Wealth Building

Maybe you are not thinking about your future financial welfare on a daily basis, but now is the time to start planning. There are multiple ways for an employee to save for their future. In addition to Social Security benefits and personal savings, Arapahoe County provides benefits to assist you in meeting your savings goals.

401(a) Defined Benefit Retirement Plan

The Arapahoe County Retirement Plan is a mandatory defined benefit program designed to help you establish a source of income for your retirement years. Through the Plan, eligible employees will set aside a pre-determined percent of salary, currently not less than 9% and subject to change on a pretax basis of which the County matches.

Retirement eligibility is determined by your age and years of service. Contributions to the Arapahoe County Retirement Plan begin with the check representing your first full pay period.

For complete details regarding your retirement plan, visit Inside Arapahoe > Departments > Human Resources > Benefits > Retirement Plan.

Smart Start Savings Plan

The Smart Start Savings Plan (457b Deferred Compensation plan) gives eligible employees the ability to deduct pre-tax earnings from their paycheck so the employee can invest those earnings towards their own personal financial goals. Enrollment and changes are employee-directed.

The Plan offers the following:

The Plan offers the following:

- Lower current taxes on your income

- Tax deferred investment earnings

- Automatic payroll deductions

- A variety of professionally managed investment choices

- In-service withdrawal options

Your Deferral Contribution

You are eligible to join this plan at any time throughout the year. You also may increase or decrease the amount of your contribution at any time throughout the year. There will be an annual contribution limit set by the IRS. Currently, employees may contribute up to $19,500. If you are 50 or older, you may contribute an additional $6,500 through the catch-up provision. Annual limits are set by the IRS. Currently, employees may contribute up to $19,500. If you are 50 or older, you may contribute an additional $6,500 through the catch-up provision. Annual limits are set by the IRS each year and are subject to change.

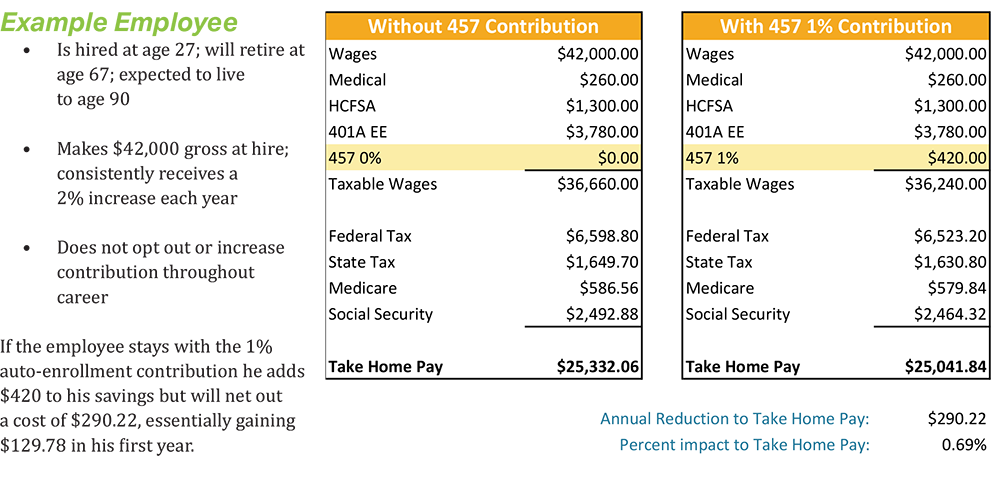

Impact to Take Home Pay Example

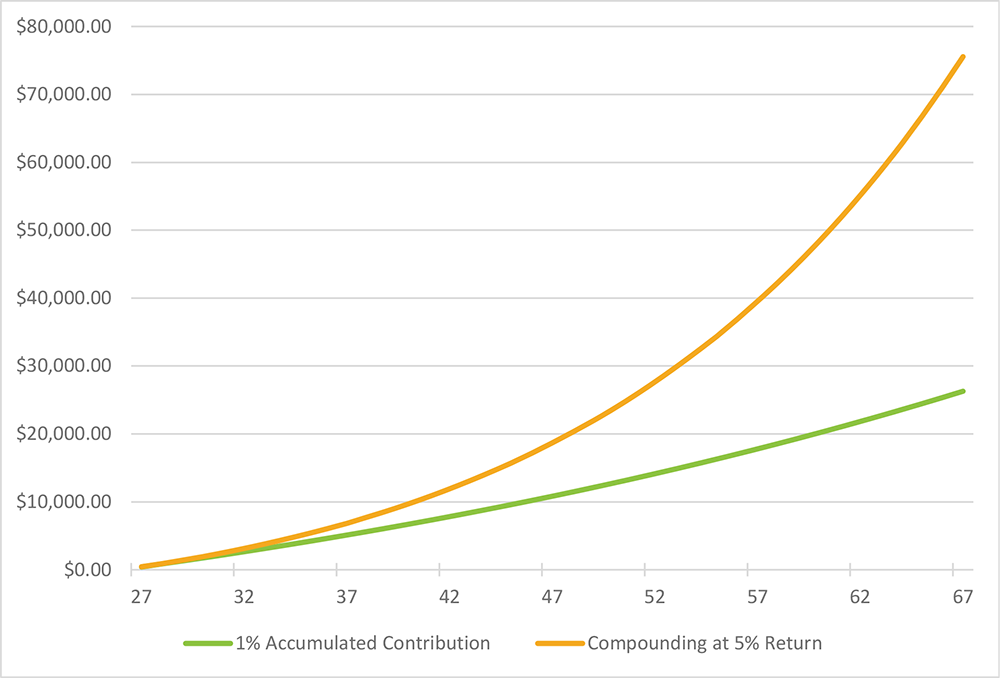

The Power of Time on Money (Compounding)

Now if that same employee continues to participate with just 1% with an average and consistent return of 5%* every year for the next 40 years, he will have: