Benefits Guide 2021

Our goal is to provide you with a benefit program designed to give you flexibility and choice, allowing you to personalize your benefits to suit your needs and the needs of your dependents.

The following pages include benefit plan options and a brief summary of the covered benefits. Please carefully review this material along with biweekly costs provided in your new hire or your open enrollment packet. The elections you make during an enrollment period will remain in effect throughout the calendar year unless you experience a qualified life event change. Complete plan information is provided at new hire orientation, during open enrollment or can be found on My Benefits.

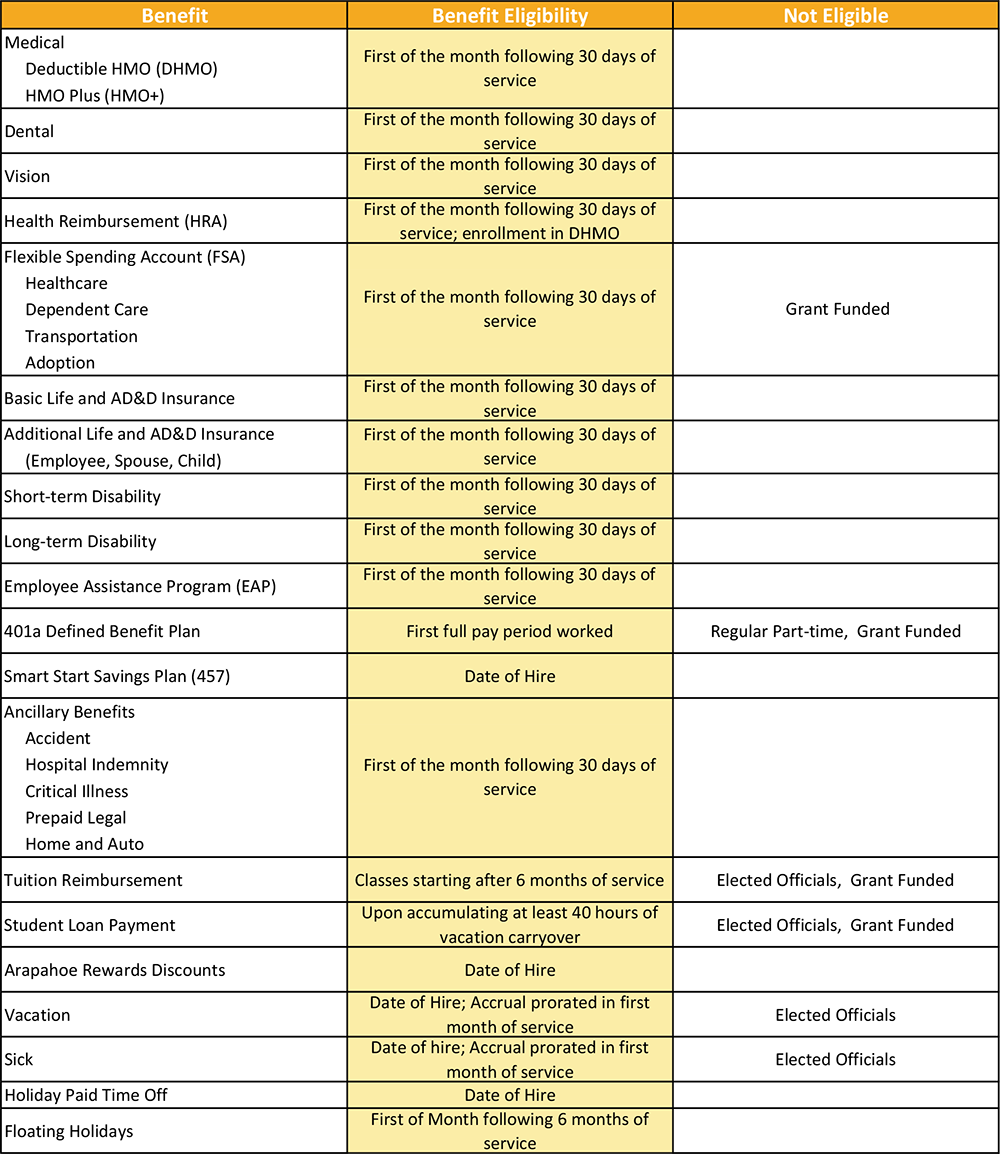

Eligibility Chart

Which family members can I cover?

Your eligible family members may also be enrolled in certain benefit plans. Eligible  family members include:

family members include:

- Your lawful spouse (as outlined for federal tax purposes)

- Your common law spouse (requires a notarized Declaration of Dependents & Common Law Marriage Form)

- Your civil union partner (requires a Civil Union Certificate)*

- Your child(ren) under age 26; if:

- Your natural child(ren)

- Your stepchild(ren) who lives with you

- Your adopted child(ren) – (adoption must be finalized by court)

- Your civil union partner’s child(ren)*

- Child(ren) for whom you have permanent legal guardianship and who is primarily dependent on you for 50 percent of their financial support

- Your child(ren) on whose behalf a Medical Child Support Notice has been issued

- Others, if required by state law

- Your child(ren) over the age of 26 who are determined to be disabled either the State or by Kaiser as not capable of self-sustaining employment because of a mental or physical handicap prior to the age of 26.

*Some benefits such as Flexible Spending Accounts and Health Reimbursement Accounts are a tax savings benefit and civil union

It is your responsibility to notify the Human Resources Benefits Team within 31 days of the eligibility or ineligibility of a dependent through MyBenefits.

It is your responsibility to notify the Human Resources Benefits Team within 31 days of the eligibility or ineligibility of a dependent through MyBenefits.

Proof of Dependent Eligibility

Prior to adding eligible dependents to your County benefit plans when you are hired, at open enrollment or upon a qualifying life event, you must submit documentation through My Benefits. Please ensure that any documentation contains a description of the relationship, and the eligible dependent(s): legal name, address if different than yours, birth date and Social Security Number (SSN) (for newborn children, update SSN as soon as received, but no later than 6 months from birth).

Prior to adding eligible dependents to your County benefit plans when you are hired, at open enrollment or upon a qualifying life event, you must submit documentation through My Benefits. Please ensure that any documentation contains a description of the relationship, and the eligible dependent(s): legal name, address if different than yours, birth date and Social Security Number (SSN) (for newborn children, update SSN as soon as received, but no later than 6 months from birth).

Loss of Dependent Eligibility

Only eligible dependents may be covered under County benefit plans. It is your responsibility to notify the Benefits Team within 31 days of loss of eligibility due to age, divorce, legal separation or other events that would disqualify a dependent from coverage.

Only eligible dependents may be covered under County benefit plans. It is your responsibility to notify the Benefits Team within 31 days of loss of eligibility due to age, divorce, legal separation or other events that would disqualify a dependent from coverage.

Failure to promptly submit a qualified life event through My Benefits is insurance fraud and may result in consequences up to and including repayment of the cost of ineligible benefits paid, loss of future plan coverage and/or loss of employment. For more information, please contact the Benefits Team at 720-874-5551.

Dual Coverage with County: If your spouse or eligible dependents are also employees of the County you may elect to be covered as either an employee or as an eligible dependent, but not as both. Note: Additional Life AD&D can only be elected as an employee, not as a dependent when both you and your spouse are Arapahoe County employees.

Dual Coverage with two employers/insurance providers: If your child(ren) are covered under your medical plan and another medical plan such as your spouse’s plan, be aware that the Spouse Birthday Rule applies: which ever policy holder’s birthday falls first in the calendar year is the primary insurance for dependents when filing claims.

If you have questions regarding dual coverage or dependent coverage, please contact the Benefits Team at 720-874-5551.

When and how can I make changes to my benefits?

Benefits are elected on an annual basis and can be changed only during Open Enrollment. However, the IRS has determined that certain life events qualify you for changes to your benefits during the year. All benefit changes require two conditions to be met before they can be approved.

- All changes must be requested through MyBenefits, and

- Appropriate documented proof provided within 31 days of the event.

If both conditions are not met within the 31 days, the Life Event will not be approved and the next opportunity to make changes will be at Open Enrollment. Please be aware that only Birth and Adoption can be retroactively covered. All other events will be effective on the first of the month following notification. To avoid breaks in coverage, you should submit a life event through My Benefits as soon as you know a Qualified Life Event will occur, even if it hasn't occurred yet.

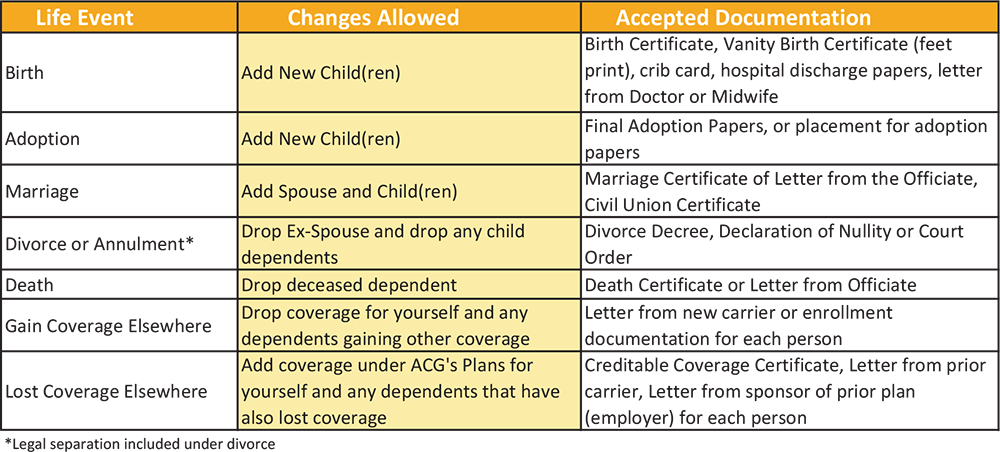

The following are Qualified Life Events:

- You gain or lose a dependent (birth, marriage, divorce, death, adoption, common law marriage, etc.)

- Your dependent loses coverage due to employment change

- Your dependent becomes eligible for other coverage

- You become ineligible for benefits because you don’t work the required number of hours

- You become eligible for benefits because your employment status changes

Your benefit changes must be requested through MyBenefits within 31 calendar days (60 for CHIP and Medicaid) from the event date.

The benefit change should be consistent with the nature of the event. Changes due to a Qualified Life Event may be requested through My Benefits.

Qualified Life Events Table

Allowable changes not requiring a Qualified Life Event

You may change the following benefits at any time:

- Smart Start Savings Plan;

- Auto and Home Insurance;

- Beneficiary Designation changes for Life Insurance, Smart Start Savings Plan or Retirement.

- Student Loan Payment

For information regarding how to make changes to these benefits, contact the Benefits Team at 720-874-5551.

Confirmation of Elections

Regardless of whether you actively enroll for benefits (during the new hire enrollment period or during open enrollment), a Benefit Detail Report is available through My Benefits.

This report outlines your benefits, premium costs and beneficiary designations for 2021.Please review this Benefit Detail Report carefully and report any administrative errors to the Benefits Team within the stated timeframe as corrections received outside of the stated timeframe will not be accepted. If there is a discrepancy between a printed Benefit Detail Report and My Benefits, My Benefits will govern.