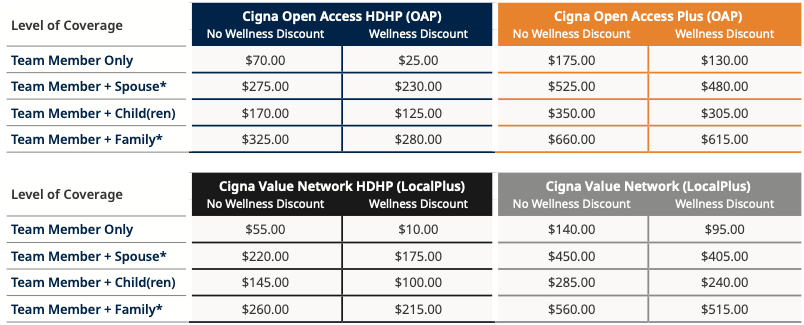

Listed below are the per pay period costs for medical insurance. The amount you pay for coverage is deducted from your paycheck on a pre-tax basis.

*$45.00 per pay period surcharge will apply on top of published rates, to cover any qualified spouses who are otherwise eligible for health coverage through their own employer. See Human Resources for more details.

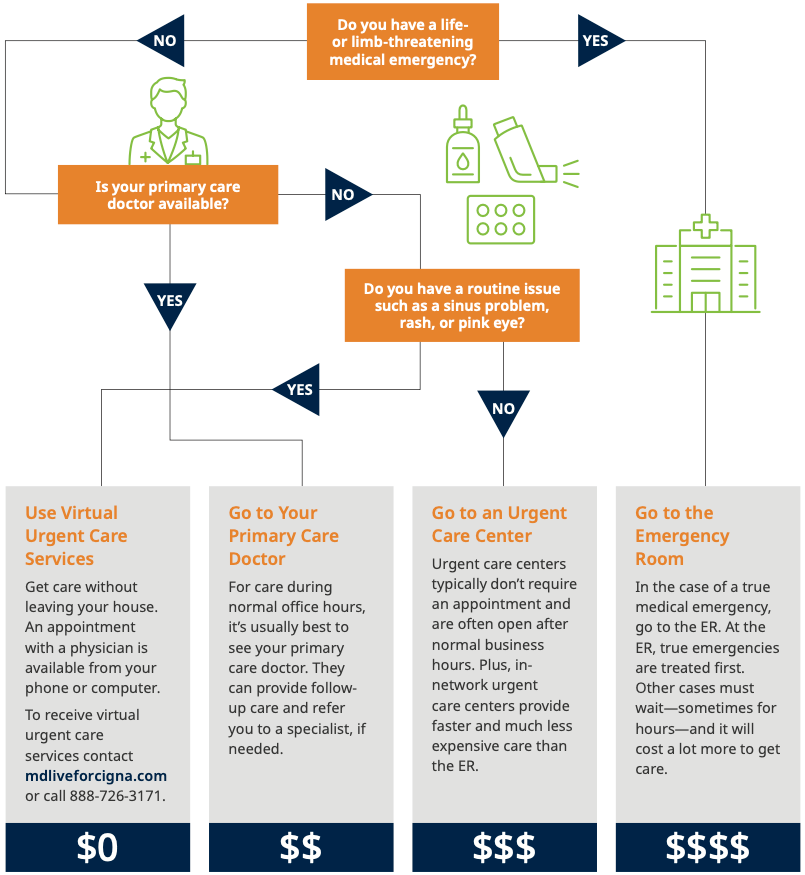

TELEMEDICINE SERVICE

All team members enrolled in an arrivia medical plan have 24/7/365 access to licensed physicians through MDLIVE. This program allows you to seek information, advice, and treatment from a medical provider right from your computer or smart phone without having to face waiting lines at your doctor’s office or an urgent care center. Your cost share for virtual medical visits will range from $25 to $55 depending on your medical plan. Telemediciane Urgent Care services are covered at 100%. This is significantly less than the cost of seeking treatment through other facilities. Save time and money by considering virtual care.

Connect with a licensed physician by visiting mdliveforcigna.com or calling 888-726-3171.

MDLIVE

With MDLIVE, you can visit a doctor from your home, office, or on the go. A network of board-certified doctors is available 24/7 by phone or secure video chat to assist with non-emergency medical conditions. See page 19 for more information on determining when telemedicine is your best option for care.

