BUDGETING FOR YOUR CARE

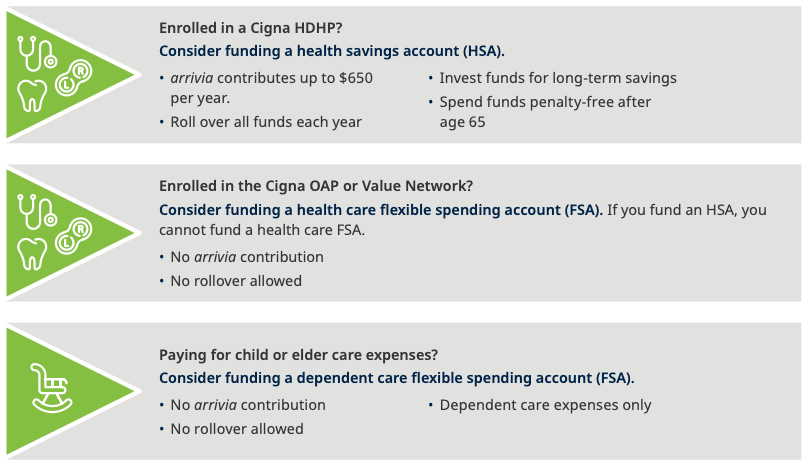

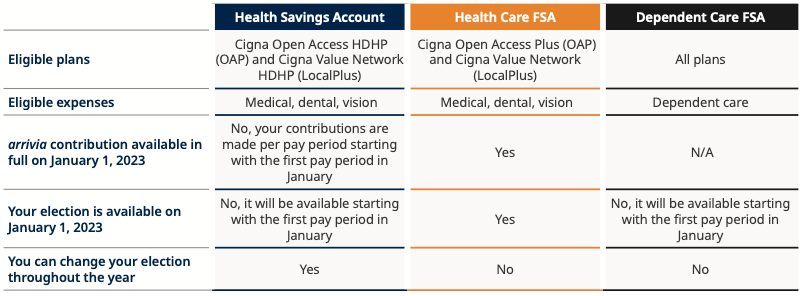

arrivia offers two types of pre-tax accounts: a health savings account (HSA) and flexible spending accounts (FSAs).

When you put money into a pre-tax account, you can save up to 20%* on your care and increase your take home pay. This is because you don’t pay tax on your contributions.

COMPARE YOUR OPTIONS

*Percentage varies based on your tax bracket.

HEALTH SPENDING ACCOUNT

If you enroll in the Cigna Open Access HDHP (OAP) or the Cigna Value Network HDHP (LocalPlus), you may be eligible to open and fund a health savings account (HSA) through WEX.

An HSA is a savings account that you can use to pay out-of-pocket health care expenses with pre-tax dollars.

arrivia CONTRIBUTION

If you enroll in a Cigna high-deductible health plan (HDHP), arrivia will help you save by contributing to your account.

If you contribute $25 per pay period ($650 annually) arrivia will match your contribution and deposit $25 per pay period in your HSA account.

2024 IRS HSA CONTRIBUTION MAXIMUMS

Contributions to an HSA cannot exceed the IRS allowed annual maximums.

- Individuals: $4,150

- All other coverage levels: $8,300

If you are age 55+ by December 31, 2024, you may contribute an additional $1,000.

HSA ELIGIBILITY

You are eligible to fund an HSA if:

- You are enrolled in the Cigna Open Access HDHP (OAP) or the Cigna Value Network HDHP (LocalPlus).

You are NOT eligible to fund an HSA if:

- You are covered by a non-HSA eligible medical plan, health care FSA, or health reimbursement arrangement.

- You are eligible to be claimed as a dependent on someone else’s tax return.

- You are enrolled in Medicare, TRICARE, or TRICARE for Life.

Refer to IRS Publication 969 for additional eligibility details. If you are over age 65, please contact Human Resources.

FLEXIBLE SPENDING ACCOUNTS

arrivia offers two flexible spending account (FSA) options through WEX.

You decide how much to contribute to your FSA on a plan year basis up to the maximum allowable amount. Your annual election will be divided by the number of pay periods and deducted evenly on a pre-tax basis from each paycheck throughout the year. Due to the favorable tax treatment of FSAs, the IRS requires you to forfeit any money left in your account after March 15, 2025.

You will receive a debit card, which can be used to pay for eligible expenses at the point of service. If you do not use your debit card and have expenses to be reimbursed, submit a claim form and a bill or itemized receipt from the provider to WEX.

Log into your account at wexinc.com to: view your account balance(s), calculate tax savings, view eligible expenses, download forms, view transaction history, and more.

HEALTH CARE FSA (NOT ALLOWED IF YOU FUND AN HSA)

Pay for eligible out-of-pocket medical, dental, and vision expenses with pre-tax dollars. The health care FSA maximum contribution is $3,200 for the 2024 plan year.

DEPENDENT CARE FSA

The dependent care FSA allows you to pay for eligible dependent day care expenses with pre-tax dollars. Eligible dependents are children under 13 years of age, or spouse, a child over 13, or elderly parent residing in your home who is physically or mentally unable to care for him or herself.

You may contribute up to $5,000 to the dependent care FSA for the 2024 plan year if you are married and file a joint return or if you file a single or head of household return. If you are married and file separate returns, you can each elect $2,500 for the 2024 plan year.

HOW TO USE AN FSA

Contribute.

Decide how much to contribute to your FSA on a plan year basis up to the maximum allowable amounts. This amount will be evenly divided by the number of pay periods and deducted on a pre-tax basis from your paycheck.

Pay.

Use your FSA debit card to pay for eligible expenses at time of service or submit a claim for reimbursement at wexinc.com. Keep all receipts in case WEX requires you to verify the eligibility of a purchase.

Use It or Lose It.

FSA dollars do not roll over. However, you have until March 15, 2025, to incur and be reimbursed for expenses at the end of the plan year.

LIFESTYLE SPENDING ACCOUNT

arrivia will provide up to $260 to help you pay for eligible expenses related to physical, financial, and emotional wellbeing*.

WHAT IS A LIFESTYLE SPENDING ACCOUNT (LSA)?

An LSA is an employer sponsored benefit that provides funds for employees to use on eligible wellness expenses to meet their individual needs. The LSA is designed to improve your wellbeing. Determine which eligible expenses or experiences will improve your lifestyle and plan your purchases.

WHO IS ELIGIBLE FOR AN LSA THROUGH ARRIVIA?

If you are registered with Vitality, you will automatically be set up with a lifestyle spending account (LSA) at WEX and are eligible to submit receipts for qualified expenses. New participants must register at powerofvitality.com/ vitality/login and then email benefits@arrivia.com after registration for access to the LSA.

An LSA’s eligible expense list is extensive, with a wide variety of options to choose from. There are three categories of expenses related to wellbeing: physical, financial, and emotional.

Eligible expenses include:

- Athletic equipment and accessories

- Fitness memberships, classes, and lessons

- Student loan reimbursement

- Home purchase expense reimbursement

- Financial adviser and planning services

- Meditation classes or apps

- Personal development classes

- Annual park passes

- Cookbooks for healthier eating

- Cosmetic Dentistry

- Ski passes

- Life emergencies (car repair,appliance repair)

- Art therapy classes

- Beauty treatments

- Spa treatments

HOW DO I GET REIMBURSED FOR ELIGIBLE EXPENSES?

To submit claims through the WEX mobile app, simply snap a photo of your receipt and submit a claim for reimbursement.

* You must be registered with Vitality to be eligible for the LSA. Qualified team members receive $10 per paycheck in their LSA.