When should you use MDLIVE?

- For a non-emergency issue

- During or after normal business hours, nights, weekends, or holidays

- If your primary care physician is not available

- To request prescription refills when appropriate

- When you’re traveling and in need of non-emergency

What can be treated?

- Allergies

- Asthma

- Cold and flu

- Diarrhea

- Ear infection

- Joint aches

- Nausea

- Fever

- Rashes

- Sinus infection

- Sore throat

- UTI

Contact MDLIVE at mdlive.com or by calling 888-632-2738. Or download the MDLIVE app at mdlive.com/getapp.

CIGNA TOOLS AND RESOURCES

CIGNA ONE GUIDE

Call a Cigna One Guide representative before you enroll to get personalized, useful guidance to choose the right plan for you.

Your personal guide will help you:

- Easily understand the basics of health coverage.

- Identify which available health plan best meets your needs.

- Check to see if your doctors are in-network, to help you avoid unnecessary costs.

- Get answers to any other questions you may have about the plans or provider networks available to you.

After enrollment, your Cigna One Guide representative will also be there to guide you through the complexities of the healthcare system, and help you avoid costly missteps.

Cigna One Guide service provides personalized assistance to help you:

- Save time and money.

- Get the most out of your plan.

- Find the right hospitals, dentists, and other health care providers in your plan’s network.

- Get cost estimates and avoid surprise expenses.

- Understand your bills.

CALL 888-806-5042 TO SPEAK WITH A CIGNA ONE GUIDE REPRESENTATIVE TODAY.

Note: During enrollment, personal representatives are available Monday through Friday,

8 a.m.–9 p.m. EST. Once your coverage begins, call the number on your ID card to speak with a personal representative. Additional customer service representatives are available 24/7.

FIND A DOCTOR

Cigna’s online directory makes it easy to find a doctor or hospital in your network.

- Step 1: Go to cigna.com, and click on “Find a Doctor” at the top of the screen. Then, under “How are your covered?” select “Employer.”

- Step 2: Change the geographic location to the city/state or zip code you want to search. Select the search type and enter a name, specialty, or other search term. Click on one of our suggestions or the magnifying glass icon to see your results.

- Step 3: Answer any clarifying questions, and then verify where you live (this will determine the networks available). Networks available:

- Cigna Open Access Network: Open Access Plus (OAP) allows you to choose your health care providers from a broad network and is available nationwide.

- Cigna LocalPlus Network: LocalPlus offers you cost-efficient access to local network that is limited to quality doctors, specialists, and hospitals, right where you live. The LocalPlus Network is available only in certain states/ areas (including Arizona, California, and Florida).

CIGNA EASY CHOICE TOOL

arrivia has partnered with Cigna to help you decide what medical plan is right for you.

NEED HELP CHOOSING A MEDICAL PLAN?

With the Cigna Easy Choice Tool, get a personalized comparison of available plans based on your answers to questions about your health care needs and the needs of your eligible family members.

The Cigna Easy Choice Tool will lay out all of the applicable plans so you can review and compare them to make the most informed decision when selecting a medical plan for 2024.

Please have the following information handy to use the Cigna Easy Choice Tool:

- Information about you and your eligible dependents (like dates of birth, addresses, etc.).

- Zip codes of eligible dependents you wish to cover that live or attend school outside of your area.

- The name, address, and phone number of any doctors or specialists you use or who is used by one of your covered dependents.

Based on your responses to the online questions, the Cigna Easy Choice Tool ranks the company’s Cigna plans as “Best,” “Next Best” and “Good” to fit for your personal needs. The tool will also show whether your current doctors are in the plan’s network.

Log in and get started at cignaeasychoice.com (access code: EHYMZTO0).

You also have access to Cigna One Guide, a personalized concierge service to help you navigate your benefits and save money. Call 888-806-5042 to speak with a Cigna One Guide representative for additional help selecting the medical plan that’s right for you.

PREVENTIVE CARE

In-network preventive care is 100% free for medical plan members on all arrivia medical plans.

You won’t have to pay anything out of your pocket when you receive in-network preventive care. Practice preventive care and reap the rewards of a healthier future.

Preventive care helps keep you healthier long-term.

An annual preventive exam can help IDENTIFY FUTURE HEALTH RISKS and treat issues early when care is more manageable and potentially more effective.

Preventive care helps keep your costs low.

With a preventive care exam each year, you can TARGET HEALTH ISSUES EARLY when they are less expensive to treat. You can also effectively manage chronic conditions for better long-term health.

Preventive care keeps your health up to date.

Yearly check-ins with your doctor keeps your health on track with AGE- AND GENDER-SPECIFIC EXAMS, VACCINATIONS, AND SCREENINGS that could save your life.

SAVE MONEY ON YOUR HEALTH CARE

Choose an in-network provider.

Choose an in-network provider and you’ll pay less out of your pocket. Why? Because in- network doctors and facilities contract with the insurance company and agree to charge a lower price for services.

Request an in-network lab.

When your doctor orders a test, confirm that an in-network lab will be used. If your tests are sent to an out-of-network lab, you may incur additional out-of-pocket expenses.

Check your explanation of benefits.

After your appointment, review your explanation of benefits (EOB) and provider bill to confirm you were billed correctly.

Note: Some services are generally not considered preventive if you get them as part of a visit to diagnose, monitor, or treat an illness or injury. Please be aware that you will be responsible for the cost of any non-preventive care services you receive at your preventive care exam based on your plan design. Learn more about preventive care at cigna.com.

MEDICAL BENEFITS

HEALTH ADVOCACY SERVICES

Cigna offers health advocacy services to help you and your family members resolve your health care challenges.

Personal health coaches, who are experienced clinicians or benefits specialists, provide individualized assistance for:

- Clinical and coaching support: Answering questions about diagnoses, treatments and medications, as well as helping to find the right providers and treatments.

- Administrative support: Explaining benefits, estimating procedure costs, and working to resolve benefit and claim issues.

- Senior care and special needs services: Locating appropriate senior care or in-home assistance.

- Complementary and alternative medicine: Identifying wellness services and alternative medicine.

Personal health coaches are available Monday through Friday between 8 a.m. and 12 a.m. ET at 866-799-2725.

OMADA

Omada is a digital lifestyle change program that inspires healthy habits that last. Combining the latest technology with ongoing support, you can make the changes that matter most—whether that’s around eating, activity, sleep, or stress.

If you or your covered adult dependents are enrolled in an arrivia medical plan, are at risk for diabetes or heart disease, or living with diabetes or high blood pressure, and are accepted into the program, you will receive the program AT NO COST.

If you are diagnosed with diabetes and/or hypertension, you will have access to an expanded Omada program.

Omada features include:

- Interactive programs to guide your journey

- A wireless smart scale to monitor your progress

- Weekly online lessons to empower you

- Professional health coaching for added support

- A small peer group to keep you engaged

To access Omada, visit omadahealth.com/arrivia.

HEALTHY PREGNANCIES, HEALTHY BABIES

The Cigna Healthy Pregnancies, Healthy Babies program is designed to help you and your baby stay healthy during your pregnancy and in the days and weeks after your baby’s birth.

When you take part and finish the program, you’ll be eligible to receive $150 if you enroll in the first trimester or $75 if you enroll in the second trimester.

HEALTH INFORMATION LINE

As a Cigna customer, you have access to the Health Information Line where you can get live support 24 hours a day, seven days a week for non-emergency situations. When you call, a Health Information Line clinician will ask you a few questions about your symptoms. The clinician can help you decide if you should seek care at an urgent care center, your doctor’s office, the emergency room, or care for yourself at home.

Log into mycigna.com for the Health Information Line phone number, or call the customer service number on the back of your virtual Cigna ID card, available through the Cigna app or at mycigna.com.

CENTERS OF EXCELLENCE

You have access to Cigna’s Centers of Excellence (COE)— higher-performing hospitals that are rated above other in-network hospitals when it comes to health outcomes and have extra savings for you for certain procedures or conditions. When you use a COE for your procedures, you will receive a $250 debit gift card once your claim is processed and confirmed. Visit mycigna.com and look for the COE symbol for your next procedure.

Here are the condition level categories that use a Cigna COE:

- Back surgery

- Cancer conditions

- Cardiac cath and angioplasty

- Child delivery

- Heart surgery

- Joint replacement

- Pulmonary medical

Note: Some services are generally not considered preventive if you get them as part of a visit to diagnose, monitor, or treat an illness or injury. Please be aware that you will be responsible for the cost of any non-preventive care services you receive at your preventive care exam based on your plan design. Learn more about preventive care at cigna.com.